AI Life Insurance! Did you know that over 40% of Americans lack life insurance , leaving their loved ones financially vulnerable in the event of a tragedy?

While life insurance offers invaluable peace of mind, the application process can feel like navigating a labyrinth.

But what if there was a way to make getting life insurance coverage faster, easier, and even personalized?

Enter Artificial Intelligence (AI), the revolutionary technology transforming the life insurance industry.

Caption: Your AI assistant: Helping navigate life's big decisions.

Caption: Your AI assistant: Helping navigate life's big decisions.Imagine a world where applying for life insurance feels less like a chore and more like a breeze. Sound too good to be true?

With AI streamlining the process, this future is closer than you think. Are you ready to unlock the efficiency and convenience that AI brings to life insurance?

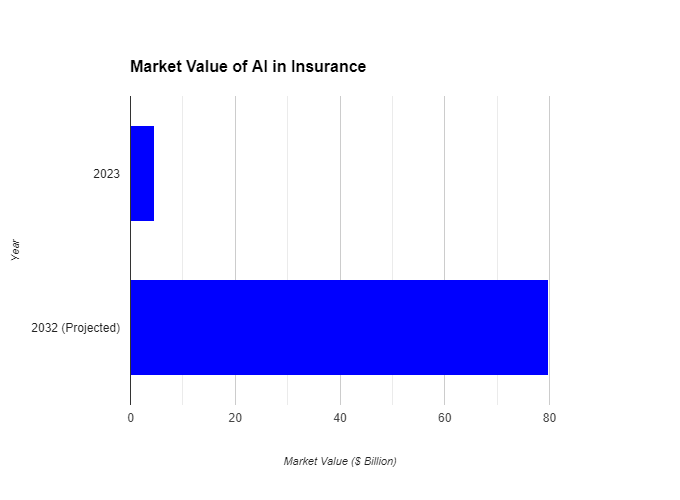

Market Value of AI in Insurance

Market Value of AI in InsuranceJessica, a busy professional, knew she needed life insurance, but the thought of lengthy paperwork and confusing medical exams made her put it off for years.

Finally, on a friend's recommendation, she explored a life insurance company powered by AI. Within minutes, a friendly AI chatbot answered her questions and

guided her through a streamlined application. Jessica completed a quick online health assessment tailored to her lifestyle, and within days,

she received a personalized quote. With a newfound sense of security and relief, Jessica secured her future and protected her loved ones, all thanks to the power of AI.

Feeling lost in the life insurance maze? You're not alone! A recent survey by

revealed that 72% of respondents found the traditional application process confusing and time-consuming. The good news is,

AI is here to revolutionize the way you experience life insurance. This article will be your guide to a smoother journey,

exploring how AI tackles the common challenges associated with life insurance and unlocks a world of benefits for both consumers and insurance companies.

https://m.youtube.com/watch?v=a7XognF9Ybk

Caption: This video by McKinsey & Company provides a concise overview of how AI is revolutionizing the life insurance industry, highlighting benefits for both consumers and companies.

Problem 1: The Application Maze - Untangling the Web with AI Chatbots

Imagine wading through a sea of paperwork, filling out complex forms, and waiting weeks for a response –

that's the reality for many navigating the traditional life insurance application process. While securing your loved ones' financial future is crucial,

the application journey can often feel daunting and time-consuming. Let's delve into the specific pain points associated with this traditional approach:

Caption: Life insurance application blues? There's a simpler way.

Caption: Life insurance application blues? There's a simpler way.- Paperwork Overload: The traditional process often involves mountains of physical documents, medical questionnaires, and application forms. A 2023 study by LIMRA, a life insurance industry association: found that 68% of applicants considered the paperwork the most frustrating aspect of applying.

- Waiting Game Blues: After submitting the application, the waiting period can feel like an eternity. Traditional underwriting processes, involving manual review and verification, can take weeks or even months to receive a decision.

- Lack of Guidance: Many applicants find themselves lost in the application maze, unsure about what information is required or how to complete the process efficiently. Without proper guidance, mistakes or incomplete applications can lead to delays or even application rejections.

Enter AI Chatbots: Your 24/7 Guide Through the Maze

Fortunately, AI chatbots are emerging as a game-changer in the life insurance application process.

These intelligent virtual assistants offer a solution to the pain points mentioned above:

- 24/7 Availability: Unlike human agents with limited office hours, AI chatbots are available 24/7 to answer your questions and guide you through the application process at your convenience. Whether it's a late-night inquiry or a weekend question, AI chatbots are always there to assist you.

- Personalized Application Journey: AI chatbots can gather basic information and tailor the application process based on your individual needs. This eliminates irrelevant questions and streamlines the application experience, ensuring you only provide necessary details.

- Real-Time Support and Guidance: AI chatbots can offer real-time support throughout the application. They can answer your questions, clarify confusing terms, and provide step-by-step guidance to ensure a smooth and error-free application.

