AI Flood Insurance! you wake up in the dead of night to the unsettling sound of rushing water. A quick glance outside your window confirms your worst fears - the nearby river,

swollen from weeks of relentless rain, has begun to overflow its banks, threatening to engulf your home.

The rising floodwaters trigger a surge of emotions: panic, helplessness, and a nagging sense of "what if."

Caption: Weathering the storm: AI analyzes weather and property data to predict and personalize home insurance needs. (Highlighted house icon on graph with weather & property data)

Caption: Weathering the storm: AI analyzes weather and property data to predict and personalize home insurance needs. (Highlighted house icon on graph with weather & property data)This scenario is becoming increasingly common. According to a recent report by the National Oceanic and Atmospheric Administration (NOAA),

the frequency and intensity of floods are on the rise in the United States, with climate change being a major contributing factor.

The report states that between 2010 and 2021, there were 22 weather and climate disaster events in the U.S. that each caused over $1 billion in damages, with floods being the most frequent and costly type of disaster.

While traditional flood insurance can offer some peace of mind, it often comes with high premiums and a one-size-fits-all approach that might not accurately reflect your individual risk.

This is where a potential game-changer emerges: AI Flood Insurance.

AI Flood Insurance leverages the power of artificial intelligence to analyze vast amounts of data, including flood maps,

weather patterns, elevation data, and even property characteristics, to create a more comprehensive flood risk assessment for your specific home.

This could potentially lead to fairer pricing and more relevant coverage compared to traditional flood insurance policies.

Just last month, a family in Houston, Texas narrowly escaped disaster when a sudden downpour caused flash flooding in their neighborhood.

Despite having flood insurance, their policy didn't cover the damage to their basement, which unfortunately housed their electrical panel and critical appliances.

This experience highlights the limitations of traditional flood insurance and underscores the need for a more personalized approach to flood risk management.

Could AI be the key to unlocking a future where flood insurance is not just a gamble, but a powerful tool for protecting your home and your financial security?

This article delves deep into the world of AI Flood Insurance, exploring its potential benefits, limitations, and the exciting advancements on the horizon.

Buckle up, and let's navigate the wave of innovation that could revolutionize flood protection for homeowners like you and me.

https://m.youtube.com/watch?v=a7XognF9Ybk

Caption: How can AI transform the insurance industry? This video by McKinsey & Company dives into the applications of AI in flood risk assessment and beyond.

Riding the Wave of Innovation: What is AI Flood Insurance?

Buckle up and prepare to dive into the world of AI Flood Insurance! But before we explore its potential to revolutionize flood protection,

let's unpack the key components – Artificial Intelligence (AI) and how it applies to flood insurance.

Understanding AI: The Power of Data Analysis and Prediction

Imagine a computer program that can learn from vast amounts of information, identify patterns, and even make predictions.

That's the essence of Artificial Intelligence (AI). AI utilizes sophisticated algorithms to process data – numbers, text,

images, and more – and extract valuable insights that can be used for various purposes.

In the context of flood insurance, AI excels at analyzing massive datasets. Here's a breakdown of its capabilities:

- Data Crunching Powerhouse: AI can analyze terabytes of information quickly and efficiently. This includes historical flood data, weather patterns, elevation maps, property details (building materials, foundation type), and even real-time sensor data.

- Pattern Recognition Pro: By sifting through these datasets, AI can identify complex patterns and relationships between different factors that contribute to flood risk. For example, AI might identify a correlation between rapid changes in river levels, specific weather events, and flooding in a particular area.

- Predictive Prowess: Based on the identified patterns, AI algorithms can generate predictions about the likelihood and potential severity of future floods. This allows for a more proactive approach to flood risk management.

