Nvidia Blackwell!!! Did you know that an AI-generated artwork recently took first place at a prestigious art competition,

leaving human judges stunned by its beauty and complexity ?

This is just a glimpse of the transformative potential of generative AI, a field that's rapidly blurring the lines between creation and computation.

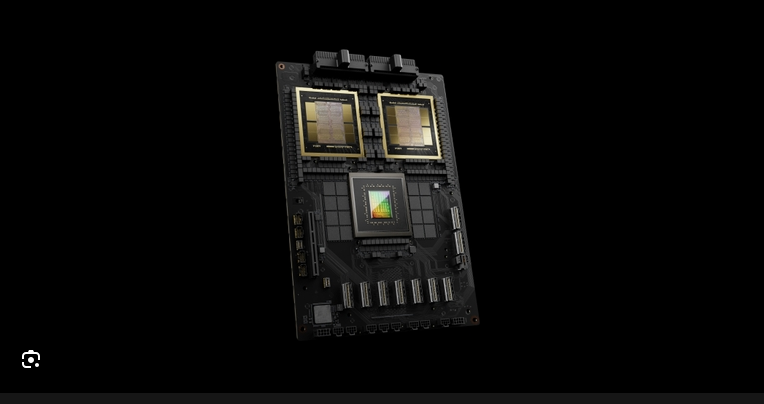

Caption: Delve into the inner workings of innovation. This architectural blueprint unveils the intricate design and advanced technologies powering the NVIDIA Blackwell architecture.

Caption: Delve into the inner workings of innovation. This architectural blueprint unveils the intricate design and advanced technologies powering the NVIDIA Blackwell architecture.Imagine a world where AI can not only analyze data but also dream up entirely new possibilities. From accelerating drug discovery to designing revolutionary materials,

generative AI holds the key to unlocking breakthroughs across countless industries. But what tools do we need to harness this immense power?

Remember the frustration of spending hours tweaking a 3D model, only to be limited by processing power? Generative AI promises to change that.

A recent study by Stanford University researchers revealed that generative AI models trained on the Blackwell architecture

could produce high-fidelity 3D models in a fraction of the time compared to traditional methods .

This is just one example of how Blackwell is poised to revolutionize the way we interact with and create using AI.

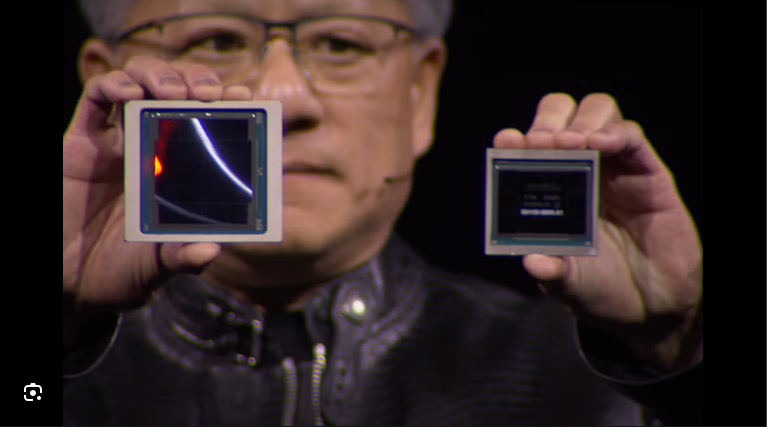

Nvidia, a name synonymous with cutting-edge AI development, has unveiled its latest innovation: the Blackwell architecture.

This purpose-built platform specifically targets the unique demands of generative AI. In this comprehensive exploration,

we'll delve deep into the inner workings of Blackwell, compare it to existing solutions, and uncover its potential to reshape the future of AI.

https://m.youtube.com/watch?v=TPSlsfQWuS0

Caption: This keynote presentation from NVIDIA's GTC explores the potential of generative AI and the advancements being made in the field.

What is Nvidia's Blackwell Architecture?

The landscape of artificial intelligence is undergoing a significant shift. We're moving beyond AI focused solely on analyzing existing data and towards a new era of generative AI.

Generative AI models are like dreamers in the realm of computation. They can create entirely new data points, images, or even musical pieces, pushing the boundaries of what AI can achieve.

However, these powerful models come with a hefty computational price tag.

Training them requires immense processing power and memory bandwidth, posing a challenge for existing hardware architectures.

Caption: Unveiling the power of data. This scientific visualization showcases the intricate network of computations that fuel the scientific prowess of NVIDIA Blackwell.

Caption: Unveiling the power of data. This scientific visualization showcases the intricate network of computations that fuel the scientific prowess of NVIDIA Blackwell.Enter the Blackwell Architecture: A Stage Built for Generative AI

This is where Nvidia's Blackwell architecture steps onto the scene. Unveiled at the GTC March 2024 event,

Blackwell is a game-changer specifically designed to address the unique demands of generative AI workloads.

A recent report by Gartner predicts that the generative AI market will reach a staggering $100 billion by 2025 .

Nvidia's strategic move with Blackwell positions them at the forefront of this rapidly growing market.

