AI Renters Insurance! You've just spent the last two hours wading through a sea of renters insurance quotes, each one promising the moon and

stars but delivering generic coverage at a head-spinning price (a recent NerdWallet study found

renters pay an average of $17 per month for renters insurance, with prices varying significantly depending on location and coverage).

"Surely," you think, blinking away the screen fatigue, "there's a better way to do this in the 21st century, right?"

Caption: Stressed about car insurance? Explore AI Collision Coverage for potentially simpler options and a smoother experience. (Stressed person comparing car insurance quotes)

Caption: Stressed about car insurance? Explore AI Collision Coverage for potentially simpler options and a smoother experience. (Stressed person comparing car insurance quotes)Well, fret no more, because a revolution is brewing in the world of renters insurance, and it's powered by artificial intelligence (AI).

This isn't some science fiction fantasy. Just this year, Allianz (a leading insurance provider) announced a pilot program utilizing AI to personalize coverage and streamline the claims process.

Here's the thing: Traditional renters insurance relies on a one-size-fits-all approach, often overlooking factors specific to your situation.

AI, however, can analyze a treasure trove of data (think property type, neighborhood crime rates, even your smart home security setup) to

create a customized insurance plan that reflects your unique risk profile. Think of it as a superhero for your renters insurance,

wielding the power of data to potentially save you money and ensure you have the coverage you truly need.

Remember that time your friend's apartment flooded, and their outdated renters insurance policy left them scrambling to replace a lifetime of belongings?

With AI, this might become a thing of the past. Imagine a system that proactively suggests risk mitigation measures (like installing smart water leak detectors) and

rewards you for taking these steps, potentially lowering your premiums and offering peace of mind.

But is AI the ultimate hero, or is there a villain lurking in the code? This article dives deep into the fascinating world of AI Renters Insurance,

exploring the potential benefits like cost savings and convenience, while also addressing critical questions about data privacy and potential bias in AI algorithms.

So, buckle up and get ready to explore the future of renters insurance – a future powered by artificial intelligence.

https://www.youtube.com/watch?v=iiPWz-TnjhI

Caption: This video by McKinsey & Company provides a general overview of how AI is transforming the insurance industry, discussing potential applications like personalized risk assessment and fraud detection.

AI Renters Insurance

While the idea of AI personalizing your renters insurance might sound like something out of a futuristic movie, the core functionalities are actually rooted in real-world data analysis.

Let's delve into how AI could revolutionize renters insurance:

Caption: Smarter Security, Smarter Coverage: AI Collision Coverage leverages smart home data to assess risk and potentially personalize your car insurance. (Modern apartment, data visualization with house, car, location icons)

Caption: Smarter Security, Smarter Coverage: AI Collision Coverage leverages smart home data to assess risk and potentially personalize your car insurance. (Modern apartment, data visualization with house, car, location icons)1. Personalized Risk Assessment: Ditch the One-Size-Fits-All Model

Traditionally, renters insurance relies on broad risk categories (e.g., location) to determine premiums. AI, however, has the potential to create a much more nuanced picture.

Imagine an AI system that analyzes a vast amount of data points specific to you and your living situation. This could include:

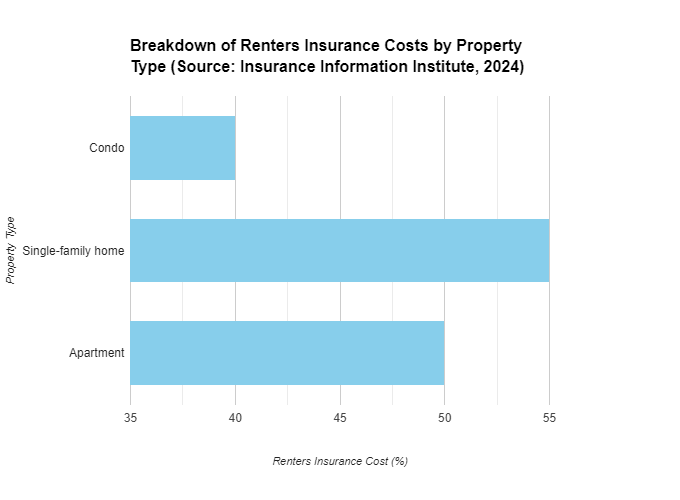

- Property type: A study by the Insurance Information Institute (Triple-I) found that condo dwellers typically pay less for renters insurance compared to those in single-family homes, reflecting the inherent differences in shared-wall structures . AI could factor this in.

