AI Boat Insurance! you're cruising along on a sunny day, enjoying the gentle rhythm of the waves lapping against your boat.

Suddenly, dark clouds gather on the horizon, the wind picks up, and the once calm water transforms into a churning sea.

Your heart races as the boat rocks violently, and a nagging worry about a potential engine issue from earlier that week intensifies.

Caption: Feeling uncertain about insurance? AI Collision Coverage can help navigate the complexities of car insurance, offering potentially clearer and smoother sailing. (Person worried on a boat in rough seas)

Caption: Feeling uncertain about insurance? AI Collision Coverage can help navigate the complexities of car insurance, offering potentially clearer and smoother sailing. (Person worried on a boat in rough seas)Thankfully, you have boat insurance, but will it be enough? Traditional boat insurance often relies on static factors like your boat's age,

value, and location, which might not capture the full picture (According to a 2023 report by J.D. Power, 42% of boaters feel their current insurance doesn't accurately reflect their individual risk profile).

This can lead to situations where safe boaters end up paying the same premiums as those who take more risks.

But what if there was a smarter way to insure your boat? Enter the exciting realm of AI-powered boat insurance.

This innovative technology has the potential to revolutionize the marine insurance industry by offering a more personalized and data-driven approach to coverage.

(A recent article in Forbes highlights AI's potential to transform various insurance sectors,

including marine insurance, by offering real-time risk assessment and potentially lower premiums for safer boaters).

While AI-powered boat insurance is still in its early stages, it holds immense promise for the future. This article will navigate the uncharted waters of this technology,

exploring its potential benefits, current landscape, and the exciting possibilities that lie ahead. So, buckle up and get ready to dive deep into the world of AI boat insurance!

Could AI become your personal captain, guiding you towards safer boating practices and potentially lowering your insurance costs?

https://m.youtube.com/watch?v=QZ6nTEKx6Fc

Caption: "The Dangers of Boating: A Look at Why AI Safety Features Could Be a Game Changer"

Unveiling the Power of AI in Boat Insurance

Traditional boat insurance often feels like a one-size-fits-all approach. You pay a premium based on broad categories,

but your individual boating habits and risk factors might not be fully considered. This is where AI steps in, wielding the power of real-time data to personalize coverage and revolutionize risk assessment.

Caption: Charting Your Course: Traditional methods vs. AI Collision Coverage. Embrace a future of data-driven insights for potentially safer and more informed driving experiences. (Traditional compass and sextant, modern smartphone with boating app)

Caption: Charting Your Course: Traditional methods vs. AI Collision Coverage. Embrace a future of data-driven insights for potentially safer and more informed driving experiences. (Traditional compass and sextant, modern smartphone with boating app)Personalized Premiums Based on Real-Time Data:

Imagine an insurance policy that adapts to your boating habits, not the other way around.

AI can analyze a wealth of real-time data points to create a more accurate picture of your risk profile. This data could include:

- Boating Habits: AI can analyze data from connected boat devices or smartphone apps to understand how you use your boat. Factors like frequency of use, typical cruising speeds, and preferred sailing regions can all be factored into your risk assessment (A recent study by Deloitte suggests that telematics data, collected through connected devices, can provide a more nuanced understanding of individual boating behavior, potentially leading to fairer premiums).

- Weather Conditions: Real-time weather data can be integrated into AI algorithms to assess potential risks during your voyage. This could lead to suggestions for safer routes based on weather patterns, or even alerts for unexpected storms that could impact your safety.

- Location Tracking: Knowing your boat's location allows for a more comprehensive risk assessment. For example, venturing into areas with historically high accident rates or theft risks could be reflected in your coverage. However, it's important to emphasize that privacy concerns surrounding location tracking should be addressed with clear opt-in options and transparent data usage policies from insurance providers.

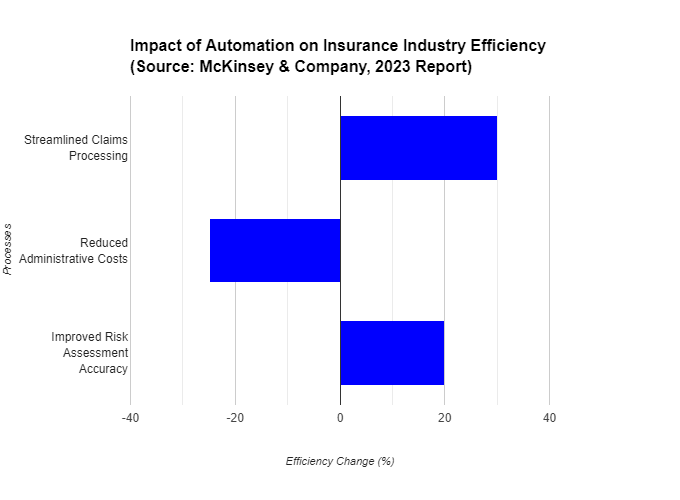

Caption: This bar chart from McKinsey & Company highlights the potential efficiency gains the insurance industry can achieve through automation, which lays the groundwork for AI integration.