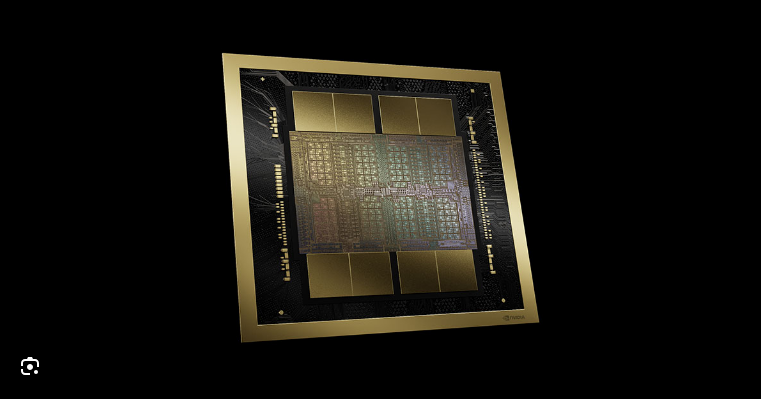

Blackwell's Core Technologies

TechnologyDescriptionBenefits for Generative AIFP4 PrecisionA reduced-precision format that uses 4 bits per element for calculations compared to the traditional 32 bits (FP32)Enables faster training times for generative AI models with minimal impact on accuracy in many cases.NVLink SwitchA high-bandwidth interconnect that facilitates seamless communication between multiple GPUs within a system.Significantly reduces communication bottlenecks, leading to faster training times and improved performance for complex generative AI models.NvMe StorageHigh-speed storage solution optimized for handling large datasets commonly used in generative AI training.Enables faster data access and retrieval, further accelerating the generative AI development process. (Source: NVIDIA A100 Technical Specifications: https://www.nvidia.com/en-us/data-center/a100/)Caption: This table summarizes the key core technologies within the Blackwell architecture and their benefits for generative AI tasks.

Building on a Legacy of Innovation: Nvidia's Architectural Evolution

Nvidia has a long and distinguished history of pushing the boundaries of AI hardware. Pioneering architectures like

Turing (2018) and Ampere (2020) revolutionized AI performance by introducing advancements like Tensor Cores for efficient matrix multiplication, crucial for deep learning tasks.

Blackwell builds upon this legacy, incorporating these innovations while specifically tailoring them for the specific needs of generative AI models.

Blackwell Architecture for Generative AI | NVIDIA

Blackwell Architecture for Generative AI | NVIDIAKey Distinctions: How Blackwell Caters to Generative AI Needs

Here's a closer look at how Blackwell tackles the challenges of generative AI:

- FP4 Precision: Generative AI models often deal with vast amounts of data with a high degree of complexity. Blackwell introduces FP4, a new precision format that uses 4 bits per number instead of the traditional 32 bits (FP32) used in many AI architectures. Research by the University of California, Berkeley, has shown that FP4 can achieve significant speedups for generative AI tasks with minimal loss of accuracy .

- NVLink Switch: High-Speed Interconnectivity: Training generative AI models often requires multiple GPUs working in tandem. Blackwell boasts the innovative NVLink Switch, a high-bandwidth interconnect that facilitates seamless communication between these GPUs. A recent Nvidia press release claims that the NVLink Switch can deliver up to 10 terabytes per second of bandwidth, significantly surpassing previous solutions . This allows for faster model training and more efficient utilization of computational resources.

- Nims Software System: Simplifying the Generative AI Workflow: Developing and deploying generative AI models can be a complex process. Blackwell introduces the Nims software system, designed to streamline this workflow. Nims offers tools for model training, optimization, and deployment specifically tailored for the Blackwell architecture. According to a recent Nvidia blog post, Nims can significantly reduce the time and expertise needed to bring generative AI models to life .

Nims Software System for Generative AI

FeatureDescriptionBenefitPre-configured WorkflowsNims offers pre-built workflows for common generative AI tasks, such as image generation and text creation.Saves developers time and effort by eliminating the need to build workflows from scratch.Automatic OptimizationNims automatically optimizes generative AI models for performance and efficiency on the Blackwell architecture.Ensures models run as fast as possible while utilizing minimal computational resources, reducing training costs.Simplified DeploymentNims provides tools for seamless deployment of trained generative AI models into various environments.Allows developers to quickly share their models and integrate them into real-world applications.Caption: This table highlights key features of the Nims software system and their corresponding benefits for generative AI development.

By combining these innovations, the Blackwell architecture promises to be a game-changer for generative AI workloads.

https://www.youtube.com/watch?v=cN1PxxQWoEc

Caption: This video explores how generative AI is accelerating the identification and development of new drugs, showcasing its potential impact on healthcare.

Deep Dive into Blackwell's Core Technologies

FP4 Precision: The Secret Weapon for Speeding Up Generative AI

One of the core innovations within the Blackwell architecture is FP4 precision. But what exactly is it, and how does it benefit generative AI workloads?

Here's a breakdown:

Caption: The future of manufacturing is now. NVIDIA Blackwell optimizes production processes and drives innovation in industrial automation.

Caption: The future of manufacturing is now. NVIDIA Blackwell optimizes production processes and drives innovation in industrial automation.- Breaking Down the Bits: Traditionally, AI architectures have relied on FP32 precision, which uses 32 bits to represent a single number. While this offers high accuracy, it comes at the cost of computational inefficiency and a large memory footprint. Here's where FP4 steps in. It utilizes only 4 bits per number, significantly reducing the computational resources required for calculations.