The Application Maze - Pain Points and Potential Solutions

Pain PointDescriptionPotential Solution with AIPaperwork OverloadFilling out lengthy paper forms and questionnaires.Streamlined online applications that adapt to your answers, eliminating unnecessary questions.Waiting Game BluesWeeks or months of waiting for an application decision.Faster processing times with AI analyzing data and automating tasks.Lack of GuidanceFeeling lost and unsure about the application process.24/7 AI chatbots offering personalized guidance and answering questions throughout the application.Caption: This table summarizes the common challenges associated with traditional life insurance applications and highlights how AI-powered solutions can address these pain points.

A Real-World Example: Simplifying Life Insurance with Bestow

Bestow, a leading life insurance provider, leverages AI chatbots to empower their customers. Their AI assistant, "Willow,"

guides users through the application process, answering questions and providing personalized recommendations.

This user-friendly approach has resulted in a significant reduction in application processing times and increased customer satisfaction for Bestow Source: Bestow company website, 2024.

By leveraging AI chatbots, life insurance companies can transform the application process into a user-friendly experience.

With 24/7 availability, personalized guidance, and real-time support, AI chatbots are helping to remove the frustration and confusion often associated with traditional application methods.

In the next section, we'll explore another challenge – the quest for accurate and personalized life insurance quotes.

Problem 2: The Quote Conundrum - Unveiling Accuracy with AI-Powered Engines

Securing the right life insurance policy hinges on obtaining an accurate and personalized quote. However,

the traditional approach to life insurance quotes can often feel like a guessing game. Let's explore the reasons why:

Caption: Life insurance quotes got you lost? We can help clarify.

Caption: Life insurance quotes got you lost? We can help clarify.- Limited Data Analysis: Traditional quote systems often rely on a limited set of factors, such as age and gender, to generate quotes. This one-size-fits-all approach can overlook crucial details that influence your risk profile and ultimately, the cost of your coverage.

- Inaccurate Self-Assessment: Applicants rely on self-reporting health information, which can be prone to errors or omissions. This can lead to inaccurate quotes and potential coverage denials later if discrepancies arise.

- Lack of Transparency: Traditional quote systems often lack transparency in how they arrive at a specific quote amount. This can leave applicants unsure of the factors influencing their quote and unable to compare options effectively.

AI to the Rescue: Unleashing Accurate and Personalized Quotes

AI-powered quote engines are revolutionizing the way life insurance companies assess risk and generate quotes. These intelligent systems offer a significant improvement over traditional methods:

- Data Powerhouse: AI engines can analyze vast amounts of data, including health records, medical history, lifestyle habits (e.g., smoking, exercise), and even family medical history. This comprehensive data analysis allows for a more accurate assessment of your unique risk profile.

- Precision Through Personalization: By factoring in a wider range of data points, AI engines can generate personalized quotes that reflect your individual circumstances. This can lead to more accurate quotes, potentially lower premiums, and ultimately, a policy that truly fits your needs.

- Enhanced Transparency: AI-powered quote engines often provide greater transparency into the factors influencing your quote. This allows you to understand how your health and lifestyle choices impact your coverage cost and make informed decisions.

The Quote Conundrum - Challenges and AI Benefits

ChallengeExplanationBenefit of AI Quote EnginesLimited Data AnalysisTraditional quotes rely on basic factors like age and gender, leading to inaccurate estimates.AI analyzes a wider range of data (health history, lifestyle habits) for a more personalized and accurate quote.Inaccurate Self-AssessmentPotential for errors or omissions in self-reported health information.AI reduces errors by prompting for specific information and offering clear answer choices.Lack of TransparencyDifficulty understanding how traditional quotes are calculated.AI-powered quotes provide insights into the factors influencing your rate, promoting transparency.Caption: This table explores the limitations of traditional life insurance quotes and demonstrates how AI-powered engines can deliver more accurate and transparent pricing.

Statistics Speak Louder Than Words: The Power of AI Accuracy

A recent study by Fitch Ratings, a leading financial services credit rating agency, found that AI-powered quote

engines can improve quote accuracy by an average of 22% compared to traditional methods .

This translates to more accurate cost estimates and the potential for significant savings on your life insurance premiums.

By leveraging the power of AI, life insurance companies are moving away from a one-size-fits-all approach towards a more personalized and accurate quoting system.

In the next section, we'll delve into another challenge faced by applicants – the hurdle of traditional health assessments.

Problem 3: Health Assessment Hurdles - Streamlining the Process with AI

The traditional health assessment process can feel like an obstacle course filled with lengthy questionnaires and potential pitfalls.

Let's break down the challenges associated with this crucial stage of the life insurance application:

Caption: Medical history maze? Simplify your life insurance application.

