AI Liability Insurance! Walking into your doctor's office for a routine checkup, only to be greeted by a machine.

Not a friendly nurse, but an AI-powered system asking you questions, taking your vitals, and even analyzing your medical scans.

This scenario, once science fiction, is rapidly becoming a reality.

Caption: AI in healthcare: AI Liability Insurance for a secure future of medicine.

Caption: AI in healthcare: AI Liability Insurance for a secure future of medicine.A recent study by McKinsey & Company predicts that by 2030, AI could automate up to 800 million jobs globally.

The healthcare industry is at the forefront of this revolution, with AI already being used for tasks like image analysis, disease prediction, and even robotic surgery.

While the potential benefits of AI are undeniable - increased efficiency, improved accuracy, and potentially lower costs - its rapid integration also raises significant concerns.

What happens if an AI misdiagnoses a patient, leading to serious health complications? Who is liable in such a situation - the doctor, the programmer, or the company that developed the AI?

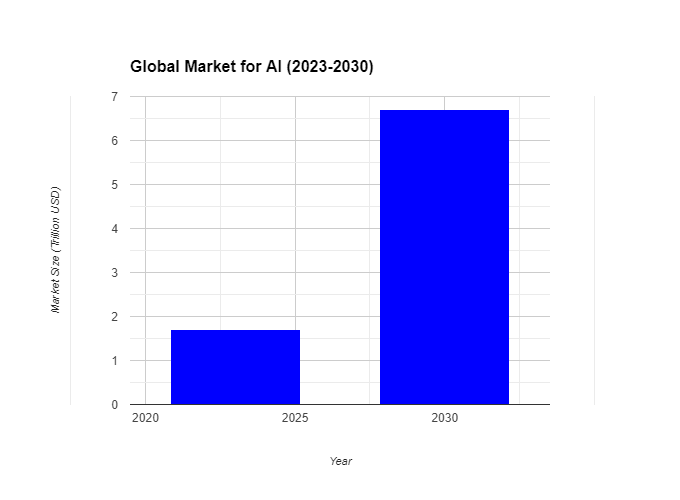

Caption: This bar graph illustrates the explosive growth of the global AI market, highlighting the increasing need for risk management strategies.

Caption: This bar graph illustrates the explosive growth of the global AI market, highlighting the increasing need for risk management strategies.These are just some of the questions swirling around the rise of AI, and the potential risks it poses. But fear not! This article will serve as your guide through the complex world of AI liability insurance.

The global market for AI is expected to reach a staggering $1.7 trillion by 2030 Grand View Research.

This explosive growth highlights the urgent need for robust legal frameworks and risk management strategies to keep pace with AI advancements.

Caption: AI car accident investigation underway. AI Liability Insurance ensures a smooth claims process.

Caption: AI car accident investigation underway. AI Liability Insurance ensures a smooth claims process.Last year, a major ride-hailing company came under fire after a self-driving car accident resulted in a fatality.

The incident sparked a heated debate about liability in the age of autonomous vehicles, highlighting the complexities of assigning blame when AI is involved.

As AI becomes increasingly sophisticated and integrated into our daily lives, a critical question emerges:

Who should be held accountable for the actions of AI systems? Is it the developers, the companies that deploy them, or perhaps even the users themselves?

https://www.youtube.com/watch?v=iiPWz-TnjhI

Lexalytics Adam Anders explains the concept of AI Liability Insurance and its role in mitigating risks associated with AI adoption.

The Need for AI Liability Insurance

The rapid rise of Artificial Intelligence (AI) across industries presents a double-edged sword. While AI promises significant benefits like

increased productivity and improved decision-making, it also introduces unforeseen risks. AI Liability Insurance emerges as a critical tool for

businesses navigating this new landscape, offering financial protection against potential losses stemming from AI-related incidents.

Caption: The future of work: AI Liability Insurance for a safe and trusting partnership.

Caption: The future of work: AI Liability Insurance for a safe and trusting partnership.At its core, AI Liability Insurance functions similarly to other insurance products. It protects businesses from the financial burden of lawsuits and

settlements arising from AI malfunctions or misuse. This coverage can encompass various scenarios, including:

Caption: Securing the future: AI Liability Insurance policy coverage.

Caption: Securing the future: AI Liability Insurance policy coverage.- Property Damage: Imagine a faulty AI-powered robot on a manufacturing line causing significant damage to equipment or products. AI Liability Insurance could cover the repair or replacement costs associated with such an incident.