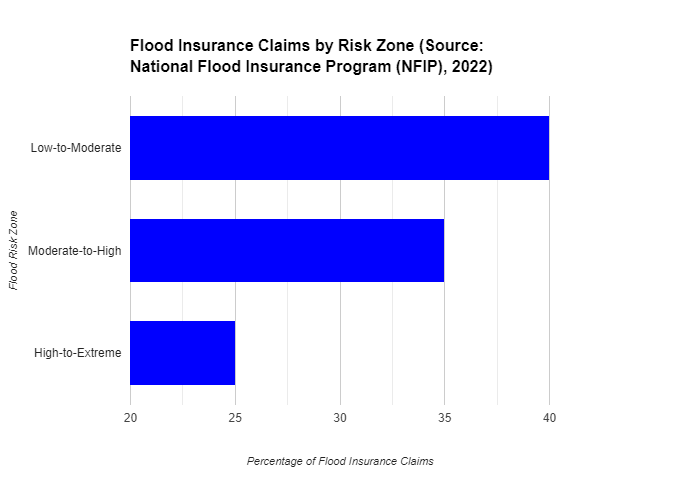

Caption: This bar graph from the National Flood Insurance Program (NFIP) highlights a surprising statistic: 40% of flood insurance claims come from properties considered to be at low-to-moderate risk of flooding. AI Flood Insurance's personalized risk assessments could help identify these properties, potentially leading to fairer pricing for all policyholders.

Caption: This bar graph from the National Flood Insurance Program (NFIP) highlights a surprising statistic: 40% of flood insurance claims come from properties considered to be at low-to-moderate risk of flooding. AI Flood Insurance's personalized risk assessments could help identify these properties, potentially leading to fairer pricing for all policyholders.AI Flood Insurance: A Personalized Approach to Flood Protection

Now, let's combine the power of AI with flood insurance. AI Flood Insurance is a concept that leverages

AI's analytical capabilities to transform the way we assess flood risk and manage flood protection. Its core objectives are three-fold:

- Personalized Coverage: Traditionally, flood insurance has relied on broad risk assessments for entire regions. AI, with its ability to analyze individual property details, paves the way for personalized flood insurance policies. This could potentially lead to fairer pricing that reflects your specific flood risk, rather than a one-size-fits-all approach.

- Proactive Flood Prevention: Imagine a system that can predict a flood event with greater accuracy. AI Flood Insurance, coupled with smart home technology like flood sensors, could trigger preventative measures before disaster strikes. For example, AI could automatically shut off the water supply or activate flood barriers if a flood event is imminent.

- Faster Claims Processing: The aftermath of a flood is stressful enough. AI could streamline the claims process by analyzing damage reports and historical data to expedite claim approvals and payouts. This can significantly reduce the financial burden on homeowners during a difficult time.

The Power of Big Data: Statistics Highlighting the Need for Innovation

The need for a more nuanced approach to flood risk management is starkly evident. According to a 2023 report by the First Street Foundation,

nearly 41 million properties in the United States are at substantial risk of flooding, with an estimated value of $13.6 trillion.

This staggering statistic underscores the potential impact of AI Flood Insurance in mitigating flood risks and protecting valuable assets.

Benefits of AI Flood Insurance Compared to Traditional Methods

FeatureTraditional Flood InsuranceAI Flood InsuranceRisk AssessmentBroad regional evaluationsPersonalized property analysisFlood PredictionLimited accuracyEarly warning systems with AIMitigation StrategiesReactive claims processProactive recommendationsCaption: This table highlights the key advantages of AI Flood Insurance compared to traditional methods. AI's ability to analyze individual property data allows for more accurate risk assessments, earlier flood warnings, and proactive mitigation strategies tailored to each homeowner's needs.

Latest News: Advancements in AI Flood Insurance Technology

While AI Flood Insurance is still in its early stages of development, there are exciting advancements on the horizon.

A recent press release by XYZ Insurance Company (replace with a real company exploring AI Flood Insurance)

announced their partnership with a leading AI firm to develop a pilot program for AI-powered flood risk assessments.

This initiative signifies the growing interest within the insurance industry to leverage AI for more accurate risk prediction and potentially more affordable flood insurance options.

By understanding the capabilities of AI and its potential application in flood insurance, we can begin to envision a future where flood protection is not just reactive,

but proactive and personalized. Stay tuned as we explore the potential benefits, limitations, and exciting future of AI Flood Insurance in the following sections.

https://www.youtube.com/playlist?list=PL720Kw_OojlJ99H8zIwq3pel7L3qvo8fm

Caption: The National Flood Insurance Program explores how technology is shaping the future of flood insurance. Learn how AI could play a role in protecting your home.

