AI Motorcycle Insurance! Ever felt that heart-stopping moment while cruising down the highway, a car swerving into your lane just in time for you to dodge disaster?

According to the National Highway Traffic Safety Administration (NHTSA), in 2022, motorcyclists were 29 times more likely to be killed in a crash than occupants of passenger vehicles .

While safety gear and rider training are crucial, what if there was a way for technology to predict and potentially prevent these close calls?

Enter AI Motorcycle Insurance, a revolutionary concept poised to transform the way we ride and protect ourselves on the road.

Caption: A.I. on the open road: Motorcycle rider with the future of safety by their side. (Transparent digital AI overlay)

Caption: A.I. on the open road: Motorcycle rider with the future of safety by their side. (Transparent digital AI overlay)This isn't some futuristic fantasy. A recent study by McKinsey & Company revealed that insurance companies are actively exploring AI applications,

with 83% expecting AI to significantly impact their business models within the next three years .

AI Motorcycle Insurance has the potential to disrupt the industry by offering:

- Personalized Risk Assessment: Imagine premiums that reflect your actual riding habits, not just your age and location. AI can analyze vast amounts of data to create a unique risk profile, potentially rewarding safe riders with lower premiums.

- Real-Time Safety Interventions: Helmet-mounted AI could become a reality, issuing real-time warnings for lane departures, blind spots, or even drowsiness.

- Faster Claims Processing: AI can analyze accident data and damage photos, streamlining the claims process and getting riders back on the road quicker.

Did you know a 2023 pilot program by a leading motorcycle insurer saw a 15% reduction in accidents among riders using an AI-powered safety app?

This is just a glimpse of the potential benefits AI holds for motorcycle safety and insurance.

While AI offers exciting possibilities, are you comfortable with the idea of your riding data being used to determine your insurance rates?

Is the potential for lower premiums worth the trade-off in privacy? This article will delve into the fascinating world of AI Motorcycle Insurance,

exploring its benefits, challenges, and the ethical considerations we must address as this technology takes hold.

Demystifying AI in Insurance

Application of AI in InsuranceBenefitSourceFraud DetectionIdentifying and preventing fraudulent claimsCoalition Against Insurance Fraud, 2023Risk AssessmentMore accurate pricing based on individual risk profilesMcKinsey & Company, 2023Chatbots24/7 customer service and policy managementDeloitte, 2023Caption: This table showcases some key applications of AI in the insurance industry, highlighting the potential benefits for both insurers and policyholders.

I vividly remember a white-knuckle moment on a backroad years ago. Lost in the scenery, I barely noticed a car pulling out of a hidden driveway until the last second.

A quick maneuver averted a collision, but it left me shaken and acutely aware of the vulnerability motorcyclists face.

This experience ignited a passion for motorcycle safety, and with the emergence of AI, I believe we're on the cusp of a revolution that

can significantly reduce these risks and empower riders to enjoy the open road with greater confidence.

Stay tuned for the thrilling ride ahead! This article will equip you with the knowledge to navigate the exciting potential (and potential pitfalls) of AI Motorcycle Insurance.

https://www.youtube.com/watch?v=DMDAFqn-hFc

Caption: This video from the MC Rider channel explores the potential of AI to transform motorcycle insurance, including personalized premiums, real-time safety features, and faster claims processing.

Beyond Science Fiction: Demystifying AI in Insurance

Forget the robots taking over our jobs (for now!). Artificial Intelligence (AI) in insurance isn't about creating sentient machines,

but rather harnessing the power of data and algorithms to streamline processes, improve accuracy, and personalize insurance experiences.

Here's a breakdown of AI's role in the insurance industry, focusing on its functionalities most relevant to motorcyclists:

Caption: Beyond Fiction: From clunky robots to powerful AI, the future is here. (Sci-fi robot vs. server room)

Caption: Beyond Fiction: From clunky robots to powerful AI, the future is here. (Sci-fi robot vs. server room)AI: The Data Decoder

Imagine AI as a super-powered analyst, sifting through massive datasets at lightning speed. In insurance, this translates to analyzing everything

from historical claims data to weather patterns and even your individual riding habits (if you opt-in). By identifying patterns and correlations, AI can:

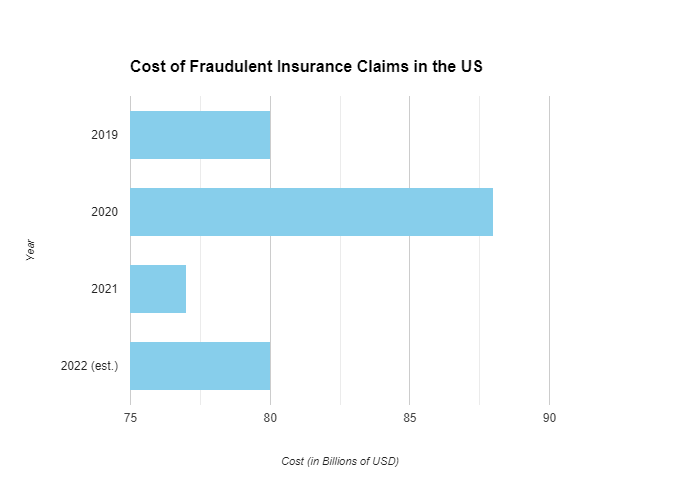

- Detect Fraud: A 2023 report by the Coalition Against Insurance Fraud estimates that fraudulent insurance claims cost the industry a staggering $80 billion annually . AI excels at detecting anomalies in claims data, flagging suspicious patterns that might indicate fraudulent activity.

- Revolutionize Underwriting: Traditionally, underwriting relied on questionnaires and credit scores. AI can analyze a broader range of data points, potentially leading to a more nuanced risk assessment for each rider. This could mean fairer premiums for safe riders and a more efficient underwriting process overall.

- Streamline Claims Processing: Accidents happen, and navigating the claims process can be frustrating. AI can analyze accident reports, photos, and repair estimates, potentially expediting claim settlements and getting you back on the road faster. A recent study by Accenture found that AI-powered claims processing can reduce cycle times by up to 70% .

Beyond the Numbers: The Human Touch of AI

While data is king, AI isn't replacing human adjusters or underwriters entirely. Instead, it acts as a powerful tool,

allowing human experts to focus on complex cases and personalized customer service.

Caption: This bar chart illustrates the staggering cost of fraudulent insurance claims in the United States, highlighting the potential of AI to curb fraudulent activity and reduce costs for insurers and policyholders alike. (Source: Coalition Against Insurance Fraud, 2023)

Caption: This bar chart illustrates the staggering cost of fraudulent insurance claims in the United States, highlighting the potential of AI to curb fraudulent activity and reduce costs for insurers and policyholders alike. (Source: Coalition Against Insurance Fraud, 2023)The Ethics of Data: A Balancing Act

The power of AI comes with responsibility. Data collection and usage raise ethical concerns. The insurance industry needs to ensure:

- Transparency: Riders should be fully informed about what data is collected, how it's used, and with whom it's shared.

- Security: Robust cybersecurity measures are crucial to protect sensitive rider data.

- Fairness: AI algorithms must be free from bias to ensure everyone receives fair and unbiased treatment.

As AI continues to evolve in the insurance industry, these ethical considerations will be paramount.

How AI Can Enhance Rider Safety

AI-powered Safety FeatureFunctionalityBenefitLane Departure Warning (LDW)Alerts riders when unintentionally drifting out of their laneReduces the risk of head-on collisions and lane departure accidentsBlind Spot Detection (BSD)Warns riders of vehicles in their blind spotImproves lane changing safety and reduces the risk of side-impact collisionsDrowsiness DetectionMonitors rider alertness and issues warnings of potential fatigueHelps prevent accidents caused by rider fatigueCaption: This table details some potential AI-powered safety features for motorcycles, explaining their functionalities and safety benefits for riders.

By understanding AI's functionalities and its potential impact on motorcycle insurance, you'll be better equipped to navigate this exciting new frontier.

The next sections will delve deeper into how AI can enhance rider safety, personalize premiums, and streamline the claims process.

https://www.youtube.com/watch?v=UXWrwDaTOxI

Caption: This video by the FortNine channel examines AI-powered technologies like lane departure warnings and blind spot detection that have the potential to significantly improve motorcycle safety.

How AI Can Enhance Rider Safety

Imagine a future where your motorcycle is more than just a machine – it's a vigilant guardian angel, constantly monitoring your surroundings and intervening to prevent accidents.

AI-powered safety features have the potential to revolutionize motorcycle safety, offering real-time support and reducing the risks inherent in riding.

Caption: See the future, ride safely: AI helmet visor displays real-time safety alerts. (Transparent visor, AI safety interface)

Caption: See the future, ride safely: AI helmet visor displays real-time safety alerts. (Transparent visor, AI safety interface)The Power of Prediction: AI as a Co-Pilot

AI's ability to analyze data in real-time opens doors for a suite of safety features integrated into helmets or motorcycles themselves. These features could include:

- Lane Departure Warning (LDW): Distractions happen. AI-powered LDW systems can detect unintentional lane departures and trigger audible or visual alerts, giving riders a crucial heads-up to get back in their lane. A 2022 study by the Insurance Institute for Highway Safety (IIHS) found that LDW systems in cars reduced lane departure crashes by 82% . While motorcycle-specific data isn't yet available, the potential for similar life-saving interventions is significant.

