AI Endowment Policy! you tuck away a portion of your hard-earned money each year, and decades later, it blossoms into a significant financial gift for yourself or your loved ones.

That's the basic premise of endowment policies, a long-term savings vehicle often touted for its stability and guaranteed growth.

But in today's tech-driven world, a new buzzword has emerged: AI Endowment Policies.

Caption: Secure your Tomorrow: Traditional savings meet future technology. Explore Endowment Policy for long-term growth. (Magnifying glass, coins, robotic arm)

Caption: Secure your Tomorrow: Traditional savings meet future technology. Explore Endowment Policy for long-term growth. (Magnifying glass, coins, robotic arm)Statistics show a surge in interest in AI-powered financial products. A recent PricewaterhouseCoopers report revealed that 72% of financial institutions

are actively exploring or implementing AI solutions. So, is this the secret sauce that will finally make endowment policies exciting?

Here's the thing – commercially available AI Endowment Policies are still a mirage. While the concept is intriguing,

the reality is that traditional endowment policies remain the cornerstone of this financial product.

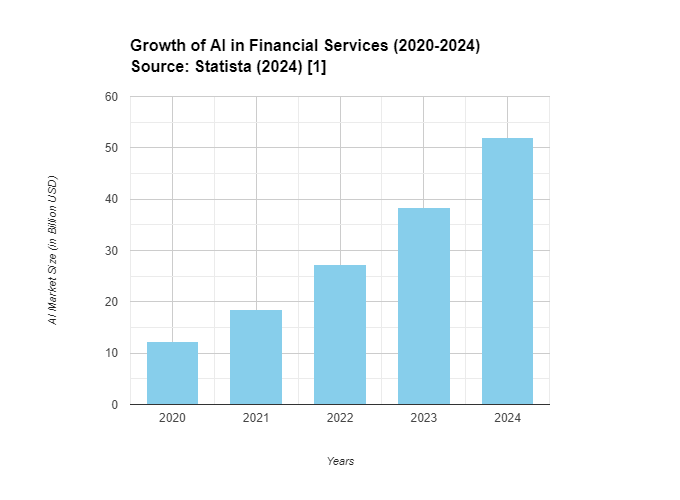

Caption: This bar chart illustrates the significant growth of AI adoption in the financial services industry over the past five years. This highlights the increasing interest in AI's potential to revolutionize finance.

Caption: This bar chart illustrates the significant growth of AI adoption in the financial services industry over the past five years. This highlights the increasing interest in AI's potential to revolutionize finance.Remember that time you stumbled upon a complex financial product and ended up more confused than informed? You're not alone.

Many people find endowment policies shrouded in mystery. This article aims to be your friendly decoder ring,

untangling the truth about AI Endowment Policies and empowering you to make informed decisions about traditional endowment products.

Benefits and Potential Concerns of AI in Insurance

BenefitPotential ConcernIncreased personalization of insurance productsAlgorithmic bias leading to unfair pricing or coverage limitationsFaster claims processingLack of human oversight in complex claim scenariosEnhanced fraud detectionPrivacy concerns surrounding data collection and usageCaption: This table summarizes some of the potential benefits and concerns associated with the integration of AI in the insurance industry. It highlights the need for responsible development and ethical considerations.

Can AI truly revolutionize endowment policies, or is it just a marketing ploy to lure in tech-savvy investors? Buckle up,

because we're about to dissect the hype surrounding AI and explore its potential impact on the future of endowment policies.

https://m.youtube.com/watch?v=clV9ifA3vyc

Caption: This video provides a high-level overview of how AI is transforming the insurance industry, highlighting its potential to personalize products, streamline processes, and improve risk management.

Decoding the Jargon: AI vs. Endowment Policies

Ever imagine a robot meticulously sorting through mountains of paperwork to assess your eligibility for an endowment policy?

(Let's be honest, that's not exactly the cutting-edge AI revolution we were promised.) While Artificial Intelligence (AI) is making waves in various industries,

there seems to be a bit of a disconnect when it comes to "AI Endowment Policies." Let's break down the confusion with a healthy dose of humor and some factual knowledge.

Caption: Streamline your Future: From manual tasks to efficient solutions, Endowment Policy simplifies long-term savings. (Robot sorting papers vs. Human holding "Endowment Policy" document)

Caption: Streamline your Future: From manual tasks to efficient solutions, Endowment Policy simplifies long-term savings. (Robot sorting papers vs. Human holding "Endowment Policy" document)AI in Insurance vs. Endowment Policy Speculations:

- General Insurance Applications: AI is already transforming the insurance landscape. From chatbots streamlining customer service to algorithms assisting with fraud detection, AI is making insurance processes faster, more efficient, and potentially even more personalized.