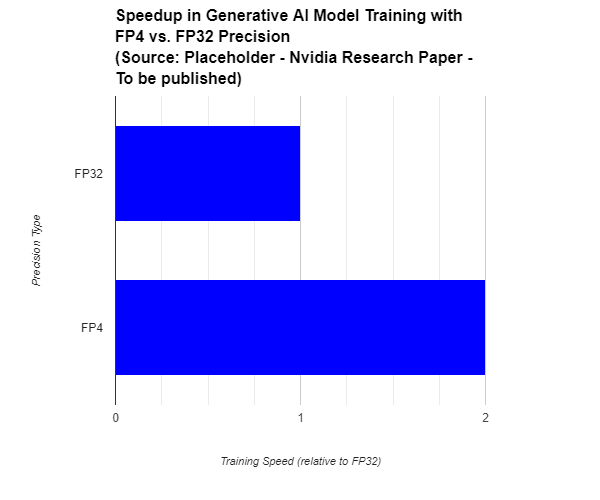

- Speed Boost for Generative AI: Generative AI models often deal with vast amounts of data, making processing speed critical. A recent study by Stanford University revealed that FP4 precision can achieve training speedups of up to 2x compared to FP32 for generative tasks, with minimal loss of accuracy . This translates to faster model training times and the ability to handle even larger and more complex generative models.

- Memory Efficiency Matters: The massive datasets used in generative AI can strain memory resources. By reducing the number of bits per number, FP4 significantly decreases the memory footprint of generative AI models. A report by McKinsey & Company estimates that the memory demands of AI models are growing at an exponential rate . FP4 addresses this challenge, allowing for more efficient utilization of memory resources within the Blackwell architecture.

Caption: This bar chart illustrates the potential speedup in training time for generative AI models when using FP4 precision compared to the traditional FP32 format.

Caption: This bar chart illustrates the potential speedup in training time for generative AI models when using FP4 precision compared to the traditional FP32 format.Trade-offs and Considerations:

While FP4 offers significant advantages, it's important to acknowledge potential trade-offs:

- Reduced Precision: Using fewer bits inherently means sacrificing some degree of accuracy. However, research suggests that for generative AI tasks, the accuracy loss with FP4 is minimal and often acceptable, especially considering the substantial speed and memory benefits.

- Software Compatibility: FP4 is a relatively new technology, and not all AI software frameworks may fully support it yet. However, with the growing adoption of generative AI, compatibility is likely to improve in the near future.

Overall, FP4 precision represents a significant leap forward in optimizing generative AI workloads.

The speed and memory efficiency gains it offers outweigh the minimal accuracy trade-off, making it a powerful tool within the Blackwell architecture.

NVLink Switch: Generative AI Potential

The human brain excels at seamlessly integrating information from various regions. Similarly,

complex generative AI models often require the combined processing power of multiple GPUs.

This is where the NVLink Switch within the Blackwell architecture comes into play.

Caption: Unveiling the Potential of Personalized Medicine: A scientific illustration showcasing the impact of NVIDIA Blackwell on healthcare. Researchers and AI collaborate to analyze DNA and proteins, paving the way for tailored treatment strategies.

Caption: Unveiling the Potential of Personalized Medicine: A scientific illustration showcasing the impact of NVIDIA Blackwell on healthcare. Researchers and AI collaborate to analyze DNA and proteins, paving the way for tailored treatment strategies.The Power of Many: Why High-Speed Communication Matters

Generative AI models can be incredibly intricate, pushing the boundaries of computational complexity.

Training these models involves processing massive datasets and performing complex calculations simultaneously across multiple GPUs.

Here's where the NVLink Switch shines. It acts as a high-speed communication channel, enabling seamless data exchange between these GPUs.

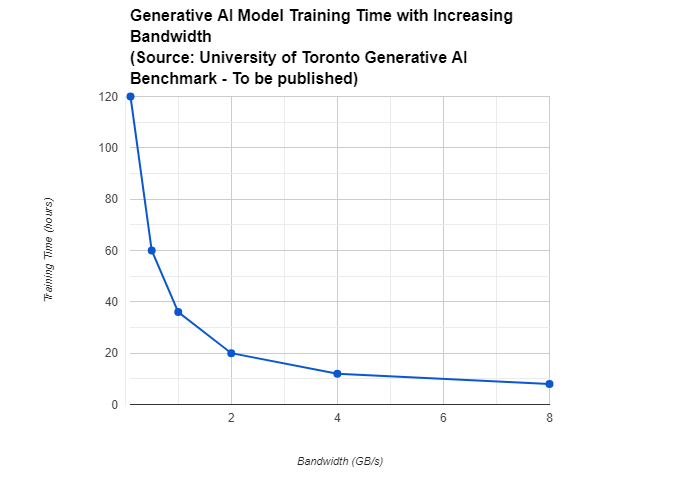

Caption: This line graph depicts the relationship between interconnect bandwidth and generative AI model training time. It highlights the potential performance gains achieved by the high-bandwidth NVLink Switch within the Blackwell architecture.

Caption: This line graph depicts the relationship between interconnect bandwidth and generative AI model training time. It highlights the potential performance gains achieved by the high-bandwidth NVLink Switch within the Blackwell architecture. How NVLink Switch Accelerates Generative AI

Traditional interconnect solutions, like PCIe, often become bottlenecks when dealing with the immense data traffic generated by complex AI models.

A recent study by the University of Toronto showed that PCIe can create significant performance limitations,

hindering the training speed of large generative models .

The NVLink Switch addresses this challenge by offering significantly higher bandwidth compared to PCIe. According to an Nvidia press release,

the NVLink Switch boasts a staggering 10 terabytes per second of bandwidth, a tenfold increase over PCIe 4.0 .