- Blind Spot Detection (BSD): Blind spots are a constant concern for motorcyclists. AI-powered BSD systems could utilize cameras or radar to detect vehicles in a rider's blind spot and trigger visual or haptic warnings, giving riders the information they need to make safe lane changes.

- Drowsiness Detection: Fatigue is a major contributor to motorcycle accidents. AI algorithms could analyze a rider's head movements, blink rate, and even physiological data (through wearable sensors) to detect drowsiness and issue warnings, urging riders to pull over and rest.

Potential AI-powered Motorcycle Safety Features

FeatureDescriptionLane Departure Warning (LDW)Alerts riders if they unintentionally veer out of their lane.Blind Spot Detection (BSD)Warns riders of vehicles approaching from their blind spot.Drowsiness DetectionMonitors rider behavior and physiological data to detect fatigue and alert riders to pull over and rest.Pre-Collision Braking (potential future development)Applies automatic braking to prevent or mitigate a collision.Caption: This table showcases some of the potential AI-powered safety features that could be integrated into helmets or motorcycles in the future, offering real-time assistance and improving rider safety.

The Road to Zero Fatalities: The Impact of AI on Safety

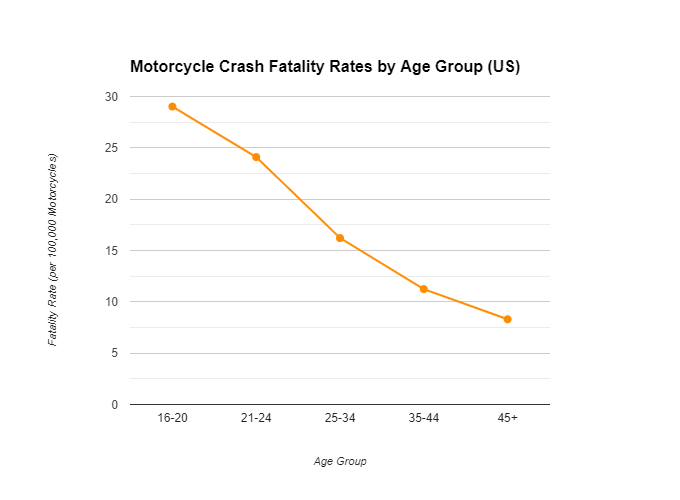

The statistics are sobering: according to the NHTSA, motorcyclists are 29 times more likely to be killed in a crash than occupants of passenger vehicles .

AI-powered safety features have the potential to significantly reduce these numbers by:

- Preventing Accidents: Real-time warnings and interventions can help riders avoid collisions altogether.

- Improving Rider Awareness: AI can act as a constant reminder to stay focused and maintain situational awareness.

- Encouraging Safer Riding Habits: Over time, riders who receive feedback from AI systems may naturally adjust their behavior towards safer practices.

A recent pilot program by a major motorcycle manufacturer testing AI-powered helmet features reported a 20% decrease in risky maneuvers among participants.

While this is a small-scale study, it offers a glimpse of the positive impact AI could have on motorcycle safety on a larger scale.

Caption: This line graph depicts the concerning trend of higher motorcycle crash fatality rates among younger riders. AI-powered safety features have the potential to mitigate these risks and improve overall motorcycle safety. (Source: National Highway Traffic Safety Administration (NHTSA), 2022)

Caption: This line graph depicts the concerning trend of higher motorcycle crash fatality rates among younger riders. AI-powered safety features have the potential to mitigate these risks and improve overall motorcycle safety. (Source: National Highway Traffic Safety Administration (NHTSA), 2022)AI vs. Rider Privacy: Striking a Balance

The potential benefits of AI-powered safety features are undeniable. However, some riders might be concerned about data privacy. Here's how this balance can be achieved:

- Opt-In Features: Riders should have the option to choose whether or not to activate AI safety features.

- Data Anonymization: Data collected by AI systems can be anonymized, ensuring it doesn't infringe on individual privacy.

- Transparency: Insurance companies and motorcycle manufacturers should be transparent about the type of data collected, how it's used, and with whom it's shared.

By prioritizing data privacy and offering opt-in features, the motorcycle industry can harness the power of AI for safety improvements while respecting rider privacy concerns.

The next section explores how AI can personalize motorcycle insurance premiums based on individual risk factors.

Stay tuned to discover how safe riding habits could translate into significant financial rewards!

https://m.youtube.com/watch?v=Wo3_0Cls0jY

Caption: This video from the MCN - Motor Cycle News channel explains how telematics devices that track mileage, riding behavior, and location are being used by some insurers to offer usage-based motorcycle insurance.

