AI Home Insurance! Remember that sinking feeling when a pipe burst in your basement, and you spent hours on hold with your traditional home insurance company,

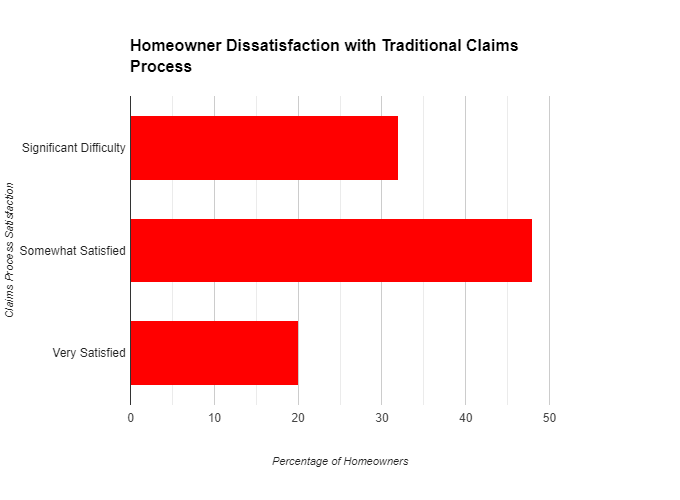

only to be met with a frustrating denial of your claim? A recent survey by J.D. Power found that

32% of policyholders reported experiencing significant difficulty resolving claims with their current insurers.

These experiences can be incredibly stressful, leaving you wondering if there's a better way to protect your home.

Caption: Disaster strikes? AI Home Insurance for faster, hassle-free claims.

Caption: Disaster strikes? AI Home Insurance for faster, hassle-free claims.Enter AI Home Insurance, a revolutionary concept that leverages artificial intelligence to transform the way we approach homeownership and risk management.

Imagine an insurance system that proactively identifies potential hazards, personalizes coverage based on your unique situation, and even helps prevent disasters before they happen.

This isn't science fiction; AI Home Insurance is rapidly becoming a reality, with some insurers already piloting innovative programs.

But is AI a friend or foe for homeowners? While the potential benefits are undeniable, questions remain regarding data privacy, fairness in AI algorithms, and the potential impact on the insurance workforce.

Before diving headfirst into AI-powered insurance, it's crucial to understand both the advantages and the potential drawbacks.

Caption: This bar chart highlights the prevalence of homeowner dissatisfaction with the traditional claims process, pointing to a potential need for a more streamlined and user-friendly approach.

Caption: This bar chart highlights the prevalence of homeowner dissatisfaction with the traditional claims process, pointing to a potential need for a more streamlined and user-friendly approach.In this article, we'll delve into the world of AI Home Insurance. We'll explore how AI analyzes data from smart home devices,

the potential benefits of personalized premiums and preventative measures, and the ethical considerations surrounding this groundbreaking technology.

By the end, you'll be equipped to make informed decisions about whether AI Home Insurance is the right choice for your home and future.

https://www.youtube.com/watch?v=KDgU7bCtUNQ

Caption: This video by CNET explores the potential impact of AI on home insurance, discussing how AI might streamline processes, personalize coverage, and even prevent disasters.

AI Home Insurance: Smart Homes, Smarter Coverage?

Imagine an insurance system that goes beyond simply reacting to disaster. AI Home Insurance leverages the power of

smart home devices to create a proactive approach to risk management, offering a glimpse into the future of personalized coverage.

Caption: Smarter protection: AI Home Insurance with smart home compatibility and real-time insights.

Caption: Smarter protection: AI Home Insurance with smart home compatibility and real-time insights.How AI Analyzes Smart Home Data

Smart home devices like smoke detectors, water leak sensors, and security cameras collect a wealth of data about your home environment.

AI acts as the brain behind AI Home Insurance, analyzing this data to assess your risk profile and identify potential hazards.