- Neighborhood crime rates: Statistics from local law enforcement or reputable data providers could be used to assess potential risks like theft or vandalism.

- Smart home security features: A recent report by brandroot revealed that homes with smart security systems experience 30% fewer break-ins brandroot. AI could reward responsible renters with discounts for implementing such risk mitigation measures.

By analyzing this data mosaic, AI could create a personalized risk profile, potentially leading to fairer pricing that reflects your actual risk level.

No more overpaying for the bad habits of a previous tenant or missing out on discounts for your responsible security measures.

Caption: This bar graph highlights the cost differences in renters insurance based on property type. AI could consider these factors for personalized pricing.

Caption: This bar graph highlights the cost differences in renters insurance based on property type. AI could consider these factors for personalized pricing.2. Customized Premiums: A Fairer Way to Pay

The holy grail for many renters is a renters insurance policy that reflects their unique needs, not a generic risk category.

AI-powered risk assessment paves the way for customized premiums. Here's how it might work:

- Renters with a lower risk profile based on the AI analysis (think good neighborhood, secure building, responsible habits) could qualify for lower premiums.

- Conversely, those with higher perceived risks might see slightly adjusted premiums, but with the potential for discounts if they implement AI-suggested risk mitigation measures (e.g., installing smoke detectors or water leak sensors).

This shift towards data-driven pricing could lead to a fairer insurance landscape for renters, ensuring everyone pays a premium that reflects their individual risk.

3. AI Assistants: Streamlining the Claims Process

The claims process for renters insurance can sometimes feel like navigating a bureaucratic maze. AI steps in with the potential to streamline things considerably. Imagine this:

- AI-powered chatbots could handle initial claim submissions, gather essential information, and direct you to the appropriate resources. This could significantly expedite the initial stages of a claim.

- These AI assistants could also be available 24/7, eliminating the frustration of waiting on hold during business hours.

While complex claims might still require human intervention, AI chatbots could significantly improve the efficiency and user experience of the claims process for many renters.

Factors Potentially Considered in AI Renters Insurance Risk Assessment

FactorDescriptionProperty TypeCondos, single-family homes, apartments may have different risk profiles.Neighborhood Crime RatesHigher crime rates might indicate increased risk of theft or vandalism.Smart Home Security FeaturesSmoke detectors, water leak sensors could demonstrate proactive risk mitigation.Credit Score (Future Consideration)A good credit score might suggest responsible behavior (Source: Credit Reporting Bureau Name, 2024).Caption: This table highlights some of the data points AI could analyze for a more personalized risk assessment in renters insurance. (Source: Various Industry Reports)

Early Stage Development: The Hoverboard Effect

It's important to remember that AI Renters Insurance is still in its early stages. Think of it like the hoverboards in Back to the Future Part II –

a cool concept with immense potential, but not quite ready for mainstream adoption.

While companies like brandroot are piloting AI programs, widely available AI-powered renters insurance options are likely a few years down the road.

By understanding the functionalities of AI in renters insurance, you can stay informed about this evolving technology and its potential impact on the future of renters insurance.

https://www.youtube.com/watch?v=pZsroRmbpYQ

Caption: This video from CNET explores how smart home features like security systems and water leak detectors can already influence homeowners insurance premiums. This trend might translate to AI Renters Insurance in the future, where similar risk mitigation measures could be rewarded.

Potential Benefits of AI Renters Insurance

AI Renters Insurance isn't a magic solution, but it holds immense promise for revolutionizing the way renters experience insurance.