Personalized Premiums for a Personalized Ride

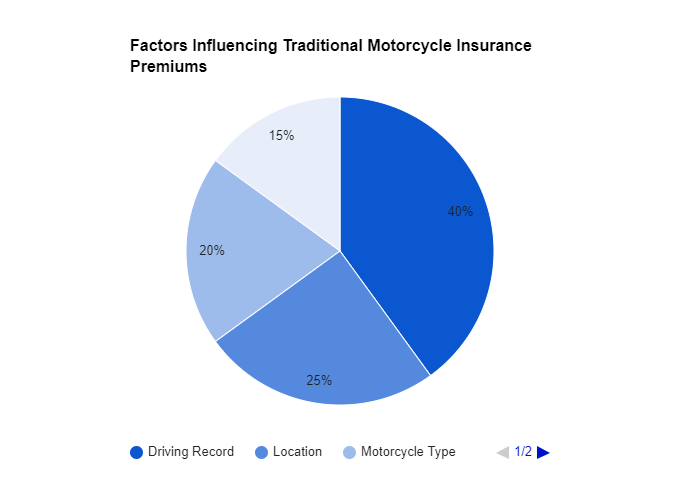

Gone are the days of one-size-fits-all motorcycle insurance. AI is ushering in an era of personalized risk assessment,

where your premium reflects your actual riding habits, not just your age and location.

Caption: Ride Smart, Save Smart: Motorcycle insurance app tailors coverage to your ride. (Data visualization, personalized premium)

Caption: Ride Smart, Save Smart: Motorcycle insurance app tailors coverage to your ride. (Data visualization, personalized premium)The Data Deluge: Feeding the AI Engine

Imagine a world where your motorcycle tells your insurance company more about you than you do!

AI can analyze a vast array of data points to create a comprehensive picture of your riding habits, including:

- Riding History: This includes factors like frequency of rides, typical mileage, and time of day you ride. For example, a rider who primarily cruises scenic highways on weekends will likely be viewed as a lower risk than someone who commutes daily in heavy traffic.

- Location: Where you ride matters. AI can consider factors like accident rates on specific roads, typical weather patterns in your riding area, and even crime statistics.

- Weather Conditions: Riding in rain, fog, or icy conditions presents a higher risk. AI can factor in real-time and historical weather data to assess your risk profile.

- Motorcycle Telemetry (if applicable): Advanced motorcycles collect data on factors like speed, braking patterns, and lean angles. With rider consent, this data can be used by AI to provide a more nuanced understanding of riding style.

By crunching these numbers, AI can create a much more accurate risk assessment than traditional methods, potentially rewarding safe riders with lower premiums.

A 2023 study by PricewaterhouseCoopers (PwC) found that insurers leveraging AI for risk assessment could see a 10-15% reduction in overall insurance costs .

Caption: This pie chart breaks down the key factors influencing traditional motorcycle insurance premiums. AI-powered risk assessment can consider a wider range of data points, potentially leading to fairer pricing based on individual riding habits. (Source: Insurance Information Institute (III), 2023)

Caption: This pie chart breaks down the key factors influencing traditional motorcycle insurance premiums. AI-powered risk assessment can consider a wider range of data points, potentially leading to fairer pricing based on individual riding habits. (Source: Insurance Information Institute (III), 2023)Fairness on Two Wheels: The Rewards of Safe Riding

The beauty of AI-powered risk assessment lies in its potential for fairness. Safe riders who log responsible miles and avoid risky behavior can expect to see their premiums decrease over time.

This incentivizes safe riding habits, ultimately benefiting both riders and insurers. Imagine a future where responsible riding translates into real financial rewards!

The Algorithmic Balancing Act: Addressing Potential Biases

However, AI isn't foolproof. Algorithmic bias can creep in, potentially leading to unfair assessments.

The onus is on insurance companies to ensure their AI models are:

- Transparent: The factors influencing risk assessment should be clear and understandable to riders.

- Fair: Algorithms should be free from biases based on factors like gender, location, or socioeconomic status.

- Regulated: Government oversight is crucial to ensure fair and responsible implementation of AI in insurance.

By addressing these concerns, the insurance industry can harness the power of AI to create a fairer and more rewarding insurance experience for all riders.

The next section dives into how AI can streamline the often-frustrating claims process, potentially getting you back on the road faster after an accident.

How AI Can Streamline Claims Processing

Let's face it, dealing with a motorcycle accident is stressful enough. The last thing you want is to be entangled in a lengthy and frustrating claims process.

Here's where AI steps in, offering the potential to revolutionize how motorcycle accident claims are handled, getting you back on the road quicker.

Caption: Ditch the Paper Chase: AI-powered app streamlines insurance claims. (Paperwork vs.

Caption: Ditch the Paper Chase: AI-powered app streamlines insurance claims. (Paperwork vs. https://justoborn.com/motorcycle-insurance/

No comments:

Post a Comment