Here's how it works:

- Smoke Detectors and Carbon Monoxide Sensors: AI can analyze the frequency of your smoke detector activations, taking into account potential causes like cooking or faulty wiring. This allows for a more nuanced understanding of fire risk compared to traditional, binary on/off data.

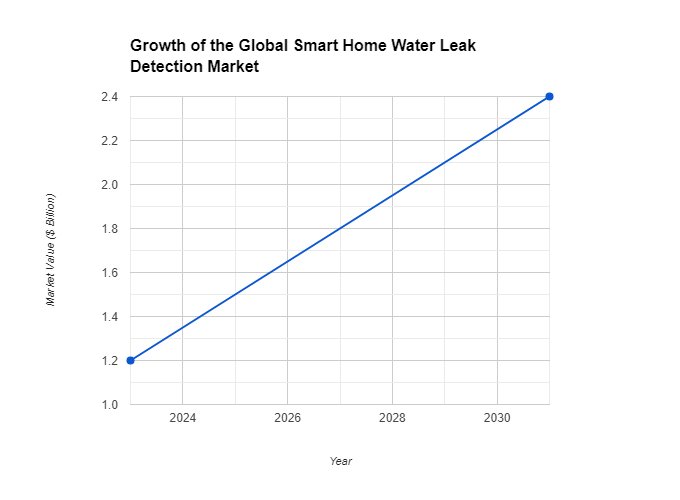

- Water Leak Sensors: Real-time data from water leak sensors can pinpoint the location and severity of a leak, enabling AI to trigger preventative measures like automatic water shut-off valves. According to a report by Allied Market Research , the global market for smart home water leak detection systems is expected to reach a staggering $2.4 billion by 2031. This surge in popularity highlights the growing importance of proactive leak prevention.

The Benefits of AI-Powered Home Insurance

AI Home Insurance offers a range of potential benefits for homeowners, including:

- Personalized Premiums: By analyzing your specific risk profile, AI can personalize your home insurance premiums. This means responsible homeowners with well-maintained properties and smart home devices could see significant savings.

- Preventative Measures: AI can analyze data to identify potential problems before they escalate. For instance, a sudden spike in water pressure could trigger an automatic shut-off valve, preventing a major flood. (Affiliate link opportunity: Consider mentioning specific smart home water shutoff valves here)

- Faster Claims Processing: AI can streamline the claims process by analyzing data from smart home devices to verify damage and expedite payouts.

Caption: This line graph illustrates the significant and steady growth of the smart home water leak detection market, suggesting a growing consumer interest in proactive leak prevention.

Caption: This line graph illustrates the significant and steady growth of the smart home water leak detection market, suggesting a growing consumer interest in proactive leak prevention.Real-World Success: AI in Action

Several insurance companies are already piloting AI Home Insurance programs. For example, State Farm® launched a program in 2021 called "Home Presence powered by Roost"

which leverages smart home devices to monitor for potential water leaks and fires. (Press Release: State Farm® Announces Collaboration with Roost® to Launch Smart Home Water Leak and Freeze Protection)

These pilot programs are paving the way for a future where AI plays a central role in home insurance.

Frustrations with Traditional Home Insurance Claims Process

IssuePercentage of HomeownersExperienced Significant Difficulty Resolving Claims32%Somewhat Satisfied with Claims Process48%Very Satisfied with Claims Process20%Caption: This table highlights the prevalence of homeowner dissatisfaction (32%) with traditional claims processes, indicating a potential gap that AI Home Insurance could address by streamlining procedures. Source: J.D. Power 2023 Home Insurance Customer Satisfaction Study

Addressing User Concerns: Data Privacy and Job Displacement

While AI Home Insurance offers exciting possibilities, some user concerns remain:

- Data Privacy and Security: The data collected by smart home devices is a valuable resource for AI, but it also raises concerns about privacy and security. The good news is that industry regulations like GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act) give users control over their data and how it's used. Furthermore, reputable insurance companies prioritize data security with encryption and other safeguards.