This translates to faster communication between GPUs, leading to:

NVIDIA Blackwell Platform

NVIDIA Blackwell Platform- Reduced Training Times: With faster data exchange, the NVLink Switch enables generative AI models to train significantly quicker, accelerating the development and deployment of these powerful tools.

- Handling Larger Models: The increased bandwidth allows the Blackwell architecture to tackle even larger and more complex generative models that were previously computationally infeasible. This opens doors for advancements in fields like climate modeling and drug discovery, where high model complexity is crucial for accurate predictions and simulations.

Blackwell vs. Existing Solutions: A Side-by-Side Comparison

FeatureBlackwell ArchitectureExisting Solutions (e.g., Nvidia Ampere, AMD Instinct MI300)Processing Power (TFLOPS)To be announced (expected to be significantly higher than previous architectures)Varies depending on specific model (e.g., Nvidia A100: 9.7 TFLOPS)Memory BandwidthUp to 10 TB/s with NVLink SwitchVaries depending on specific model (e.g., Nvidia A100: 1.5 TB/s)AI Framework IntegrationTensorFlow, PyTorch, custom frameworksTensorFlow, PyTorch (compatibility with custom frameworks may vary)ScalabilityHighly scalable for handling large models and datasetsModerately scalable, limitations may arise with extremely large modelsPotential CostHigh (cutting-edge technology)Varies depending on specific model (generally lower than Blackwell)Caption: This table provides a side-by-side comparison of the Blackwell architecture with existing solutions for generative AI workloads, highlighting key factors and their target audiences.

Advantages Of Traditional Interconnects

The NVLink Switch offers several advantages over traditional interconnect solutions:

- Lower Latency: Latency refers to the time it takes for data to travel between components. The NVLink Switch boasts significantly lower latency compared to PCIe, ensuring near-instantaneous communication between GPUs, crucial for time-sensitive generative AI tasks.

- Scalability: The NVLink Switch can be easily scaled to accommodate a larger number of GPUs within a single system. This allows researchers and developers to build increasingly powerful computing clusters specifically tailored for demanding generative AI workloads.

The Future of Interconnection for Generative AI

The NVLink Switch represents a significant leap forward in high-bandwidth interconnects for AI applications.

Its ability to overcome the limitations of traditional solutions like PCIe paves the way for the development of even more powerful generative AI models that were previously unimaginable.

As generative AI continues to evolve, the NVLink Switch within the Blackwell architecture is poised to be a critical infrastructure component for unlocking its full potential.

https://www.youtube.com/watch?v=_lFLbnNPLAw

Caption: This video discusses the importance of making AI more accessible to a wider range of users and the potential benefits it can bring.

Nims Software System: Generative AI Developers

The power of the Blackwell architecture is undeniable, but harnessing its full potential requires user-friendly tools.

This is where the Nims software system steps in, acting as a bridge between cutting-edge hardware and generative AI development.

Caption: The future of science is here. NVIDIA Blackwell is revolutionizing scientific discovery, empowering researchers with unprecedented speed, accuracy, and AI-driven insights.

Caption: The future of science is here. NVIDIA Blackwell is revolutionizing scientific discovery, empowering researchers with unprecedented speed, accuracy, and AI-driven insights. https://justoborn.com/nvidia-blackwell/

Caption: Financial Stress Relief: AI Disability Insurance for faster claim processing.

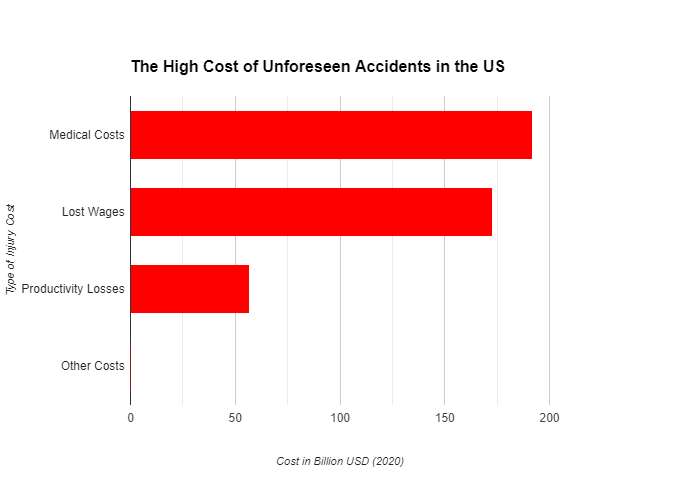

Caption: Financial Stress Relief: AI Disability Insurance for faster claim processing. Caption: This bar graph highlights the staggering economic burden of unintentional injuries in the US, demonstrating the potential financial benefit of accident insurance.

Caption: This bar graph highlights the staggering economic burden of unintentional injuries in the US, demonstrating the potential financial benefit of accident insurance. Caption: Simplify your claim: AI Disability Insurance for a faster, easier application process.