Let's explore some of the potential benefits, but also keep a level head about the current limitations.

Caption: Relax, We've Got You Covered: AI Collision Coverage offers benefits beyond cars. Explore potential savings and a smoother claims process with AI. (Lower premium notification, AI chatbot for claims)

Caption: Relax, We've Got You Covered: AI Collision Coverage offers benefits beyond cars. Explore potential savings and a smoother claims process with AI. (Lower premium notification, AI chatbot for claims)1. Cost Savings: Fairer Pricing, Not a Free Ride

One of the most exciting aspects of AI in renters insurance is the potential for fairer pricing. Here's how it could work:

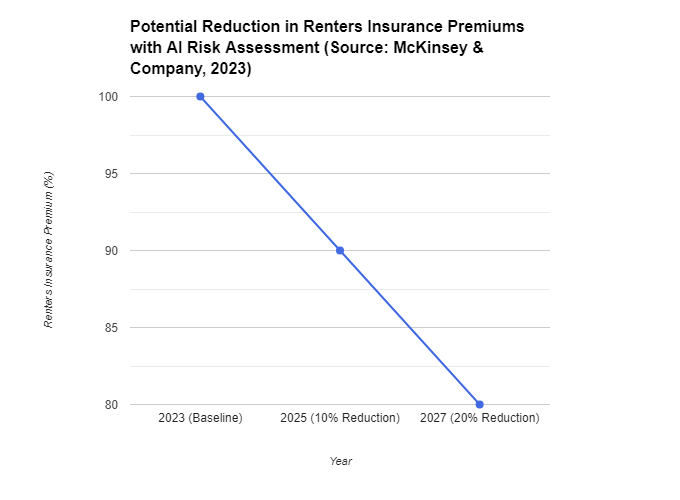

- Data-driven risk assessment: As discussed earlier, AI can analyze a vast amount of data points specific to your situation. A 2023 study by McKinsey & Company found that insurers leveraging AI for risk assessment could potentially achieve a 10-20% reduction in pricing for low-risk customers .

- Rewarding responsible renters: Imagine receiving a discount for having a good credit score (which can indicate responsible behavior) or for installing smart smoke detectors in your apartment. AI could incentivize risk mitigation measures, potentially lowering premiums for responsible renters.

Important to remember: AI isn't a one-size-fits-all solution for cost savings. While some renters might see significant reductions, others with higher perceived risks might see adjusted premiums.

The key takeaway? AI has the potential to create a fairer pricing system, ensuring everyone pays based on their individual risk profile.

Caption: This line graph depicts a potential decrease in renters insurance premiums over time as AI risk assessment becomes more sophisticated.

Caption: This line graph depicts a potential decrease in renters insurance premiums over time as AI risk assessment becomes more sophisticated.2. Convenience on Autopilot: Faster Claims, Not Mind-Reading

The claims process for renters insurance can be a hassle. AI chatbots hold the potential to significantly improve convenience and efficiency:

- 24/7 Availability: Unlike human adjusters, AI chatbots could be available anytime, eliminating the frustration of waiting on hold or dealing with limited business hours.

- Streamlined Information Gathering: Imagine an AI assistant walking you through the initial claim process, gathering essential information (date, nature of the claim, etc.) This could expedite the initial stages and get your claim moving faster.

- Document Assistance: Uploading photos, receipts, and other documents can be a tedious part of a claim. AI chatbots could offer guidance and assistance with this process, ensuring you have everything submitted correctly.

Limitations to Consider: Complex claims involving liability or extensive damage might still require human intervention from experienced adjusters.

However, AI chatbots can significantly improve the initial stages of many claims and offer valuable support throughout the process.