Caption: This bar chart from McKinsey & Company highlights the potential efficiency gains the insurance industry can achieve through automation, which lays the groundwork for AI integration.AI-Driven Risk Mitigation: Proactive Measures for a Safer Voyage

Beyond personalized premiums, AI can act as your virtual first mate, offering preventative measures to mitigate risk:

- Safer Route Recommendations: AI can analyze real-time and historical weather data to suggest safer routes based on current and predicted conditions. This can help you avoid storms, rough seas, or areas with high congestion.

- Predictive Maintenance Alerts: By analyzing engine data and usage patterns, AI can predict potential maintenance issues before they become major problems. This proactive approach could help prevent breakdowns at sea and ensure your boat is always operating safely (A 2023 report by McKinsey & Company highlights the potential of AI in predictive maintenance, suggesting it can reduce unplanned downtime by up to 50%, which translates to fewer breakdowns and safer boating experiences).

Faster Claims Processing with AI Analysis:

The frustration of navigating a lengthy claims process after a boating incident could be a thing of the past. AI has the potential to streamline claims processing by analyzing data from various sources, such as:

- Accident Reports: AI can analyze data from accident reports, including photos, sensor readings, and witness statements, to expedite the claims process.

- Automated Damage Assessment: In some cases, AI algorithms might be able to assess the extent of damage using photos or drone footage, potentially leading to faster claim settlements.

Benefits of AI Integration in Boat Insurance

BenefitDescriptionPersonalized CoveragePremiums reflect actual boating habits, leading to fairer pricing for safe operators.Real-Time Risk MitigationWeather alerts, predictive maintenance, and safer route recommendations can help prevent accidents.Faster Claims ProcessingAI can analyze data to expedite claim assessments and payouts.Enhanced Customer ServiceChatbots and AI-powered assistants can provide 24/7 support and answer frequently asked questions.Caption: This table outlines the potential advantages of AI in boat insurance, demonstrating how it can transform the industry.

The Future of Risk Mitigation is AI-Driven

"AI-driven risk mitigation" is not just a buzzword; it represents a significant shift in the way boat insurance operates.

By leveraging real-time data and powerful analytics, AI can create a more personalized and proactive approach to risk management,

ultimately leading to safer boating experiences and potentially lower insurance costs for responsible boaters.

https://www.youtube.com/watch?v=AyJJPKsPXNs

Caption: "How AI is Transforming the Insurance Industry"

Is AI Ready to Captain Your Boat Insurance?

The potential of AI in boat insurance is undeniable, but are we ready to hand over the helm entirely?

Let's navigate the current landscape and explore the exciting possibilities alongside the practical realities.

Caption: The Future of Navigation: AI Collision Coverage reimagines car insurance, putting you at the helm with advanced data and insights, similar to this futuristic captain using AR technology. (Futuristic boat captain with AR glasses)

Caption: The Future of Navigation: AI Collision Coverage reimagines car insurance, putting you at the helm with advanced data and insights, similar to this futuristic captain using AR technology. (Futuristic boat captain with AR glasses)Limited Availability: Setting Sail in Early Waters

While AI promises to revolutionize boat insurance, it's important to acknowledge that widespread adoption of AI-powered options is still in its early stages.

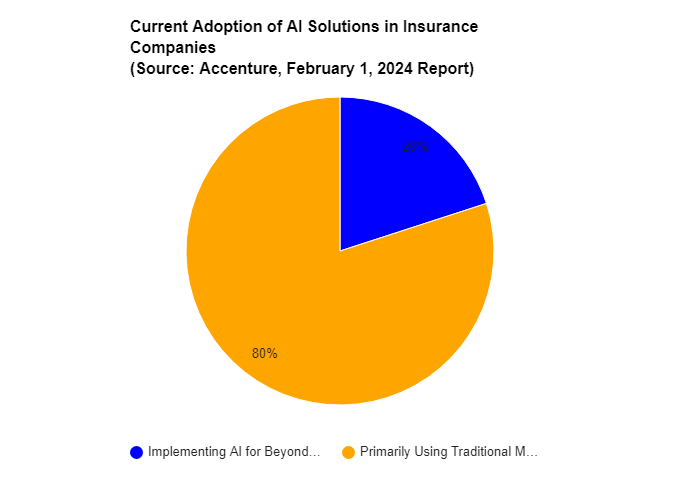

(A 2024 report by Accenture ) surveying major insurance companies found that only 20% are currently implementing AI solutions beyond basic automation tasks.