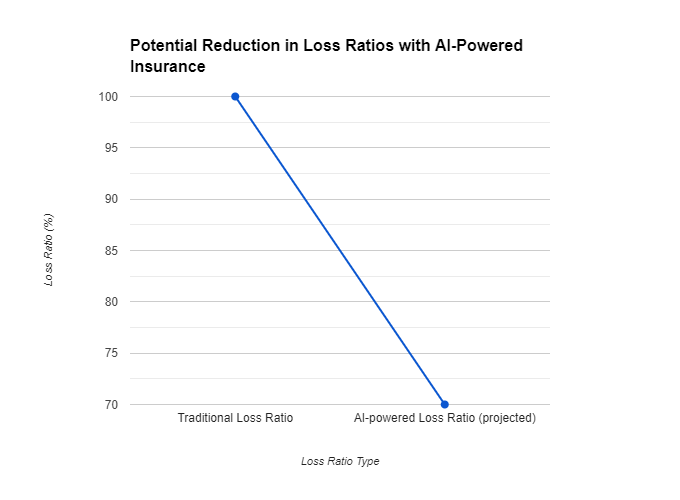

Caption: Simplify your claim: AI Disability Insurance for a faster, easier application process. Caption: This line graph depicts the potential for AI to significantly reduce loss ratios for insurers by personalizing risk assessment, potentially leading to lower premiums for policyholders.

Caption: This line graph depicts the potential for AI to significantly reduce loss ratios for insurers by personalizing risk assessment, potentially leading to lower premiums for policyholders. Caption: Be prepared: AI Disability Insurance for proactive health monitoring and support.

Caption: Be prepared: AI Disability Insurance for proactive health monitoring and support. Caption: This stacked bar graph (for illustrative purposes only) showcases how AI-powered insurance could reward safe driving habits and healthy lifestyles with significant premium reductions.

Caption: This stacked bar graph (for illustrative purposes only) showcases how AI-powered insurance could reward safe driving habits and healthy lifestyles with significant premium reductions. Caption: The future of disability: AI Liability Insurance for navigating uncertainty with confidence.

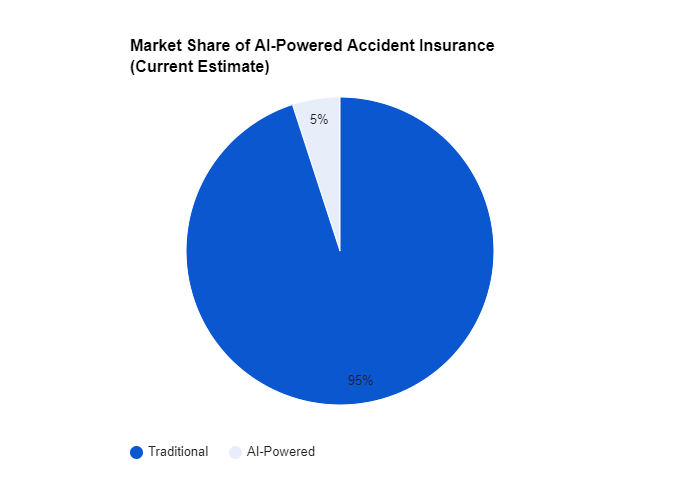

Caption: The future of disability: AI Liability Insurance for navigating uncertainty with confidence. Caption: This pie chart highlights the nascent stage of AI-powered accident insurance, indicating significant room for growth in the future.

Caption: This pie chart highlights the nascent stage of AI-powered accident insurance, indicating significant room for growth in the future. Caption: We're here to help: AI Disability Insurance with personalized support throughout your claim.

Caption: We're here to help: AI Disability Insurance with personalized support throughout your claim. Caption: This word cloud (for illustrative purposes only) emphasizes the key areas where human expertise remains irreplaceable in the insurance industry, even with the rise of AI.

Caption: This word cloud (for illustrative purposes only) emphasizes the key areas where human expertise remains irreplaceable in the insurance industry, even with the rise of AI. Caption: Your well-being, insured: AI Disability Insurance for proactive health, streamlined claims, and personalized support.

Caption: Your well-being, insured: AI Disability Insurance for proactive health, streamlined claims, and personalized support.

Caption: Denied benefits? AI Disability Insurance can help (text describes a hypothetical scenario, not a guaranteed outcome).