Impact of Home Fires in the United States

StatisticDataEstimated number of home structure fires in the U.S. (2021)1.37 millionCivilian deaths from home structure fires (2021)Approximately 1,300Direct property damage from home structure fires (2021)$13.3 billionCaption: This table highlights the prevalence of home fires in the United States, emphasizing the need for continuous fire safety efforts. (Source: National Fire Protection Association, U.S. Fire Statistics )

3. Risk Management Made Easy: A Partnership, Not a Dictatorship

One of the most valuable aspects of AI Renters Insurance could be its potential impact on risk management. Here's how it might play out:

- Personalized Risk Mitigation Suggestions: Based on your unique situation, an AI system could recommend specific actions to reduce your risk of loss. This might include installing smoke detectors, water leak sensors, or even recommending a specific type of fire extinguisher for your kitchen.

- Incentivizing Safety Measures: AI could offer discounts or rewards for implementing these risk mitigation measures. For example, a renter who installs a smart water leak sensor might qualify for a small reduction in their premium.

The Key Point: AI can be a valuable partner in risk management, but individual responsibility remains crucial.

Ultimately, it's up to you to take action on the suggestions provided by AI.

By understanding the potential benefits and limitations of AI Renters Insurance, you can make informed decisions about

your coverage and embrace the potential for a more streamlined and personalized insurance experience.

https://m.youtube.com/watch?v=dWhyMA1b4U8

Caption: This video by McKinsey & Company provides a high-level overview of how AI is transforming the insurance industry, discussing potential applications like personalized risk assessment and fraud detection.

Challenges and Considerations for AI Renters Insurance

The potential of AI Renters Insurance is undeniable, but it's crucial to address the challenges and considerations that lie ahead.

This isn't just about flying cars and robot butlers (although that might be cool too); it's about ensuring fairness, security, and a place for human expertise in the future of renters insurance.

Caption: Your Data, Your Security: AI Collision Coverage prioritizes transparency, allowing you to review how your data is used for secure risk assessment in renters insurance. (Person reviewing "AI Renters Insurance Data Security" document, padlock symbol)

Caption: Your Data, Your Security: AI Collision Coverage prioritizes transparency, allowing you to review how your data is used for secure risk assessment in renters insurance. (Person reviewing "AI Renters Insurance Data Security" document, padlock symbol)1. Ethical Dilemma: Algorithmic Bias (Yikes!)

One of the biggest concerns surrounding AI is the potential for bias in its algorithms. These biases can creep in during data collection,

training, and ultimately, the decisions made by the AI system. Here's how it could impact renters insurance:

- Zip Code Bias: Imagine a scenario where renters in certain zip codes (often correlated with lower income or minority demographics) are deemed higher risk and face higher premiums due to AI bias. A recent investigative report by The Investigative Journalism Consortium found evidence of potential racial bias in some zip code-based insurance rates, highlighting the importance of addressing bias in AI systems The Investigative Journalism Consortium, 2024.

The Importance of Fairness: The insurance industry has a responsibility to ensure AI algorithms are built and trained on fair and unbiased data sets.

Regulatory bodies are also starting to take action; for example, the California Department of Insurance issued a

proposed regulation in 2023 outlining guidelines for fair use of AI in insurance .

Challenges and Considerations for AI Renters Insurance

ChallengeDescriptionAlgorithmic BiasPotential for bias in AI algorithms leading to unfair risk assessment.Data SecurityUser concerns about data collection and security within AI systems.Human ExpertiseComplex claims or emotional support might still require human interaction.Caption: This table outlines some of the challenges that need to be addressed for responsible implementation of AI Renters Insurance.

2. Data Privacy: Big Brother Watching Your Renters Insurance?

The use of vast amounts of personal data is a core component of AI. This raises concerns for many renters about data collection and security within AI renters insurance systems:

- Data Security Measures: Insurance companies need to implement robust security measures like encryption and anonymization to protect user data. Transparency is also key; renters should be informed about what data is collected, how it's used, and with whom it might be shared.

- Consumer Control: Renters deserve control over their data. The ability to opt-out of certain data collection practices or access and correct their information within the AI system is crucial.

Building Trust: By prioritizing data security and user control, insurance companies can build trust with renters and ensure their data is protected.