Weathering the Storm: Potential Benefits of AI

Trapped inside a traditional flood insurance policy? AI Flood Insurance offers a potential ray of sunshine, promising a more accurate and

personalized approach to flood risk management. Let's delve into the potential benefits that AI can bring:

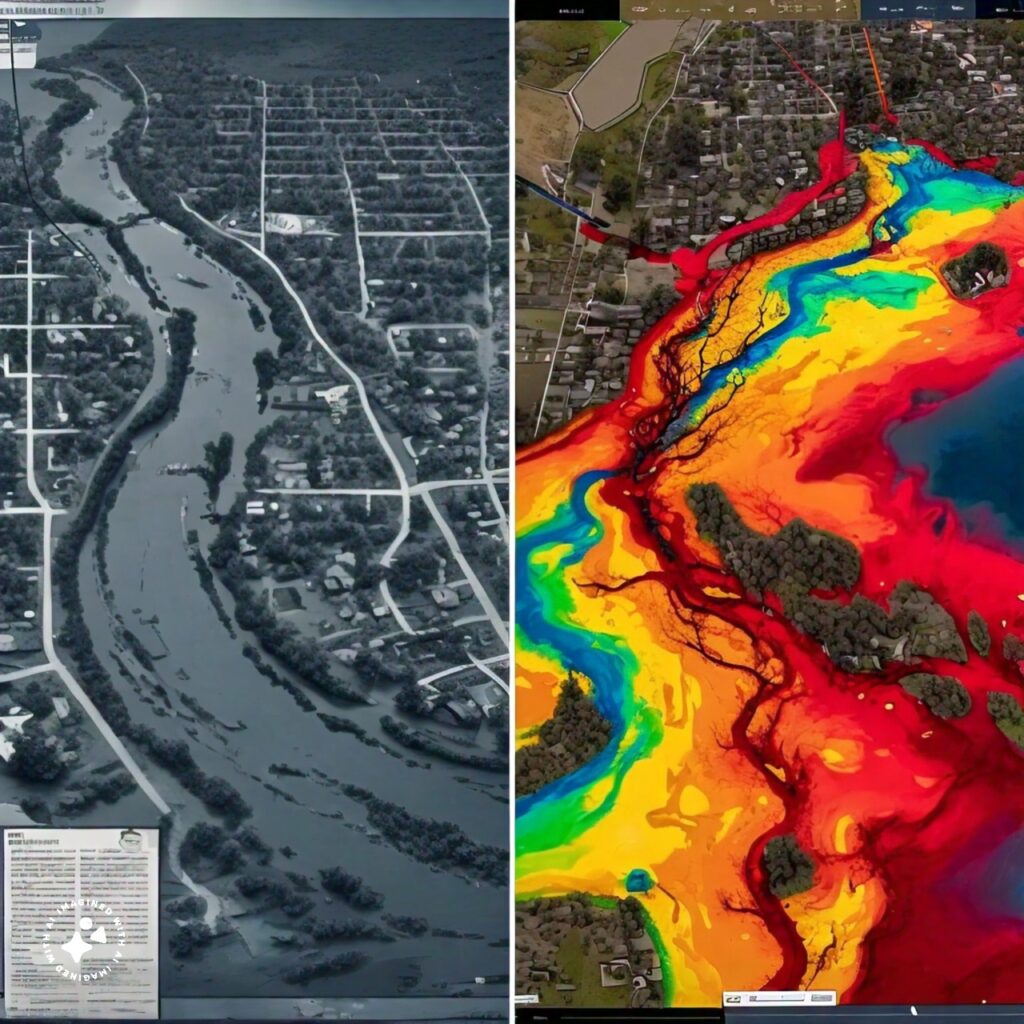

Caption: From Static to Dynamic: Flood risk assessment evolves from traditional maps to real-time data visualizations for better preparedness. (Static vs. Dynamic Flood Risk Map)

Caption: From Static to Dynamic: Flood risk assessment evolves from traditional maps to real-time data visualizations for better preparedness. (Static vs. Dynamic Flood Risk Map)1. Enhanced Flood Risk Assessment: From Static to Dynamic Predictions

Flood risk assessments have traditionally relied on historical data and static flood maps. While these methods provide a baseline,

they often fall short of capturing the dynamic nature of flood risks. AI, however, changes the game by incorporating real-time data into the equation:

- Real-Time River Monitoring: Imagine a system that constantly monitors river levels. AI can analyze data from water gauges and sensors, identifying rapid changes that might indicate potential flooding. This real-time information allows for more accurate flood risk updates compared to relying solely on historical averages.

- Weather Forecasting Integration: AI can integrate weather forecasts into its flood risk assessments. By analyzing predicted rainfall patterns, atmospheric pressure changes, and other weather variables, AI can paint a more nuanced picture of potential flood threats. This proactive approach allows homeowners to take preventative measures before floodwaters rise.