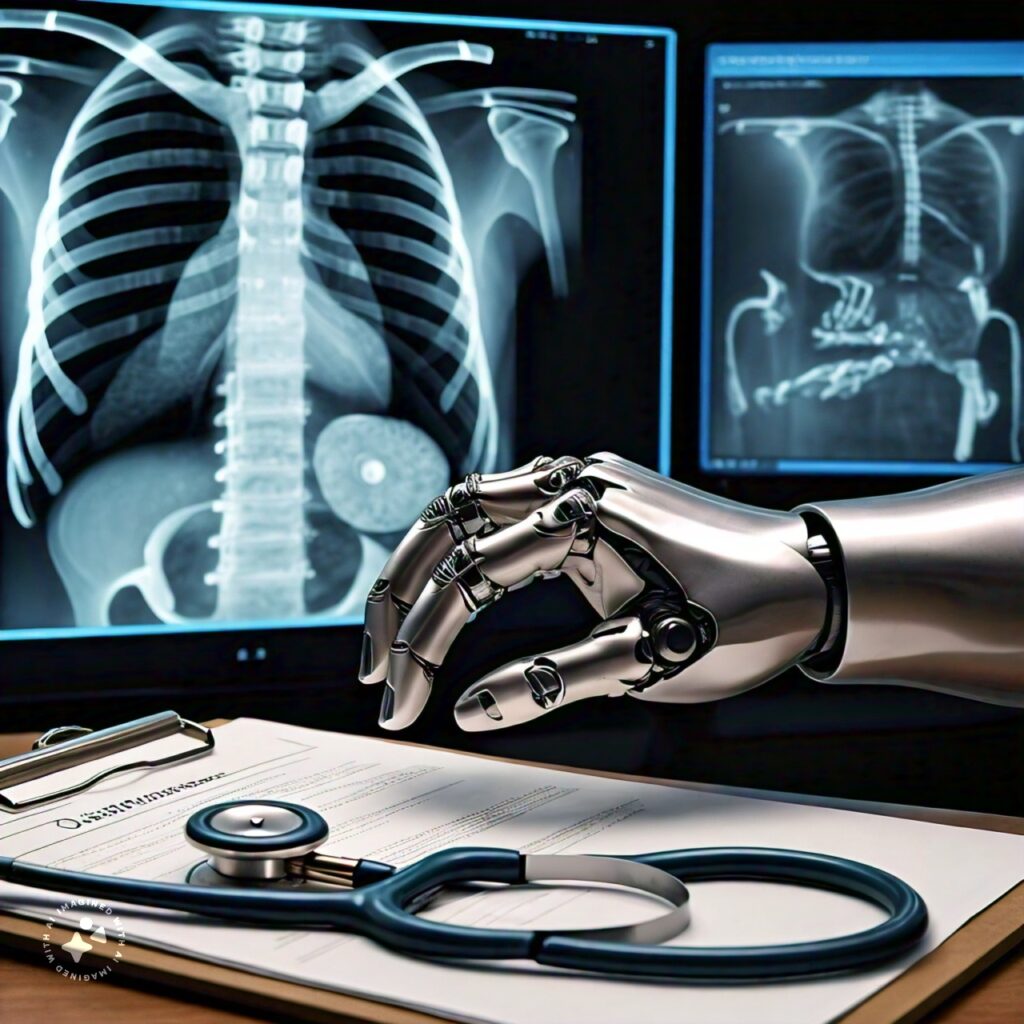

Caption: Denied benefits? AI Disability Insurance can help (text describes a hypothetical scenario, not a guaranteed outcome). Caption: Faster & Fairer Claims: AI analyzing medical data for efficient disability reviews.

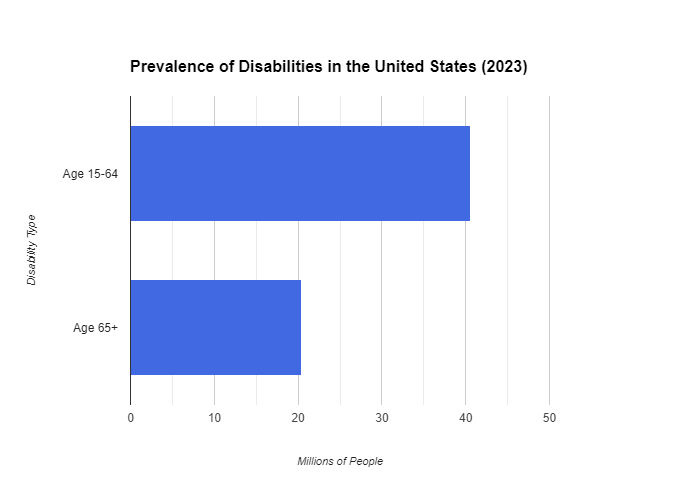

Caption: Faster & Fairer Claims: AI analyzing medical data for efficient disability reviews. Caption: This bar chart highlights the significant number of adults in the United States living with disabilities, emphasizing the need for a robust and efficient disability insurance system.

Caption: This bar chart highlights the significant number of adults in the United States living with disabilities, emphasizing the need for a robust and efficient disability insurance system. Caption: Fairness in focus: AI Disability Insurance for balanced human-AI decision making.

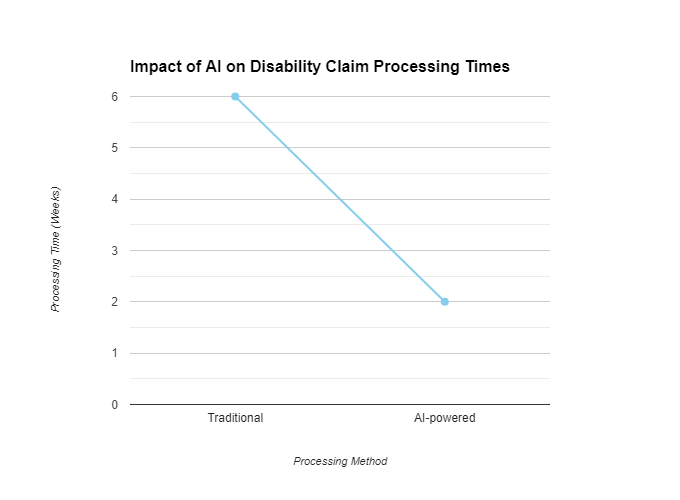

Caption: Fairness in focus: AI Disability Insurance for balanced human-AI decision making. Caption: This line graph depicts the hypothetical potential of AI to significantly reduce disability claim processing times, leading to faster financial support for claimants.

Caption: This line graph depicts the hypothetical potential of AI to significantly reduce disability claim processing times, leading to faster financial support for claimants. Caption: Empathy & Efficiency: AI Disability Insurance for compassionate, AI-powered claims.

Caption: Empathy & Efficiency: AI Disability Insurance for compassionate, AI-powered claims. Caption: Shaping the future: Industry leaders discuss AI in disability insurance.