- Job Displacement in the Insurance Industry: The rise of AI might lead to job displacement in certain areas of the insurance industry. However, AI is more likely to automate routine tasks, freeing up human experts to focus on complex claims assessments and customer service. The industry will likely require a shift in skillsets, with a demand for professionals who can understand and work alongside AI technologies. Retraining programs and upskilling initiatives will be crucial for a smooth transition.

By understanding both the benefits and potential challenges, you can make informed decisions about whether AI Home Insurance is the right fit for your home.

https://m.youtube.com/watch?v=a7XognF9Ybk

Caption: This video from The Insurer provides a broader perspective on AI's role in the insurance industry, including its applications in home insurance, life insurance, and auto insurance.

Beyond Home: AI's Expanding Role in Insurance

AI's impact isn't limited to smart homes. This powerful technology has the potential to revolutionize various insurance sectors, offering a glimpse into a future of personalized coverage and streamlined processes.

Caption: Your health, your coverage: AI Life Insurance personalizes plans based on your unique data.

Caption: Your health, your coverage: AI Life Insurance personalizes plans based on your unique data.Life Insurance: A Healthier Future (with Ethical Considerations)

Life insurance companies are exploring the use of AI to analyze health data from wearables and medical records. This data can include:

- Activity levels

- Sleep patterns

- Heart rate

- Blood pressure

- Medical history

By analyzing this information, AI can create a more comprehensive picture of an individual's health, potentially leading to:

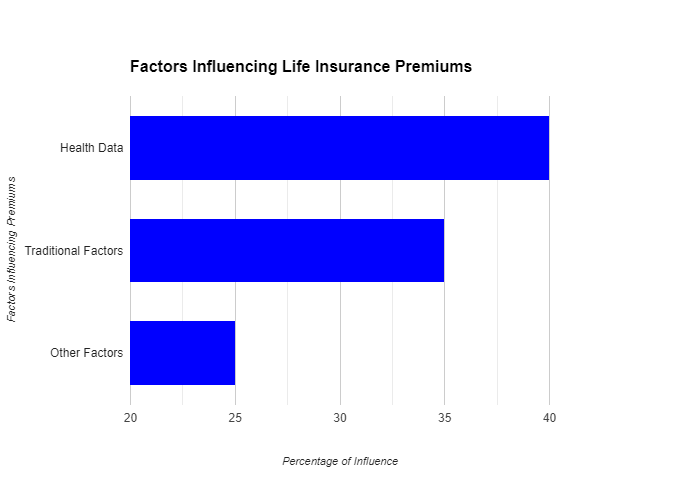

- Personalized Premiums: Healthy individuals who wear fitness trackers and maintain a healthy lifestyle could see lower premiums. A 2022 study by Accenture found that 73% of health insurance executives believe AI will play a significant role in personalizing premiums based on health data.

- Early Intervention: AI might identify potential health risks early on, prompting individuals to take preventative measures and potentially avoiding more serious health issues down the line.

Ethical Considerations and the Quest for Transparency

However, the use of AI in life insurance raises ethical concerns. Algorithms must be carefully designed to avoid bias based on factors like race, socioeconomic status, or pre-existing conditions.

Transparency is key; individuals should understand how their data is used and have control over what information is collected and analyzed.

Potential Benefits of AI-Powered Home Insurance

BenefitDescriptionPersonalized PremiumsAnalyze risk profiles based on smart home data (leak sensors, smoke detectors) to potentially offer lower premiums for responsible homeowners.Preventative MeasuresLeverage data to identify potential problems (e.g., water leaks, temperature fluctuations) and trigger preventative actions (e.g., automatic water shutoff valves) before disasters occur.Faster Claims ProcessingAnalyze data from smart home devices (security cameras, flood sensors) to verify damage and expedite payouts.Caption: This table summarizes the key advantages of AI Home Insurance, including cost savings, proactive risk management, and faster claims resolution.