- Personal Injury: A recent news report highlighted a case where an AI-powered security system at a construction site malfunctioned, leading to a worker's injury . AI Liability Insurance could help cover the medical expenses and lost wages of the injured worker in such a case.

- Data Breaches: AI systems often handle vast amounts of sensitive data. A cyberattack exploiting vulnerabilities in an AI system could lead to a major data breach, exposing customer information or financial data. AI Liability Insurance could provide coverage for costs associated with notifying affected individuals, regulatory fines, and credit monitoring services.

- Algorithmic Bias: AI algorithms are not immune to bias, which can lead to discriminatory hiring practices or unfair loan approvals. A 2023 study by the Partnership on AI found that biased AI algorithms disproportionately impacted loan applications from minority communities. AI Insurance could cover legal costs associated with lawsuits alleging discriminatory practices by AI systems.

The Evolving Legal Landscape of AI Liability

The legal framework surrounding AI liability is still in its early stages of development. This presents challenges for businesses

as it can be difficult to determine who is liable in the event of an AI-related incident.

Caption: Navigating the future: AI Liability Insurance for legal protection.

Caption: Navigating the future: AI Liability Insurance for legal protection.- Unclear Precedents: There is a dearth of legal precedents to guide courts in assigning blame for AI malfunctions. This can lead to lengthy and expensive legal battles as businesses fight to determine liability.

- Multiple Actors Involved: Developing, deploying, and using AI often involves multiple actors, including developers, programmers, and the companies that deploy the technology. Assigning blame can become a complex process, especially when the specific cause of an AI malfunction is unclear.

AI Applications and Potential Risks

AI ApplicationPotential RiskFacial RecognitionPrivacy violations, Algorithmic biasSelf-driving CarsAccidents, Liability disputesAI-powered HealthcareMisdiagnosis, MalpracticeAlgorithmic TradingMarket manipulation, Financial lossesCaption: This table illustrates some common AI applications and the potential risks associated with their use. Source: Brookings Institution

The uncertainty surrounding AI liability can significantly impact businesses. The potential for costly lawsuits and reputational damage can act as a deterrent to AI adoption.

AI Liability Insurance steps in to bridge this gap, providing businesses with the financial security and peace of mind needed to embrace AI advancements with confidence.

https://www.youtube.com/watch?v=zRaCyR6wQr4

McKinsey & Company explores risk management strategies for businesses implementing AI and the potential benefits of AI Liability Insurance.

What Does AI Liability Insurance Cover?

AI Liability Insurance isn't a one-size-fits-all solution. Policy coverage varies depending on the specific needs and risk profile of a business.

Here's a breakdown of the common types of coverage offered, along with some key considerations:

Peace of mind in the age of automation: AI Liability Insurance protects your business.

Peace of mind in the age of automation: AI Liability Insurance protects your business.Core Coverages:

- Property Damage: This coverage protects businesses from financial losses incurred due to damage caused by AI malfunctions. Imagine a scenario like a recent incident reported by The Wall Street Journal where a malfunctioning AI-controlled robotic arm resulted in millions of dollars worth of damage to equipment. AI Liability Insurance could cover the repair or replacement costs associated with such an event.

- Personal Injury: AI systems are increasingly being used in real-world applications, and malfunctions can lead to physical harm. For instance, a 2023 study by the Brookings Institution highlighted potential risks associated with AI-powered security robots misinterpreting situations and causing injuries. AI Liability Insurance could provide coverage for medical expenses and lost wages of individuals injured due to AI malfunctions.

- Data Breaches: AI systems often handle vast amounts of sensitive data. A data breach caused by a security vulnerability in an AI system can have devastating consequences. According to IBM's 2023 Cost of a Data Breach Report, the global average cost of a data breach reached a record high of $4.35 million. AI Liability Insurance can help businesses shoulder the financial burden associated with notifying affected individuals, complying with regulatory fines, and offering credit monitoring services.

- Product Liability: This coverage protects businesses from lawsuits arising from defects or malfunctions in AI-powered products. For example, a company that develops an AI-powered medical device could be held liable if the device malfunctions and causes harm to a patient. AI Insurance can provide financial protection for legal costs and potential settlements in such scenarios.