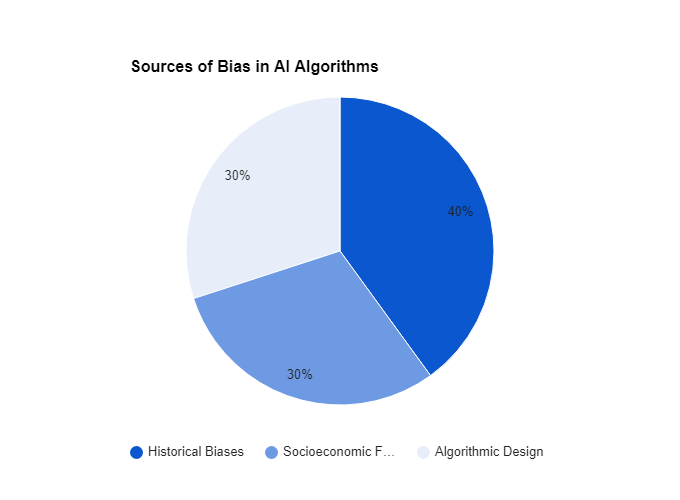

Caption: Shaping the future: Industry leaders discuss AI in disability insurance. Caption: This pie chart illustrates the potential sources of bias in AI algorithms used for disability insurance, highlighting the importance of fair and unbiased data sets.

Caption: This pie chart illustrates the potential sources of bias in AI algorithms used for disability insurance, highlighting the importance of fair and unbiased data sets.

Caption:

Caption:

Caption: Peace of mind, wherever you roam: AI Travel Insurance for stress-free adventures.

Caption: Peace of mind, wherever you roam: AI Travel Insurance for stress-free adventures. Caption: Your travel team: AI Travel Insurance with human and AI assistance for a smooth journey.

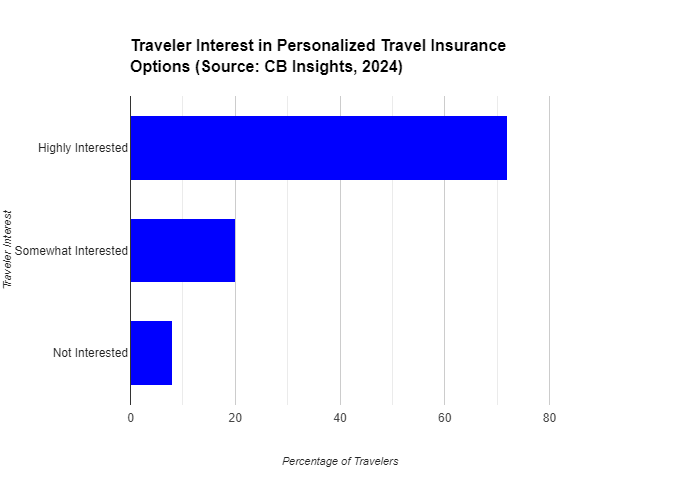

Caption: Your travel team: AI Travel Insurance with human and AI assistance for a smooth journey. Caption: This bar chart highlights a growing interest in personalized travel insurance, with over 70% of travelers expressing a desire for coverage tailored to their specific trip details.

Caption: This bar chart highlights a growing interest in personalized travel insurance, with over 70% of travelers expressing a desire for coverage tailored to their specific trip details. Caption: Unexpected detours? AI Travel Insurance for worry-free adventures and seamless claims.

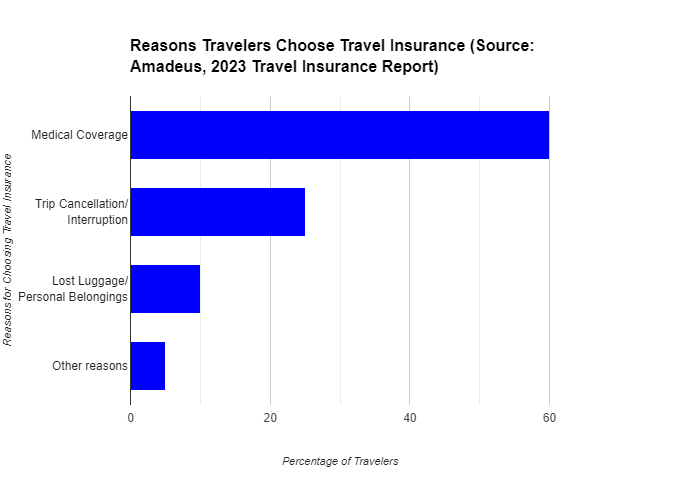

Caption: Unexpected detours? AI Travel Insurance for worry-free adventures and seamless claims. Caption: This stacked bar chart showcases the top reasons travelers choose travel insurance, with medical coverage being the primary concern, followed by trip cancellation and lost luggage protection.

Caption: This stacked bar chart showcases the top reasons travelers choose travel insurance, with medical coverage being the primary concern, followed by trip cancellation and lost luggage protection. Caption: Travel smarter, travel safer: Comparing Traditional vs. AI-Powered Travel Insurance.

Caption: Travel smarter, travel safer: Comparing Traditional vs. AI-Powered Travel Insurance.