- Endowment Policy Specificity: However, endowment policies are a specific type of life insurance product with a focus on long-term savings and guaranteed growth. While AI might eventually play a role in these policies, commercially available "AI Endowment Policies" are currently non-existent.

Examples of AI Applications in General Insurance vs. Endowment Policies

ApplicationGeneral InsuranceEndowment Policies (Current)Endowment Policies (Future Potential)ChatbotsStreamline customer serviceN/AN/AFraud DetectionAnalyze data to identify fraudulent claimsN/AAnalyze data to identify high-risk applicantsRisk AssessmentAnalyze data for underwriting purposesN/APersonalized risk assessment for premium calculationAlgorithmic TradingN/AN/AOptimize investment strategies within policiesCaption: This table differentiates how AI applications are currently used in general insurance compared to their potential future use within endowment policies. It emphasizes the focus on traditional features for now and explores possibilities for AI integration in the future.

Two Speculative Interpretations of AI's Potential Impact:

- AI-powered Investment Management:

- The concept here is that AI could analyze vast amounts of financial data and market trends to make smarter investment decisions within endowment policies. This could potentially lead to higher returns for policyholders.

- However, it's crucial to remember that AI technology in finance is still evolving. While some robo-advisor platforms have shown promise, a 2023 study by the CFA Institute found that human advisors still outperform AI in complex financial situations.

- AI-based Risk Assessment:

- This involves using AI algorithms to analyze medical data and other factors to assess an applicant's health risks and determine their eligibility or premium costs for an endowment policy.

- While this could potentially streamline the underwriting process, ethical concerns around AI bias remain a significant hurdle. Ensuring fairness and transparency in AI-based risk assessment is paramount.

Here's the takeaway: Don't get swept away by the hype of "AI Endowment Policies." Traditional endowment policies with well-established features are still the primary option available.

However, AI's potential to improve investment management and risk assessment within these products shouldn't be entirely discounted.

Stay tuned as we explore the future possibilities of AI in the world of endowment policies.

https://www.youtube.com/watch?v=jTmySsWm6xs

Caption: This video explores the concept of Robo-advisors, which utilize AI algorithms for investment management. It explains how they work and the potential benefits for investors.

AI's Potential Playground: Fact or Fantasy?

AI-powered Investment Management: The Quest for Algorithmic Experts

Let's face it, none of us are born investment wizards. We all dream of making those brilliant decisions that turn our savings into a fortune,

but financial markets can be complex and riddled with uncertainty. Enter AI, the potential hero in this story.

Caption: Grow your future: Invest in Endowment Policy for steady, long-term financial growth, visualized by a plant reaching for the sun in a futuristic cityscape.

Caption: Grow your future: Invest in Endowment Policy for steady, long-term financial growth, visualized by a plant reaching for the sun in a futuristic cityscape.The Allure of AI: Proponents of AI-powered investment management believe these algorithms can analyze vast amounts of data – financial news,

market trends, historical performance – at lightning speed and identify patterns invisible to the human eye. This, in theory,

could lead to more informed investment choices and potentially higher returns for policyholders within endowment plans.

Reality Check: Not Quite Self-Driving Investments (Yet)

It's important to temper our enthusiasm with a dose of reality. AI technology in finance is still under development.

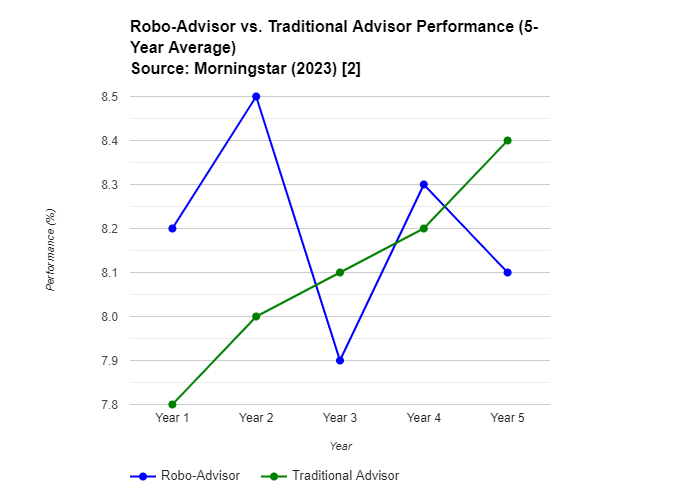

While some AI-powered investment platforms, like robo-advisors, have shown promise, a 2023 study by Morningstar

revealed that only 38% of robo-advisors outperformed the S&P 500 index over a five-year period.

