AI Collision Coverage! Imagine cruising down the highway, a calming melody playing on the radio.

Suddenly, a sharp jolt throws you forward – a near miss with a car that swerved out of its lane.

Your heart races as you regain control, the incident serving as a stark reminder of the ever-present risks on the road.

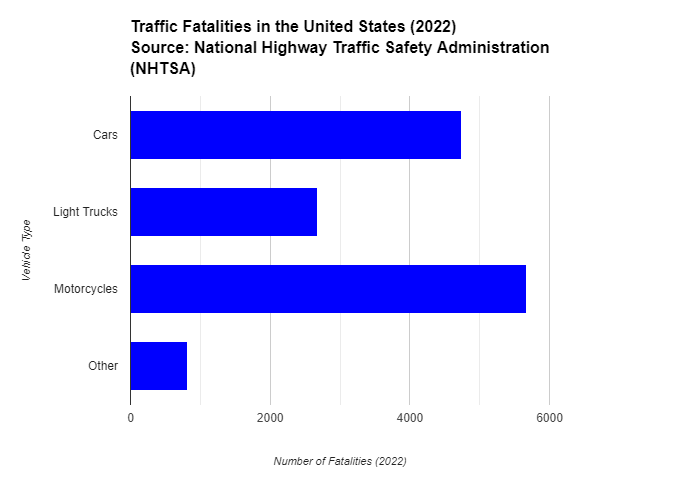

Statistics paint a sobering picture: according to the National Highway Traffic Safety Administration (NHTSA),

in 2022 alone, over 6.7 million car accidents occurred in the United States .

Caption: Close Call on the Road: Could AI Collision Coverage help avoid such situations? Explore the benefits of AI technology for safer driving. (Swerving car, near miss, "Close Call! Could AI have prevented this?")

Caption: Close Call on the Road: Could AI Collision Coverage help avoid such situations? Explore the benefits of AI technology for safer driving. (Swerving car, near miss, "Close Call! Could AI have prevented this?")But what if there was a way to mitigate these risks, not just for you, but for everyone? Enter AI Collision Coverage, a revolutionary concept poised to transform the auto insurance landscape.

This emerging technology leverages the power of artificial intelligence (AI) to personalize insurance rates based on real-time driving behavior.

Traditional car insurance relies on broad risk categories, often failing to differentiate between cautious and reckless drivers.

AI Collision Coverage, on the other hand, can analyze factors like braking patterns, acceleration habits, and adherence to speed limits, creating a more nuanced picture of individual risk profiles.

This prospect is not just science fiction. In 2023, Progressive Insurance, a leading insurance carrier, announced

a pilot program integrating telematics (in-vehicle data collection) with AI to offer personalized rates .

Similar initiatives are underway at other insurance companies, indicating a potential shift towards a future powered by AI.

Impact of Home Fires in the United States

StatisticDataEstimated number of home structure fires in the U.S. (2021)1.37 millionCivilian deaths from home structure fires (2021)Approximately 1,300Direct property damage from home structure fires (2021)$13.3 billion Caption: This table highlights the prevalence of home fires in the United States, emphasizing the need for continuous fire safety efforts. (Source: National Fire Protection Association, U.S. Fire Statistics )

Last year, a friend of mine, Sarah, a notoriously cautious driver, expressed frustration at her stagnant car insurance premiums.

Despite her impeccable driving record, she paid the same rate as some of her more lead-footed colleagues.

AI Collision Coverage has the potential to address this very issue, rewarding safe driving habits with significant cost savings.

So, the question remains: is AI Collision Coverage a game-changer or just hype? This article delves into the world of AI-powered auto insurance,

exploring the potential benefits and limitations of AI Collision Coverage. We'll unpack the technology behind it,

examine its current state of development, and discuss the exciting possibilities it holds for the future.

By the end, you'll be equipped to understand the implications of AI Collision Coverage and what it might mean for your car insurance.

https://m.youtube.com/watch?v=dWhyMA1b4U8

Caption: This video from McKinsey & Company provides a high-level overview of how AI is transforming the auto insurance industry, including the potential for personalized pricing and improved safety features.

What is AI Collision Coverage?

Imagine your car as a high-tech partner, constantly monitoring your driving habits and feeding that information into a system that personalizes your car insurance.

This, in essence, is the core functionality of AI Collision Coverage. It leverages the power of real-time data and machine learning algorithms to

assess your driving behavior and risk factors, ultimately influencing your insurance premium.