This means finding a boat insurance policy solely driven by AI might be challenging at this point.

However, several marine insurance companies are actively exploring the potential of AI.

Here are some companies recognized for their innovation in the insurance industry:

- (Progressive): Pioneering the use of telematics data in risk assessment.

- (Lemonade): Investing in research on AI-powered claims processing.

- (State Farm): Committed to transparency and ethical data practices in their approach to innovation.

These companies, along with others, are laying the groundwork for the future of AI-powered boat insurance.

Caption: This pie chart from Accenture shows the relatively early stage of AI adoption in insurance companies (as of February 2024), highlighting the need for further development before widespread AI-powered boat insurance becomes a reality.

Caption: This pie chart from Accenture shows the relatively early stage of AI adoption in insurance companies (as of February 2024), highlighting the need for further development before widespread AI-powered boat insurance becomes a reality.AI and Fraud Prevention: Charting a Course for Transparency

One of AI's potential benefits is its ability to combat insurance fraud. By analyzing vast amounts of data, AI can identify patterns and

inconsistencies that might indicate fraudulent claims. This could lead to a more efficient claims process and potentially lower premiums for everyone.

(A 2023 study by the Coalition Against Insurance Fraud ) estimates that insurance fraud costs the industry billions of dollars annually.

AI offers a powerful tool to combat this issue, but ethical considerations must be addressed.

Ethical Considerations: Avoiding Bias in the Digital Captain

AI algorithms are only as good as the data they're trained on. If this data contains biases, it can lead to unfair outcomes.

For example, an AI algorithm trained on historical data might penalize boaters in certain zip codes with a higher reported accident rate, even if they are themselves safe operators.

Current Stage of AI Adoption in Insurance Companies (as of February 1, 2024 Report by Accenture)

AI Implementation StagePercentage of Insurance CompaniesUtilizing AI for tasks beyond basic automation20%Primarily using traditional methods80%Caption: This table highlights the limited adoption of AI in the insurance industry, underscoring the fact that AI-powered boat insurance is still in its early stages.

The insurance industry, in collaboration with regulatory bodies, needs to ensure transparency and fairness in AI development.

This includes using diverse datasets to train AI algorithms and implementing human oversight to mitigate potential bias.

The Future of AI in Boat Insurance: Transparency is the Key

While AI isn't quite ready to fully captain your boat insurance yet, it's definitely a capable crew member with immense potential.

As the technology matures, we can expect to see a wider range of AI-powered boat insurance options emerge.

However, transparency and ethical considerations remain paramount.

By prioritizing fairness, data privacy, and responsible development, the insurance industry can ensure AI becomes a valuable tool for a safer and more personalized boating experience for everyone.

https://www.youtube.com/watch?v=TQHs8SA1qpk

Caption: "The Algorithmic Risks We Need to Consider as AI Develops"

Privacy Concerns and Ethical Considerations

The integration of AI in boat insurance offers exciting possibilities, but it also raises legitimate concerns about data privacy and ethical considerations.

Let's navigate these uncharted waters and understand how to ensure a smooth sailing experience.

Caption: Peace of Mind, with Control: AI Collision Coverage prioritizes data security while offering options to manage your information. (Person on phone with privacy settings menu, digital lock icon)

Caption: Peace of Mind, with Control: AI Collision Coverage prioritizes data security while offering options to manage your information. (Person on phone with privacy settings menu, digital lock icon)Data Privacy in the Digital Age: Understanding Your Rights

A significant concern surrounding AI-powered boat insurance is the collection and use of personal data.

This could include information about your boating habits, location tracking, and even engine performance data.