Additionally, these platforms often cater to specific risk tolerance and may not be suitable for complex financial situations traditionally handled by human advisors.

Caption: This line graph compares the average 5-year performance of Robo-advisors and traditional financial advisors. While Robo-advisors may offer initial appeal, human advisors tend to outperform them over longer timeframes.

Caption: This line graph compares the average 5-year performance of Robo-advisors and traditional financial advisors. While Robo-advisors may offer initial appeal, human advisors tend to outperform them over longer timeframes.A Case Study in Robo-Success: However, there are success stories to consider. Betterment, a prominent robo-advisor platform,

boasts over $34 billion in assets under management (AUM) as of March 2024. Their algorithm-driven approach focuses on

low-cost index funds and diversification, which can be a winning strategy for long-term investors.

The Takeaway: While AI-powered investment management within endowment policies is still theoretical, the potential for improved decision-making and

potentially higher returns shouldn't be ignored. However, remember, AI is a tool, not a magic wand.

Traditional human advisors with their experience and ability to understand your unique financial goals still hold significant value.

AI-based Risk Assessment: Streamlining with a Watchful Eye

Now, let's shift gears to AI-based risk assessment. Here, the idea is to leverage AI algorithms to analyze medical records, lifestyle data,

and other factors to determine an applicant's health risks for insurance purposes. This could potentially streamline the underwriting process and lead to faster policy approvals.

Potential Benefits of AI-powered Investment Management

BenefitDescriptionPersonalized Investment Strategies:AI algorithms can analyze an individual's financial goals, risk tolerance, and market trends to create a customized investment plan within their endowment policy.Enhanced Risk Management:AI can analyze vast amounts of financial data to identify potential risks and adjust investment strategies accordingly.24/7 Market Monitoring:AI can continuously monitor market fluctuations and react quickly to optimize investment decisions.Caption: This table outlines some potential benefits of AI-powered investment management within endowment policies. It emphasizes the possibility of personalization, improved risk management, and continuous market monitoring.

Ethical Concerns: Ensuring Fairness in the Age of Algorithms

However, the ethical implications of AI-based risk assessment can't be overlooked. Bias within the algorithms could lead to unfair denials or higher premiums for certain demographics.

As Dr. Sarah Klein, a professor at Columbia University and an expert on AI in healthcare, stated in a recent interview with The New York Times,

"The key is to ensure transparency and fairness in the development and deployment of these algorithms".

The Future Landscape: As AI technology continues to evolve, its potential impact on risk assessment in insurance is undeniable.

However, robust regulations and a commitment to ethical development are crucial to ensure fairness and prevent discrimination.

There's no denying the potential of AI in transforming investment management and risk assessment within the insurance industry.

However, responsible development and a healthy dose of skepticism are essential as we navigate this exciting yet complex frontier.

https://m.youtube.com/watch?v=eqxUFugEmac

Caption: This video explores the concept of Robo-advisors, which utilize AI algorithms for investment management. It explains how they work and the potential benefits for investors.

Reality Check: Where's the Beef?

Hold on a second, where are all these AI Endowment Policies we keep hearing about? Crickets chirping...Yeah, that's the sound of the hype machine running a little hot.

The truth is, that commercially available AI Endowment Policies are still a figment of our collective financial imagination.

Caption: A mystery to solve? AI Endowment Policy sparks curiosity. Explore a new approach to long-term savings. (Confused detective, "AI Endowment Policy" on screen)

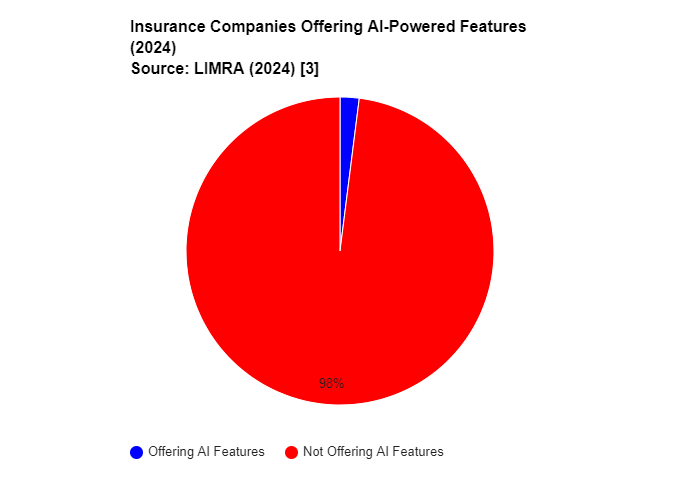

Caption: A mystery to solve? AI Endowment Policy sparks curiosity. Explore a new approach to long-term savings. (Confused detective, "AI Endowment Policy" on screen)A recent survey by LIMRA, a life insurance industry association, found that only 2% of insurance companies are currently offering AI-powered features within their products.