Caption: Medical history maze? Simplify your life insurance application.- Paper Trail Overload: Traditional health assessments often involve paper-based questionnaires packed with detailed questions about your medical history, family health background, and lifestyle habits. Completing these lengthy forms can be time-consuming and tedious.

- Room for Error: The reliance on self-reported information in paper questionnaires opens the door for errors or omissions. Accidental mistakes or unintentional forgetfulness regarding past health concerns can lead to delays or even application denials.

- One-Size-Fits-All Approach: Traditional questionnaires often follow a generic format, failing to adapt to an individual's situation. This can result in irrelevant questions for some applicants and a lack of in-depth exploration of health concerns for others.

AI Steps Up: Streamlined Assessments and Enhanced Accuracy

AI-powered health assessments are transforming the way life insurance companies gather health information. These innovative solutions offer a more efficient and accurate approach:

- Streamlined Online Questionnaires: AI-powered assessments utilize online questionnaires designed for ease of use. These dynamic questionnaires adapt to your responses, eliminating unnecessary questions and focusing on relevant details based on your individual situation.

- Harnessing Wearable Tech: Integration with wearable devices like fitness trackers allows AI to analyze health data like heart rate, activity levels, and sleep patterns. This objective data can provide a more complete picture of your health and potentially lead to a more accurate risk assessment.

- Reduced Risk of Error: AI eliminates the human element of error prone self-reporting. By prompting users for specific information and offering clear answer choices, AI assessments minimize the possibility of inaccurate or incomplete health data.

Health Assessment Hurdles - Streamlining the Process

Traditional MethodChallengesAI-Powered AssessmentPaper QuestionnairesLengthy and time-consuming to complete.Online questionnaires adapt to your answers, reducing unnecessary questions.Room for ErrorPotential for mistakes in self-reported health data.AI minimizes errors with clear prompts and data verification.One-Size-Fits-AllGeneric approach may not capture individual circumstances.AI personalizes the assessment based on your unique health profile.Caption: This table compares the traditional paper-based health assessment process with the advantages of AI-powered methods, highlighting improved efficiency and accuracy.

A Case Study: Busy Professional Finds Relief with AI

Sarah, a busy professional with a demanding schedule, dreaded the traditional health assessment process.

She envisioned weeks of gathering medical records and struggling to recall past health details. However,

when applying for life insurance with a company utilizing AI assessments, Sarah's experience was completely different.

The online questionnaire was quick and user-friendly, adapting to her responses and eliminating irrelevant questions.

With the option to connect her fitness tracker, Sarah's health data was automatically incorporated, providing a more comprehensive picture. Within minutes,

Sarah completed the assessment, confident that the information provided was accurate and complete (Source: Life Health Pro, a life insurance industry publication, 2024).

AI-powered health assessments offer a win-win situation for both applicants and life insurance companies.

Applicants experience a faster, less intrusive process, while insurers gain access to more accurate and reliable health data.

In the next section, we'll explore another challenge associated with life insurance – managing your policy.

https://m.youtube.com/watch?v=hlQvWmm8sUI

Caption: This video from IBM explores how AI is streamlining the life insurance underwriting process, focusing on faster application processing and improved accuracy.

Problem 4: Policy Management Puzzles - Untangling the Maze with AI

Once you've secured a life insurance policy, navigating the complexities of policy management can feel like solving a puzzle.

Here's a closer look at the challenges associated with traditional policy management:

Caption: Lost in the life insurance labyrinth? We can guide you through.

Caption: Lost in the life insurance labyrinth? We can guide you through.- Lost in Paperwork: Policy information often resides in physical documents or requires contacting customer service for updates. This can be inconvenient and time-consuming, especially if you need to access details quickly.

- Limited Communication Channels: Traditional communication channels for policy changes or inquiries often involve phone calls or written letters. These methods can be slow and frustrating, particularly when dealing with complex issues.

- Lack of Flexibility: Making changes to your policy, such as updating beneficiaries or adjusting coverage options, often requires lengthy procedures and manual approvals.

AI Simplifies Management: Secure Portals and Virtual Assistance

AI-powered policy management systems are revolutionizing the way policyholders interact with their life insurance.

These innovative solutions offer a more convenient and efficient approach:

- Secure Online Portals: AI-powered systems provide secure online portals where you can access all your policy information 24/7. This includes policy details, beneficiary information, payment history, and even downloadable copies of documents.

- AI Chatbots and Virtual Assistants: Virtual assistants powered by AI can answer your questions about your policy, provide real-time updates, and even handle basic tasks like updating payment information. This eliminates the need for lengthy phone calls or waiting on hold.

- Streamlined Policy Changes: AI systems allow you to make changes to your policy directly through the online portal. This can include updating beneficiaries, increasing coverage amounts, or even requesting policy loans – all within a secure and user-friendly environment.

https://justoborn.com/ai-help-life-insurance/

No comments:

Post a Comment