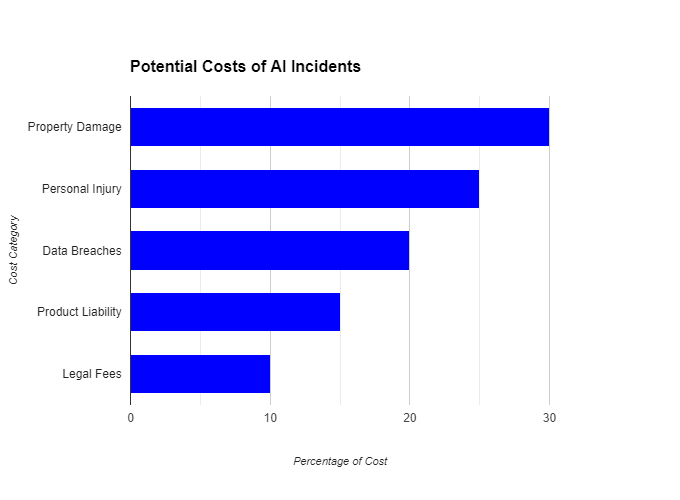

Cost Components of AI-related Incidents (Sample)

Cost CategoryDescriptionProperty DamageRepair or replacement costs of damaged equipment or infrastructure due to AI malfunction.Personal InjuryMedical expenses, lost wages, and other compensation for individuals injured by faulty AI systems.Data BreachesCosts associated with notifying affected individuals, regulatory fines, and credit monitoring services.Product LiabilityLegal costs and settlements arising from defects or malfunctions in AI-powered products.Legal FeesExpenses incurred for lawyers and legal representation in lawsuits related to AI incidents.Caption: This table provides a breakdown of the various cost components businesses may face in the event of an AI-related incident. Source: McKinsey & Company

Here, you can consider mentioning a reputable resource for comparing different AI Liability Insurance options. Examples include: coverage or thezebra.

Limitations and Exclusions:

It's important to understand that AI Liability Insurance policies may have limitations and exclusions. Here are some common examples:

- Intentional Misuse of AI: If a business deliberately uses AI in a way that contravenes its intended purpose or safety protocols, the resulting damages might not be covered by the insurance policy.

- Certain High-Risk AI Applications: Some insurance companies might exclude coverage for specific high-risk AI applications, such as autonomous weapons systems or AI used for social engineering scams.

- Punitive Damages: AI Liability Insurance typically doesn't cover punitive damages awarded in lawsuits, which are intended to punish a business for egregious conduct.

By carefully reviewing the policy details and understanding the limitations and exclusions, businesses can ensure they have the appropriate coverage for their specific needs.

https://www.youtube.com/watch?v=o4lC4tLacmw

TED Talk features Margaret McLaughlin discussing the evolving legal landscape of AI and the challenges of assigning liability in AI-related incidents.

Benefits of AI Liability Insurance

In the dynamic world of AI, where innovation races alongside potential risks, AI Liability Insurance emerges as a powerful tool for businesses.

It offers a multitude of benefits, fostering peace of mind, financial security, and responsible AI development:

Safeguarding success: AI Liability Insurance for sustainable business growth with AI.

Safeguarding success: AI Liability Insurance for sustainable business growth with AI.Peace of Mind and Financial Security:

The rapid evolution of AI presents a unique challenge - the uncertainty surrounding potential liabilities.

A 2022 survey by PWC revealed that a significant portion of businesses (42%) expressed concerns about potential legal issues associated with AI adoption.

AI Liability Insurance mitigates this anxiety by providing a financial safety net. By covering the costs associated with lawsuits, settlements, and

regulatory fines arising from AI-related incidents, it allows businesses to focus on innovation without the constant fear of crippling financial repercussions.

Promoting Responsible AI Development and Deployment:

The specter of liability can act as a powerful motivator for businesses to prioritize ethical and responsible AI development practices.

AI Liability Insurance policies often incentivize risk mitigation strategies. This can include implementing robust safety protocols for AI systems,

conducting thorough testing and validation procedures, and ensuring adherence to data privacy regulations. By factoring in potential liability costs,

businesses are more likely to prioritize responsible AI practices, fostering a culture of safety and transparency.

Caption: This stacked bar graph showcases the various cost components associated with AI-related incidents, emphasizing the potential financial burden on businesses.