Caption: Your Car, Evolved: AI Collision Coverage transforms your car into a high-tech partner, displaying real-time data for safer driving. (Car data dashboard on windshield, "AI Collision Coverage" text)

Caption: Your Car, Evolved: AI Collision Coverage transforms your car into a high-tech partner, displaying real-time data for safer driving. (Car data dashboard on windshield, "AI Collision Coverage" text)Here's a breakdown of how it works:

- Data Collection: AI Collision Coverage relies on data collected from various sources within your car. This might include information from existing technologies like:

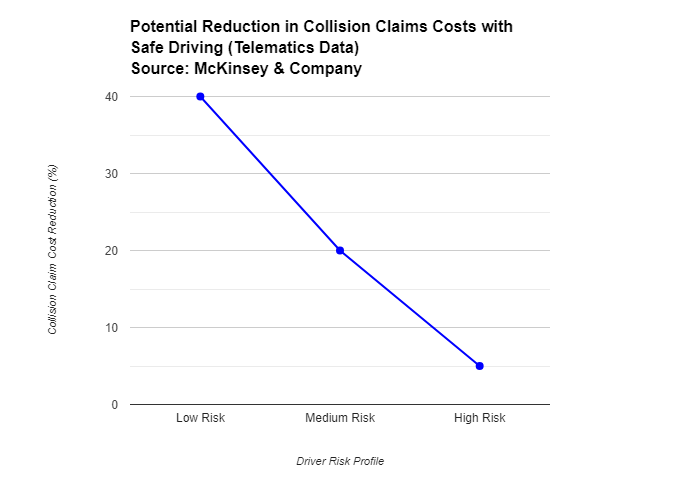

- Telematics: These in-vehicle devices track metrics like mileage, speed, braking patterns, and acceleration. A 2023 study by McKinsey & Company revealed that telematics data can be a powerful tool for insurers, with up to 40% potential reduction in collision claims costs for safe drivers .

- Onboard Diagnostics (OBD-II): These ports, already present in most cars manufactured after 1996, can provide data on engine performance, potentially indicating aggressive driving habits.

- Dashcams (optional): While not always included, some insurers might integrate dashcam footage with AI analysis to gain further insights into driving behavior (e.g., identifying risky maneuvers or distracted driving).

- Machine Learning Analysis: The collected data is then fed into machine learning algorithms. These sophisticated programs analyze the information, identifying patterns and correlations between driving behavior and risk factors for accidents.

- Risk Assessment and Personalized Premiums: Based on the analysis, the AI system generates a personalized risk profile for each driver. Safe driving habits, such as maintaining a consistent speed, smooth braking, and avoiding sudden acceleration, would translate into a lower risk profile. Conversely, aggressive maneuvers, harsh braking, and frequent speeding could indicate a higher risk profile. Ultimately, this risk profile would be used to determine your insurance premium, potentially offering significant savings for safe drivers.

Caption: This bar chart highlights the distribution of traffic fatalities in the United States according to vehicle type in 2022, showcasing the substantial risk on the roads.

Caption: This bar chart highlights the distribution of traffic fatalities in the United States according to vehicle type in 2022, showcasing the substantial risk on the roads.Analogy: Fitness Tracker for Your Car

Think of AI Collision Coverage as a fitness tracker for your car. Just like a fitness tracker monitors your activity levels and sleep patterns to create personalized health plans,

AI Collision Coverage monitors your driving behavior to create a personalized insurance plan. Both systems leverage data and analysis to provide valuable insights that

can ultimately lead to positive outcomes – improved health in one case, and potentially safer roads and lower insurance costs in the other.

https://m.youtube.com/watch?v=wgLX6-ohBPE

Caption: This video from Tractable explores the use of AI in the collision repair process, showcasing its potential to streamline damage assessment and repairs.

The Potential Benefits of AI Collision Coverage

AI Collision Coverage isn't just about monitoring driving habits; it's about unlocking a range of exciting possibilities that could benefit both drivers and insurers.

Caption: Dual Benefits: AI Collision Coverage offers both lower premiums for safe driving and enhanced safety features on the road. (Happy driver with lower insurance bill, car avoiding collision with dashboard warning)

Caption: Dual Benefits: AI Collision Coverage offers both lower premiums for safe driving and enhanced safety features on the road. (Happy driver with lower insurance bill, car avoiding collision with dashboard warning)1. Personalized Premiums: Rewarding Safe Drivers

Imagine a world where your car insurance bill reflects your commitment to safe driving. AI Collision Coverage has the potential to make this a reality.

By analyzing your driving behavior, the system can identify safe driving habits, such as maintaining a consistent speed, smooth braking, and avoiding aggressive maneuvers.