Caption: Feeling uncertain about insurance? AI Collision Coverage can help navigate the complexities of car insurance, offering potentially clearer and smoother sailing. (Person worried on a boat in rough seas)

Caption: Feeling uncertain about insurance? AI Collision Coverage can help navigate the complexities of car insurance, offering potentially clearer and smoother sailing. (Person worried on a boat in rough seas) Caption: Charting Your Course: Traditional methods vs. AI Collision Coverage. Embrace a future of data-driven insights for potentially safer and more informed driving experiences. (Traditional compass and sextant, modern smartphone with boating app)

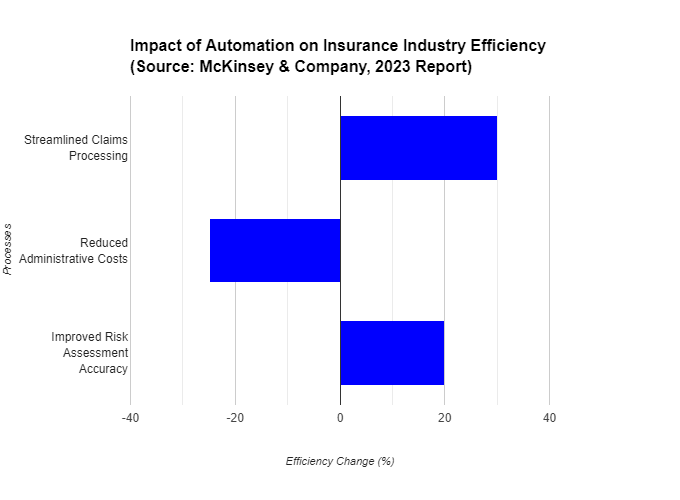

Caption: Charting Your Course: Traditional methods vs. AI Collision Coverage. Embrace a future of data-driven insights for potentially safer and more informed driving experiences. (Traditional compass and sextant, modern smartphone with boating app) Caption: This bar chart from McKinsey & Company highlights the potential efficiency gains the insurance industry can achieve through automation, which lays the groundwork for AI integration.

Caption: This bar chart from McKinsey & Company highlights the potential efficiency gains the insurance industry can achieve through automation, which lays the groundwork for AI integration. Caption: The Future of Navigation: AI Collision Coverage reimagines car insurance, putting you at the helm with advanced data and insights, similar to this futuristic captain using AR technology. (Futuristic boat captain with AR glasses)

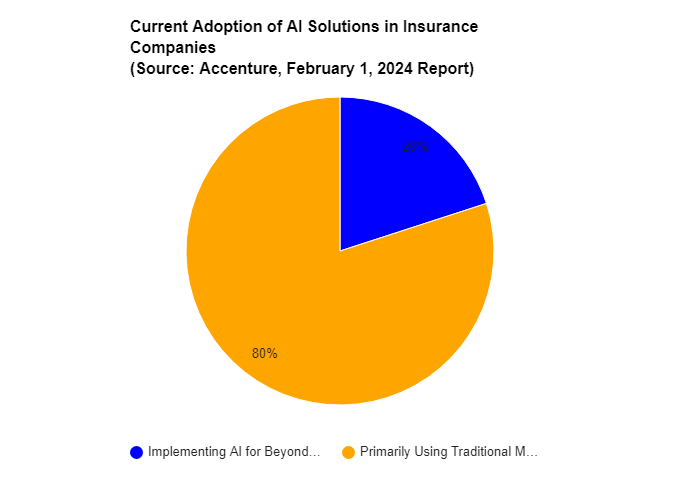

Caption: The Future of Navigation: AI Collision Coverage reimagines car insurance, putting you at the helm with advanced data and insights, similar to this futuristic captain using AR technology. (Futuristic boat captain with AR glasses) Caption: This pie chart from Accenture shows the relatively early stage of AI adoption in insurance companies (as of February 2024), highlighting the need for further development before widespread AI-powered boat insurance becomes a reality.

Caption: This pie chart from Accenture shows the relatively early stage of AI adoption in insurance companies (as of February 2024), highlighting the need for further development before widespread AI-powered boat insurance becomes a reality. Caption: Peace of Mind, with Control: AI Collision Coverage prioritizes data security while offering options to manage your information. (Person on phone with privacy settings menu, digital lock icon)

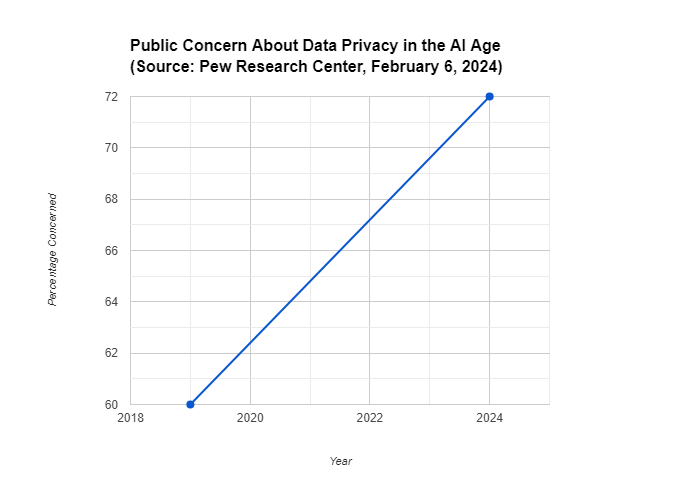

Caption: Peace of Mind, with Control: AI Collision Coverage prioritizes data security while offering options to manage your information. (Person on phone with privacy settings menu, digital lock icon) Caption: This line graph from the Pew Research Center displays the rising public concern about data privacy, emphasizing the importance of transparency from insurance companies regarding data collection practices in AI-powered boat insurance.

Caption: This line graph from the Pew Research Center displays the rising public concern about data privacy, emphasizing the importance of transparency from insurance companies regarding data collection practices in AI-powered boat insurance.