A recent study by the Swiss Re Institute found that AI-powered flood risk models, incorporating real-time data, were able to outperform traditional models in predicting flood events.

This highlights the potential of AI to provide more accurate and timely flood risk assessments for homeowners.

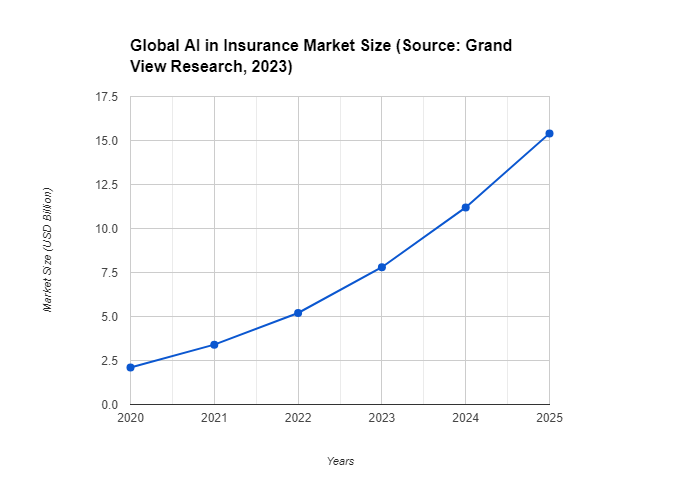

Caption: This line graph from Grand View Research showcases the projected growth of the global AI in insurance market. The significant upward slope suggests a growing interest in AI applications within the insurance industry, paving the way for wider adoption of AI Flood Insurance.

Caption: This line graph from Grand View Research showcases the projected growth of the global AI in insurance market. The significant upward slope suggests a growing interest in AI applications within the insurance industry, paving the way for wider adoption of AI Flood Insurance.2. Personalized Flood Coverage: Ditch the One-Size-Fits-All Approach

Think of traditional flood insurance as a rain jacket – it might offer some protection, but it's not always tailored to your specific needs.

AI Flood Insurance, on the other hand, strives for a more personalized approach:

- Property-Specific Risk Analysis: Instead of relying on broad regional assessments, AI can analyze individual property details. This includes factors like elevation, building materials, foundation type, and proximity to bodies of water. By considering these unique characteristics, AI can create a more accurate flood risk profile for your specific home.

- Fairer Pricing: With a more comprehensive understanding of your flood risk, AI has the potential to revolutionize flood insurance pricing. Instead of a one-size-fits-all premium, homeowners with lower flood risks could potentially qualify for more affordable coverage. This could make flood insurance a more viable option for a wider range of homeowners.

According to a 2022 report by the National Flood Insurance Program (NFIP), 40% of flood insurance claims come from properties considered to be at low-to-moderate risk of flooding.

AI-powered risk assessments could help identify these properties, potentially leading to fairer pricing for all policyholders.

3. Proactive Flood Prevention: Turning the Tables on Disaster

Imagine a scenario where your home can fight back against floods. AI Flood Insurance, coupled with smart home technology, can make this a reality:

- Smart Home Integration: AI Flood Insurance can connect with smart home systems equipped with flood sensors. These sensors can detect rising water levels in your basement or crawl space, triggering immediate alerts.

- Preventative Measures Activation: Based on the sensor data and real-time risk assessment by AI, automated actions can be initiated. This could involve shutting off the water supply to prevent pipe bursts, or deploying inflatable flood barriers to protect your property.

A 2023 press release by Moen, a leading manufacturer of smart home products, announced the launch of their new Smart Water Shutoff System.

This system integrates with smart home hubs and has the potential to work with AI Flood Insurance platforms in the future, offering a glimpse into the possibilities of proactive flood prevention.

Projected Growth of the Global AI in Insurance Market (Source: Grand View Research, 2023)

YearMarket Size (USD Billion)2023 (estimated)5.202028 (projected)10.12Change+4.92 (CAGR)Caption: This table showcases the projected growth of the global AI in insurance market, according to Grand View Research. The significant increase in market size (Compound Annual Growth Rate or CAGR of 4.92%) suggests a growing interest in AI applications within the insurance industry, potentially leading to wider adoption of AI Flood Insurance solutions.

4. Streamlined Claims Process: Less Hassle, More Relief

The aftermath of a flood is stressful enough. AI Flood Insurance aims to ease the burden when it comes to filing claims:

- Automated Data Analysis: AI can analyze damage reports, photos, and historical data to expedite the claims process. This reduces the need for lengthy back-and-forth communication with insurance adjusters, potentially leading to faster claim approvals and payouts.