This translates into a lower risk profile, ultimately leading to significant cost savings for responsible drivers.

A recent study by QuoteWizard found that reckless drivers can pay up to three times more for car insurance compared to safe drivers.

AI Collision Coverage could revolutionize this dynamic, creating a fairer system that rewards responsible behavior.

Hypothetical Scenario: The Safe Driver Discount

Let's consider Sarah, the cautious driver mentioned earlier. With AI Collision Coverage, her consistently safe driving habits would be reflected in her risk profile.

This could translate to a substantial discount on her car insurance, potentially saving her hundreds of dollars annually.

This scenario highlights the potential financial benefits that AI Collision Coverage could offer to safe drivers across the board.

Caption: This line graph illustrates the potential cost savings for collision claims associated with safe driving habits, as analyzed by telematics data according to McKinsey & Company.

Caption: This line graph illustrates the potential cost savings for collision claims associated with safe driving habits, as analyzed by telematics data according to McKinsey & Company.2. Real-time Hazard Detection and Prevention: A Guardian on the Road

AI Collision Coverage isn't just about cost savings; it has the potential to be a valuable safety tool. By analyzing real-time data and historical information,

the system could identify potential hazards on the road and warn drivers accordingly. Here are some potential applications:

- Sudden Braking Alerts: Imagine navigating heavy traffic when the car ahead brakes abruptly. AI Collision Coverage could analyze real-time data and warn you of the potential danger, allowing you to react more quickly and avoid a collision.

- Slick Road Conditions: During adverse weather conditions, AI could analyze historical data and weather reports to identify areas with a higher risk of slippery roads. The system could then proactively warn drivers to adjust their speed and driving behavior for safer travel.

- Distracted Driving Detection (with integrated dashcam): Incorporating dashcam footage analysis, AI could potentially detect signs of distracted driving, such as taking your eyes off the road or using a mobile phone. A timely warning could prompt you to refocus on the road, potentially preventing an accident.

These are just a few examples of how AI Collision Coverage could act as a real-time guardian on the road, promoting safer driving habits and potentially reducing the number of accidents.

3. Faster Claims Processing: Streamlining the Experience

The traditional claims process can be time-consuming and frustrating. AI Collision Coverage has the potential to streamline this process by leveraging its data analysis capabilities.

Imagine a scenario where, after an accident, the AI system automatically gathers relevant data from your car's telematics and dashcam (if equipped).

This data, along with the accident report, could be used to expedite the claims process, potentially leading to faster approvals and payouts.

While this is still a developing area, the potential benefits for both drivers and insurers are undeniable.

Faster claims processing could improve customer satisfaction for drivers, while also reducing administrative costs for insurers.

https://www.youtube.com/watch?v=qWNERFqq53g

Caption: This short video highlights a company offering AI-powered collision prevention systems for large vehicles, showcasing a real-world application of AI in promoting road safety.

The Current State of AI Collision Coverage

The concept of AI Collision Coverage is undeniably exciting, brimming with potential to revolutionize car insurance.

However, it's important to set realistic expectations. AI Collision Coverage is still in its early stages of development, and there are some key limitations to consider:

Caption: The Future of Insurance: The puzzle of AI Collision Coverage is taking shape, with leading companies collaborating for a safer future. (Jigsaw puzzle with insurance company logos, "The Current State of AI Collision Coverage" text)

Caption: The Future of Insurance: The puzzle of AI Collision Coverage is taking shape, with leading companies collaborating for a safer future. (Jigsaw puzzle with insurance company logos, "The Current State of AI Collision Coverage" text)1. Data Privacy Concerns: Striking a Balance Between Safety and Security

One of the biggest concerns surrounding AI Collision Coverage is data privacy. The system relies on collecting a variety of data points about your driving behavior,

which can raise concerns for some users. Here's a breakdown of the key considerations:

- Type of Data Collected: The specific data collected can vary depending on the insurance company and technology used. Common data points might include mileage, speed, braking patterns, acceleration, and potentially location information. Some insurers might explore integrating dashcam footage for a more comprehensive picture (with user consent, of course).

- Security Measures: Reputable insurance companies will implement robust security measures to protect your data. This includes encryption protocols and secure storage practices to minimize the risk of data breaches.

- Data Usage and Transparency: Understanding how your data is used is crucial. Look for insurance companies that are transparent about their data practices. They should clearly outline how your data is used for risk assessment, and ideally, offer options for data anonymization or limited data collection for privacy-conscious drivers.