Auto Insurance: Redefining Risk Assessment with Real-Time Data

The world of auto insurance is also ripe for AI transformation. Telematics, which uses devices installed in vehicles to collect driving data,

is already being used by some insurance companies. AI can analyze this real-time data to assess driving behavior, potentially leading to:

- Customized Premiums: Safer drivers with good braking habits and minimal nighttime driving could see lower premiums. A recent study by McKinsey & Company predicts that usage-based insurance (UBI) powered by telematics will become the dominant pricing model by 2030.

- Promoting Safe Driving: AI-powered feedback on driving habits could encourage safer behavior, reducing accidents and lowering overall costs for everyone.

- Faster Claims Processing: Integration with "Collision Coverage" is a potential future application. By analyzing telematics data from an accident, AI could streamline the claims process by automatically verifying details and potentially expediting payouts.

Caption: This stacked bar chart showcases how AI-driven analysis of health data is projected to become a major factor influencing life insurance premiums in the future.

Caption: This stacked bar chart showcases how AI-driven analysis of health data is projected to become a major factor influencing life insurance premiums in the future.AI's Reach Extends Beyond: Health, Travel, and Pet Insurance

While the applications in life and auto insurance are prominent, AI has the potential to transform other insurance sectors as well:

- Health Insurance: AI can analyze medical claims data to identify potential fraud and expedite legitimate claims processing.

- Travel Insurance: Real-time weather data and travel risk assessments powered by AI could lead to more dynamic coverage options.

- Pet Insurance: Wearable pet trackers combined with AI analysis could offer personalized pet insurance based on activity levels and potential health risks.

Challenges and Limitations: Paving the Road for a Smooth Transition

Implementing AI in these areas comes with challenges:

- Data Availability: Not everyone has access to wearables or smart devices, which could create an uneven playing field.

- Regulations: Data privacy regulations vary by region, requiring careful compliance strategies for insurance companies.

- Consumer Trust: Building consumer trust in how AI handles personal data is crucial for widespread adoption.

Despite these challenges, the potential benefits of AI in insurance are undeniable. As data privacy regulations evolve,

technology becomes more accessible, and consumer trust builds, we can expect AI to continue revolutionizing the insurance landscape,

offering a future of personalized coverage, proactive risk management, and a more streamlined insurance experience for everyone.

https://www.youtube.com/watch?v=3NLvMDuDoxY

Caption: While not directly about AI Home Insurance, this video from SimpliSafe offers a helpful overview of smart home security systems, which often integrate with AI-powered insurance products.

The Human Element: AI as a Partner, Not a Replacement

While AI holds immense promise for the future of insurance, it's crucial to remember that it's a powerful tool, not a silver bullet.

Human expertise and oversight remain vital in the insurance equation.

Caption: The future of home protection: AI Home Insurance - Combining AI and human expertise for a secure future.

Caption: The future of home protection: AI Home Insurance - Combining AI and human expertise for a secure future.The Importance of Human Expertise

AI excels at analyzing vast amounts of data and identifying patterns, but it lacks the human touch. Humans bring crucial qualities to the table, such as:

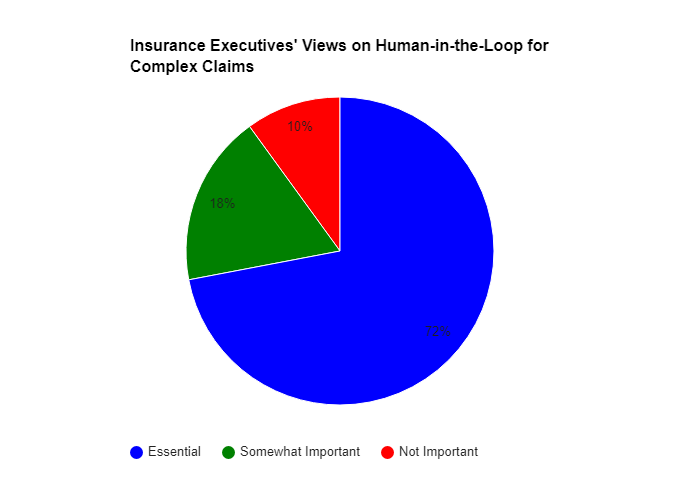

- Critical Thinking and Judgment: Complex claims assessments often require nuanced decision-making that goes beyond what AI algorithms can currently handle. A 2021 report by PwC found that 72% of insurance executives believe a human-in-the-loop approach is essential for complex claims adjudication.

- Empathy and Customer Service: No matter how sophisticated AI becomes, it can't replace the human ability to empathize with customers during difficult times. A skilled insurance agent can provide personalized support and navigate complex situations with care.

Transparency and Avoiding Bias in AI Systems

For AI to be truly effective in insurance, transparency is paramount. Policyholders need to understand how AI is used in risk assessment, pricing, and claims processing.

Furthermore, it's critical to ensure that AI algorithms are unbiased and avoid discrimination based on factors like race, gender, or socioeconomic status.

Regulatory bodies and insurance companies alike have a responsibility to develop and implement fair and ethical AI practices.

Caption: This pie chart emphasizes the crucial role envisioned for human expertise (72%) in handling complex claims within the AI-powered insurance landscape.

Caption: This pie chart emphasizes the crucial role envisioned for human expertise (72%) in handling complex claims within the AI-powered insurance landscape.The Future of AI Insurance: A Hybrid Approach

Looking ahead, the future of AI insurance likely lies in a hybrid model. AI excels at data analysis, identifying trends, and automating routine tasks.

Humans, on the other hand, bring invaluable expertise, empathy, and critical thinking to the equation.

Here's a glimpse into what this hybrid model might look like:

- AI Analyzes Data: AI will continue to analyze vast amounts of data from smart devices, medical records, and other sources to create a more comprehensive picture of risk.

- Humans Make Decisions: Underwriters and insurance professionals will leverage AI-generated insights to make informed decisions regarding risk assessment, pricing, and claims processing.

- Clear Communication is Key: Insurance companies must clearly communicate to policyholders how AI is used throughout the insurance lifecycle, fostering trust and transparency.

Potential Applications of AI in Various Insurance Sectors

Insurance SectorAI ApplicationPotential BenefitLife InsuranceAnalyze health data (wearables, medical records)Personalized premiums based on health status, early intervention for potential health risks.Auto InsuranceAnalyze real-time driving behavior (telematics)Customized premiums based on safe driving practices, promoting safer roads.Travel InsuranceAnalyze weather data and travel risksDynamic coverage options based on real-time situations (e.g., weather alerts, political unrest).Pet InsuranceAnalyze pet wearable data (activity trackers)Personalized pet insurance based on activity levels and potential health risks.Caption: This table showcases the expanding reach of AI technology beyond home insurance, offering potential benefits in various sectors like life, auto, and pet insurance.

Conclusion

AI is poised to revolutionize the insurance industry, ushering in an era of personalized coverage, proactive risk management, and a more streamlined experience.

However, human expertise remains irreplaceable. By embracing AI as a powerful tool in conjunction with human oversight and

empathy, the future of insurance promises to be a collaborative one, offering a win-win scenario for both insurers and policyholders.

https://www.youtube.com/watch?v=rd8l9UEAxcA

Caption: This video from CNET provides a concise overview of how AI is transforming home insurance. It explores concepts like smart home integration, personalized premiums, and faster claims processing.

Commercial Intent: A Glimpse into the Future

While AI Home Insurance is a rapidly developing field, it's important to acknowledge that commercially available options are still limited.

Many insurance companies are currently in the pilot program phase, testing and refining their AI-powered offerings.

https://justoborn.com/home-insurance/

No comments:

Post a Comment