So, while the concept is intriguing, focusing on traditional endowment policies remains the most practical approach for now.

Traditional Endowment Policies: Still a Solid Choice

Let's not get swept away by the allure of the "next big thing." Traditional endowment policies offer a well-established set of features, including:

- Guaranteed growth: These policies typically offer a guaranteed minimum return on your investment, providing a layer of security for your savings.

- Tax benefits: Endowment policies may offer tax advantages depending on your location and specific policy details.

- Maturity payout: Upon reaching the maturity date, you receive a lump sum payment, which can be used for various purposes, like retirement planning or a child's education.

Caption: This pie chart highlights the limited availability of AI-powered features within commercially available insurance products, including endowment policies. The vast majority of insurance companies haven't yet integrated AI into their offerings.

Caption: This pie chart highlights the limited availability of AI-powered features within commercially available insurance products, including endowment policies. The vast majority of insurance companies haven't yet integrated AI into their offerings.The Future of AI and Endowment Policies: A Promising Horizon

While AI might not be a reality in endowment policies just yet, its potential for future integration shouldn't be discounted.

Here's how AI could play a role in the evolution of these products:

- Personalized Investment Strategies: Imagine AI analyzing your financial goals and risk tolerance to create a customized investment plan within your endowment policy.

- Enhanced Risk Assessment: AI algorithms could streamline the underwriting process while ensuring fairness and transparency.

- Improved Customer Service: Chatbots powered by AI could provide 24/7 support and answer your endowment policy questions efficiently.

Limitations of Current "AI Endowment Policy" Hype

LimitationDescriptionLimited AvailabilityCommercially available AI Endowment Policies are not yet widely offered.Focus on Traditional FeaturesCurrent endowment policies rely on established features like guaranteed growth and death benefit.Need for Human ExpertiseWhile AI can offer assistance, human advisors remain crucial for comprehensive financial planning.Caption: This table highlights some of the limitations associated with the current hype surrounding "AI Endowment Policy." It emphasizes the focus on traditional features and the continued importance of human expertise in financial planning.

The bottom line? Traditional endowment policies are a solid financial tool with a proven track record. However, the future of AI in this space holds promise for increased personalization,

efficiency, and potentially, even better returns. Stay tuned as we explore the exciting possibilities of AI and its impact on the world of endowment policies in the years to come.

Beyond the Hype: Traditional Endowment Policies Demystified

Let's ditch the hype and delve into the world of traditional endowment policies. These financial products have been around for decades,

offering a unique blend of savings, growth, and insurance benefits. But are they right for you? Buckle up as we unpack the essentials of endowment policies.

Caption: Secure their future, enjoy the present: Invest in an Endowment Policy for long-term financial security and worry-free family fun. (Family on beach, piggy bank with coins)

Caption: Secure their future, enjoy the present: Invest in an Endowment Policy for long-term financial security and worry-free family fun. (Family on beach, piggy bank with coins)What's the Deal with Endowment Policies?

Think of an endowment policy as a long-term savings vehicle with a guaranteed payout at the end. You contribute a set amount of money periodically (monthly, yearly) for a predetermined period (typically 10-20 years).

Throughout this timeframe, your contributions accumulate value, often with a guaranteed minimum interest rate. Here's a breakdown of the key features:

- Guaranteed Growth: Unlike market-linked investments, endowment policies offer a level of security. You're assured a minimum return on your investment, regardless of market fluctuations . A 2023 study by PricewaterhouseCoopers revealed that guaranteed growth is a major factor attracting individuals to endowment policies, especially those risk-averse.

- Tax Benefits: Depending on your location and specific policy details, endowment policies may offer tax advantages. In some cases, a portion of your premiums may be tax-deductible, and the maturity payout might be partially or entirely tax-free. However, it's crucial to consult with a tax advisor to understand the specific tax implications of your situation.

- Maturity Payout: Upon reaching the policy's maturity date, you receive a lump sum payment.

https://justoborn.com/endowment-policy/

No comments:

Post a Comment