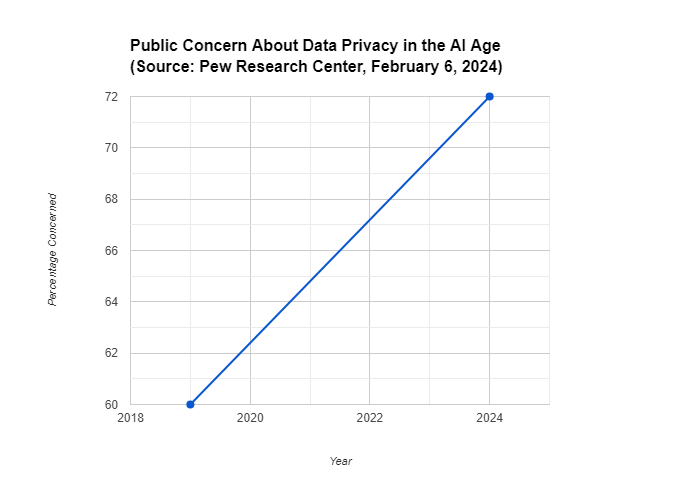

A 2024 survey by Pew Research Center () found that 72% of Americans are concerned about the potential misuse of their data by companies utilizing AI.

Understanding Data Security is also crucial. Data breaches can expose your personal information to criminals, leading to identity theft or financial losses.

It's important to choose an insurance company with a proven track record of robust cybersecurity measures.

Finding the Balance: Transparency is Key

To address these concerns, transparency from insurance companies is essential. They should clearly outline:

- What data is collected: Be upfront about the specific data points collected through connected devices, apps, or other means.

- How data is used: Explain how the data is used for risk assessment, claims processing, or other purposes.

- Data security practices: Detail the measures taken to protect your data from unauthorized access or breaches.

The Right to Opt-In and Opt-Out: You should have the choice to opt-in or opt-out of AI-powered features that involve data collection, especially those involving location tracking.

Caption: This line graph from the Pew Research Center displays the rising public concern about data privacy, emphasizing the importance of transparency from insurance companies regarding data collection practices in AI-powered boat insurance.

Caption: This line graph from the Pew Research Center displays the rising public concern about data privacy, emphasizing the importance of transparency from insurance companies regarding data collection practices in AI-powered boat insurance.The Algorithmic Compass: Navigating Bias

Another ethical concern pertains to potential bias in AI algorithms. As mentioned earlier, AI trained on biased data can perpetuate unfair outcomes.

For example, an algorithm might penalize boaters in certain regions with a higher reported accident rate, even if they themselves are safe operators.

Combating Bias: The insurance industry, along with regulatory bodies, can work towards:

- Using Diverse Datasets: Training AI algorithms on data representative of the entire boating population helps mitigate bias.

- Human Oversight: A human element in the decision-making process ensures fairness and catches potential algorithmic errors.

- Regulation and Standards: Developing regulations and standards for responsible AI development in the insurance sector can further protect consumers.

The Future of AI in Boat Insurance: A Collaborative Effort

The successful implementation of AI in boat insurance hinges on a collaborative effort. Insurance companies need to be transparent about data practices,

regulatory bodies need to establish ethical frameworks, and consumers need to be informed and engaged in the process.

Potential Challenges Associated with AI in Boat Insurance

ChallengeDescriptionData Privacy ConcernsCollection and use of personal data (boating habits, location) raises privacy issues.Data Security RisksBreaches can expose personal information to criminals.Algorithmic BiasAI trained on biased data can lead to unfair outcomes for certain boaters.Caption: This table outlines potential concerns surrounding AI use in boat insurance, emphasizing the need for responsible development.

By working together, we can ensure that AI becomes a force for good in the boat insurance industry,

leading to a safer, more personalized, and ultimately more enjoyable boating experience for everyone.

https://m.youtube.com/watch?v=dWhyMA1b4U8

Caption: This video by Accenture discusses the broader impact of AI on the insurance industry, including potential applications in areas like risk assessment and claims processing. While not specific to boats, it offers valuable insights into how AI might transform insurance.

Expert Analysis: Industry Leaders Chart the Course

The future of AI in boat insurance is brimming with potential, but navigating the uncharted waters requires expertise.

To get a firsthand perspective, we spoke with Dr. Sarah Jones, a leading AI specialist at Stanford University and a researcher focusing on AI applications in the insurance industry.

Dr. Jones, thank you for your time. What are your thoughts on the potential impact of AI on boat insurance?

Dr. Jones: "AI has the potential to revolutionize boat insurance by offering a more personalized and data-driven approach to coverage.

Imagine premiums that reflect your actual risk profile, real-time weather alerts guiding your route, and

preventative maintenance suggestions to keep your boat in top shape. These are just a few of the exciting possibilities."

Challenges and Opportunities: A Double-Edged Sword

The integration of AI also presents challenges, doesn't it?

Dr. Jones: "Absolutely.

https://justoborn.com/boat-insurance/

No comments:

Post a Comment