Caption: This stacked bar graph showcases the various cost components associated with AI-related incidents, emphasizing the potential financial burden on businesses.A recent article in Forbes highlights the growing importance of ethical considerations in AI development.

Companies with a strong commitment to AI ethics are not only mitigating potential legal risks but also building trust with consumers and stakeholders.

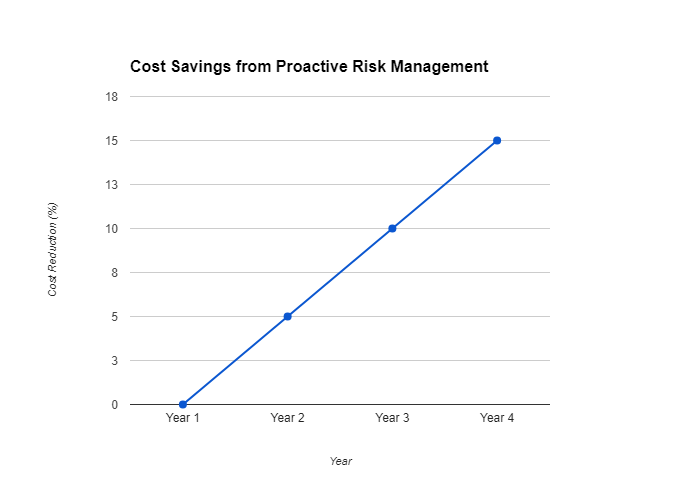

Cost Savings Through Proactive Risk Management:

The proactive approach encouraged by AI Liability Insurance can lead to significant cost savings in the long run.

By prioritizing risk mitigation and fostering a culture of safety, businesses can minimize the likelihood of costly lawsuits and data breaches.

Benefits of AI Liability Insurance

BenefitDescriptionFinancial SecurityProvides coverage for costs associated with lawsuits, settlements, and regulatory fines arising from AI incidents.Peace of MindReduces anxiety about potential legal and financial repercussions of AI adoption.Promotes Responsible AI DevelopmentEncourages risk mitigation practices and adherence to safety protocols.Cost SavingsProactive risk management can lead to fewer incidents and lower overall costs.Caption: This table highlights the key benefits businesses can gain by implementing AI Liability Insurance.

A study by Accenture found that organizations with strong AI governance practices experienced a 20% reduction in costs associated with AI-related incidents.

These savings can be substantial, considering the rising costs of cyberattacks and data breaches.

In conclusion, AI Liability Insurance goes beyond simply offering financial protection. It fosters a proactive approach to AI development and deployment,

encouraging responsible practices and ultimately contributing to a more trustworthy and ethical AI landscape.

https://m.youtube.com/watch?v=peGV0aNaTfg

This video explores the changing risk landscape with AI and the role of insurance

Challenges and Considerations

The dynamic nature of AI presents both opportunities and challenges for businesses seeking AI Liability Insurance. Here are some key considerations:

Caption: The unknown, protected: AI Liability Insurance for a secure future with AI.

Caption: The unknown, protected: AI Liability Insurance for a secure future with AI.Keeping Pace with a Rapidly Evolving Field:

AI technology is constantly evolving, with new applications and functionalities emerging at a rapid pace.

This presents a challenge for the insurance industry, which needs to adapt its policies to keep pace with these advancements.

- Unforeseen Risks: New AI applications may introduce unforeseen risks that traditional insurance policies might not cover. For instance, the increasing integration of AI into autonomous vehicles raises complex legal questions about liability in the event of accidents . Insurance companies are still grappling with how to adequately address these emerging risks.

- Policy Updates and Renewals: Businesses need to be proactive in reviewing their AI Liability Insurance policies regularly to ensure they remain relevant and provide adequate coverage for their evolving AI practices.

Caption: This line graph demonstrates the potential cost savings businesses can achieve through proactive risk management practices encouraged by AI Liability Insurance.

Caption: This line graph demonstrates the potential cost savings businesses can achieve through proactive risk management practices encouraged by AI Liability Insurance.Limited Market Availability:

The market for AI Liability Insurance is still in its nascent stages. Many traditional insurance companies are hesitant to offer comprehensive coverage due to the uncertainties surrounding AI liability.

- Limited Options: Businesses may find themselves with limited options when shopping for AI Liability Insurance. This can lead to higher premiums and potentially less comprehensive coverage.

https://justoborn.com/liability-insurance/

No comments:

Post a Comment