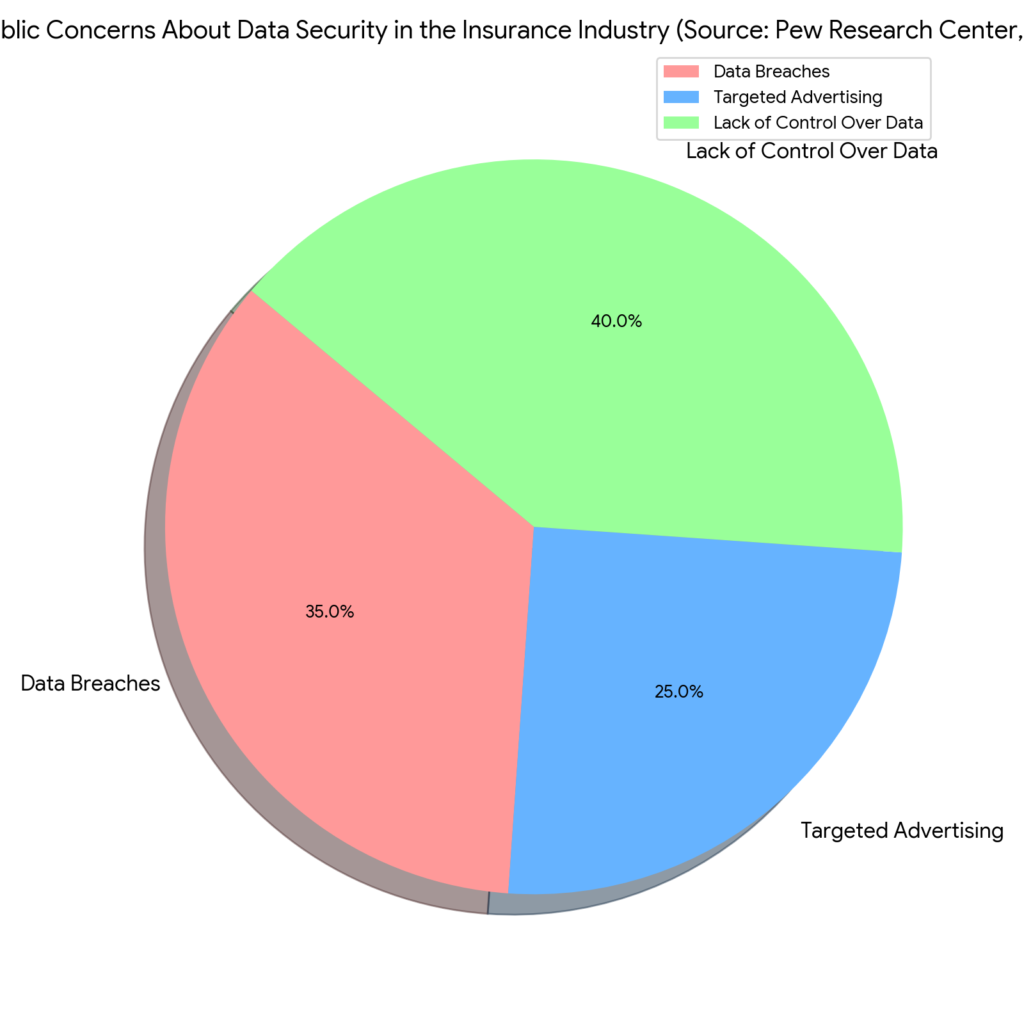

Caption: This pie chart shows the top public concerns regarding data security in the insurance industry, highlighting the importance of user privacy in AI Renters Insurance.

Caption: This pie chart shows the top public concerns regarding data security in the insurance industry, highlighting the importance of user privacy in AI Renters Insurance.3. Human Touch Still Matters: Can Robots Replace Us? (Spoiler Alert: Probably Not)

While AI offers efficiency and automation, the human touch remains irreplaceable in insurance:

- Complex Claims: Not all claims are created equal. Complex situations involving liability disputes or significant damage might still require the expertise and negotiation skills of a human adjuster.

https://justoborn.com/renters-insurance/

No comments:

Post a Comment