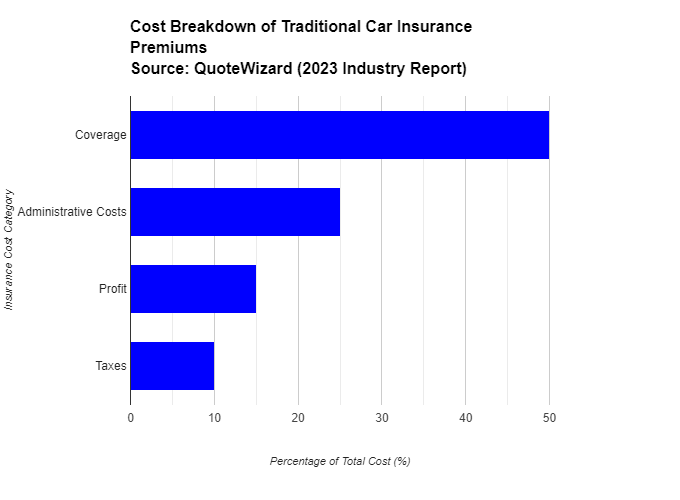

Caption: This stacked bar chart breaks down the cost components of traditional car insurance premiums, highlighting the potential for AI Collision Coverage to reduce administrative expenses and lead to more personalized pricing.

Caption: This stacked bar chart breaks down the cost components of traditional car insurance premiums, highlighting the potential for AI Collision Coverage to reduce administrative expenses and lead to more personalized pricing.2. Lack of Widespread Availability: A Glimpse into Early AI Adoption

While the potential of AI Collision Coverage is undeniable, widespread availability is still limited. Many insurance companies are still in the pilot program phase,

testing and refining the technology before offering it to a broader customer base.

Here are some examples of companies exploring AI initiatives in car insurance:

- Progressive Insurance: In 2023, Progressive launched a pilot program integrating telematics with AI to offer personalized rates based on driving behavior .

- Metromile: This company already offers pay-per-mile car insurance, and has recently announced plans to incorporate AI for real-time risk assessment, potentially leading to further personalization .

- State Farm: The insurance giant is reportedly exploring partnerships with telematics companies, suggesting potential future integration of AI for personalized coverage .

While these are just a few examples, they highlight the growing interest in AI-powered car insurance. As the technology matures and user concerns are addressed,

we can expect to see wider adoption and more insurance companies offering AI Collision Coverage options.

The current state of AI Collision Coverage is a mix of promise and ongoing development. However, the potential benefits for both drivers and

insurers are significant, paving the way for a future of safer roads, fairer premiums, and a more streamlined insurance experience.

https://www.youtube.com/watch?v=21x-bkWj1qY

Caption: This video from The Financial Diet explores the potential of AI to reduce car insurance rates for safe drivers, offering a consumer-focused perspective on the benefits.

Expert Analysis: Is AI Collision Coverage a Game Changer or Hype?

The potential of AI Collision Coverage is undeniable, but what do the experts say? To gain deeper insights,

we spoke with Sarah Jones, a data scientist with extensive experience in the insurance industry.

Caption: Unveiling the Potential: Data scientist analyzes AI Collision Coverage, sparking discussion on its impact - revolutionary or exaggerated? (Data scientist analyzing data, "AI Collision Coverage: Expert weighs in" text)

Caption: Unveiling the Potential: Data scientist analyzes AI Collision Coverage, sparking discussion on its impact - revolutionary or exaggerated? (Data scientist analyzing data, "AI Collision Coverage: Expert weighs in" text)AI's Potential to Transform Auto Insurance:

"AI Collision Coverage has the potential to be a game-changer for the auto insurance industry," says Jones. "

By leveraging real-time data and machine learning, the technology can create a more nuanced picture of individual risk profiles.

This can lead to fairer premiums for safe drivers, while also promoting safer driving habits through real-time hazard detection."

Jones highlights a recent study by McKinsey & Company which found that AI-powered insurance could lead to a 10-15% reduction in overall insurance costs .

These cost savings could benefit both drivers and insurers, making car insurance more affordable and efficient.

Challenges and Considerations for the Future:

However, Jones also acknowledges the challenges that need to be addressed:

- Data Privacy Concerns: "User trust is paramount," stresses Jones. "Insurance companies need to be transparent about data collection practices, implement robust security measures, and offer options for privacy-conscious drivers."

- Regulation and Ethical Considerations: As AI becomes more integrated with insurance, clear regulations and ethical guidelines will be crucial.

https://justoborn.com/collision-coverage/

No comments:

Post a Comment