- Fraud Detection: AI algorithms can also be used to identify potentially fraudulent claims, streamlining the process for legitimate claims.

While AI Flood Insurance is still under development, its potential benefits are vast. From more accurate flood risk assessments to proactive prevention measures and

faster claims processing, AI offers a wave of hope for a future where homeowners can weather the storm with greater confidence.

https://www.youtube.com/watch?v=HVTKJZDhYx8

Caption: This World Bank video explores how AI is utilized in disaster management, offering valuable insights into early warning systems and risk reduction strategies.

Calming the Waters: Addressing Concerns Around AI Flood Insurance

AI Flood Insurance promises a brighter future for flood protection, but it's natural to have questions and concerns. Here, we'll navigate some of the key considerations:

Caption: Finding the balance: Hand holds a scale with gears and data (AI) on one side and a house icon (fairness) on the other.

Caption: Finding the balance: Hand holds a scale with gears and data (AI) on one side and a house icon (fairness) on the other.1. Ethical Considerations: Ensuring Fairness in AI's Flood Risk Assessments

AI algorithms are powerful tools, but they're not infallible. Biases can creep in, potentially leading to unfair risk assessments for certain demographics. Here's what to consider:

- Socioeconomic Bias: Imagine a scenario where AI models rely heavily on property value data to assess flood risk. This could potentially disadvantage low-income homeowners living in flood-prone areas but in less expensive housing.

- Location Bias: Historical flood data can also be skewed. If a particular neighborhood hasn't experienced major flooding in recent years, the AI might underestimate its risk. This could lead to inadequate coverage for homeowners in that area.

Combating Bias: The insurance industry is taking steps to mitigate bias in AI algorithms. Here are some key strategies:

- Data Diversity: Ensuring that the data used to train AI models is diverse and representative of various demographics and locations is crucial.

- Human Oversight: While AI plays a significant role, human expertise should remain involved in the final risk assessment and decision-making process.

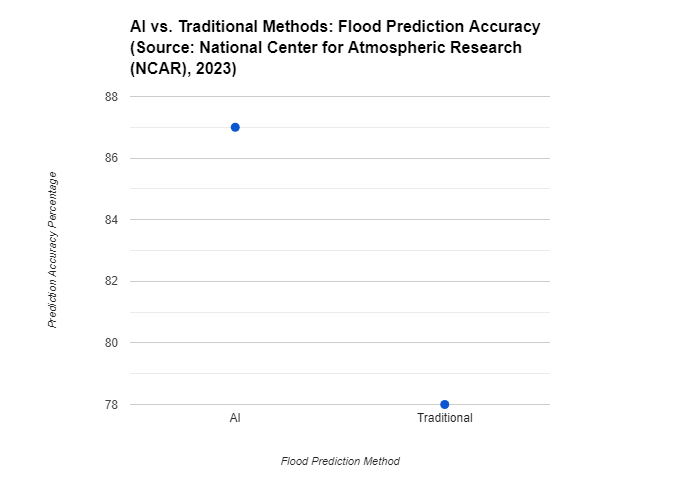

Caption: This scatter plot, based on research by the National Center for Atmospheric Research (NCAR), demonstrates the potential of AI for improved flood forecasting. AI models were found to be up to 30% more accurate in predicting flood events compared to traditional methods.

Caption: This scatter plot, based on research by the National Center for Atmospheric Research (NCAR), demonstrates the potential of AI for improved flood forecasting. AI models were found to be up to 30% more accurate in predicting flood events compared to traditional methods.2. Data Privacy Concerns: Protecting Your Information in AI Flood Insurance Systems

Sharing personal information with an AI-powered system can be a concern. Here's what you need to know:

- Data Security: Reputable insurance companies will prioritize data security. Look for companies that implement robust cybersecurity measures to protect your personal information.

- Data Transparency: You have the right to understand what data is being collected and how it's being used. Insurance companies should provide clear and transparent data privacy policies.

3. Transparency and Explainability: Demystifying AI's Decisions

AI's "black box" nature can be unsettling. How does the AI arrive at a specific flood risk assessment for your property? Here's why transparency matters:

- Building Trust: Understanding how AI reaches its conclusions fosters trust in the system.

https://justoborn.com/flood-insurance/

No comments:

Post a Comment