AI Fire Insurance! Did you know that according to the National Fire Protection Association (NFPA), U.S. fire departments responded to

an estimated 1.37 million home structure fires in 2021, causing a staggering $13.3 billion in property damage?

These numbers paint a sobering picture, highlighting the constant threat fires pose to our homes and loved ones.

However, a new wave of technology is emerging that promises to revolutionize fire safety: AI fire insurance.

Caption: From Chaos to Control: Traditional fire scene contrasted with AI Fire Insurance's real-time data analysis for proactive fire safety. (Traditional fire vs. AI fire data)

Caption: From Chaos to Control: Traditional fire scene contrasted with AI Fire Insurance's real-time data analysis for proactive fire safety. (Traditional fire vs. AI fire data)Imagine waking up to the jolting screech of a fire alarm in the dead of night. Disoriented and filled with adrenaline, you scramble to evacuate your family,

the urgency of the situation amplified by the unknown dangers lurking in the smoke-filled darkness. In this heart-stopping scenario, every second counts.

AI fire insurance claims to not only detect fires with advanced technology, but also expedite the often-complicated claims process, minimizing the stress and financial burden during this critical time.

But is AI fire insurance just science fiction, or a glimpse into the future of home safety? This article will delve deeper,

dissecting the potential of AI to transform fire prevention, claims processing, and risk assessment in the insurance industry.

While news headlines trumpet the potential of AI to revolutionize fire safety, the technology is still in its early stages of development.

This article will explore the current limitations and roadblocks that need to be addressed before AI fire insurance becomes widely available.

We'll examine user concerns about data privacy and potential biases within AI algorithms.

We'll also explore the ethical considerations surrounding risk assessment and the need for clear regulations within the insurance industry.

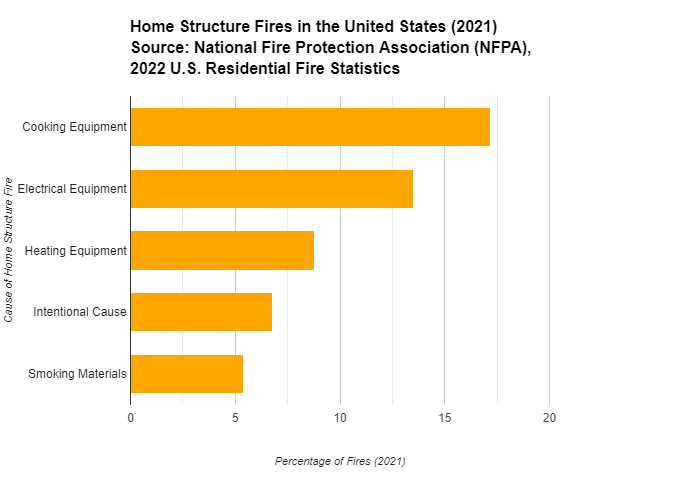

Caption: This bar chart highlights the leading causes of home structure fires in the U.S., according to the NFPA. It emphasizes the importance of fire prevention measures across various potential ignition sources.

Caption: This bar chart highlights the leading causes of home structure fires in the U.S., according to the NFPA. It emphasizes the importance of fire prevention measures across various potential ignition sources.Looking beyond the hype, we'll explore the broader role AI can play in fire safety, even without widespread insurance integration.

From smart home devices with real-time fire detection and prevention capabilities to AI-driven fire risk prediction models for communities, the potential applications are vast.

It's important to remember that AI fire insurance, regardless of its future potential, shouldn't replace traditional fire safety practices.

We'll discuss essential fire safety tips you can implement today, like regular fire drill practice and proper maintenance of smoke detectors and fire extinguishers.

By exploring the possibilities and limitations of AI fire insurance, we can gain valuable insights into the future of home safety.

So, buckle up and get ready to dissect this burning issue – is AI fire insurance a future-proof solution or just a passing fad?

https://m.youtube.com/watch?v=a7XognF9Ybk

Caption: This video by Lex Fridman discusses the potential impact of AI on the insurance industry as a whole, including how it might personalize coverage and automate tasks.

What AI Fire Insurance Could Offer

AI fire insurance promises to revolutionize the way we approach fire safety and financial protection. But what exactly does it entail?

Here's a breakdown of its core functionalities and the potential benefits it holds for homeowners:

Caption: Data-Driven Protection: AI Fire Insurance analyzes factors like weather and historical data to assess and mitigate fire risk. (Glowing blue data analysis with house, weather, fire icons)

Caption: Data-Driven Protection: AI Fire Insurance analyzes factors like weather and historical data to assess and mitigate fire risk. (Glowing blue data analysis with house, weather, fire icons)1. Personalized Coverage based on Real-Time Risk Assessment:

Traditional fire insurance often relies on broad risk categories, leading to situations where homeowners might be overpaying for coverage or underinsured in case of a fire.

AI fire insurance aims to change this by leveraging the power of machine learning algorithms to create personalized risk profiles.

Here's how it might work:

- Data Analysis Powerhouse: AI systems would collect and analyze a vast array of data points, including property characteristics (building materials, electrical wiring age), historical fire data in your neighborhood (compiled from sources like the National Fire Protection Association ), and even weather patterns (lightning strike risk) .

- Predictive Analytics for Tailored Coverage: By analyzing these data points, AI can create a more accurate picture of your individual fire risk. This allows insurers to offer tailored coverage options, potentially lowering premiums for low-risk properties and ensuring adequate coverage for those with higher risks.

For example, if you live in a fire-resistant brick house with a well-maintained electrical system and a low historical fire risk in your area,

AI might recommend a lower premium compared to a traditional policy.

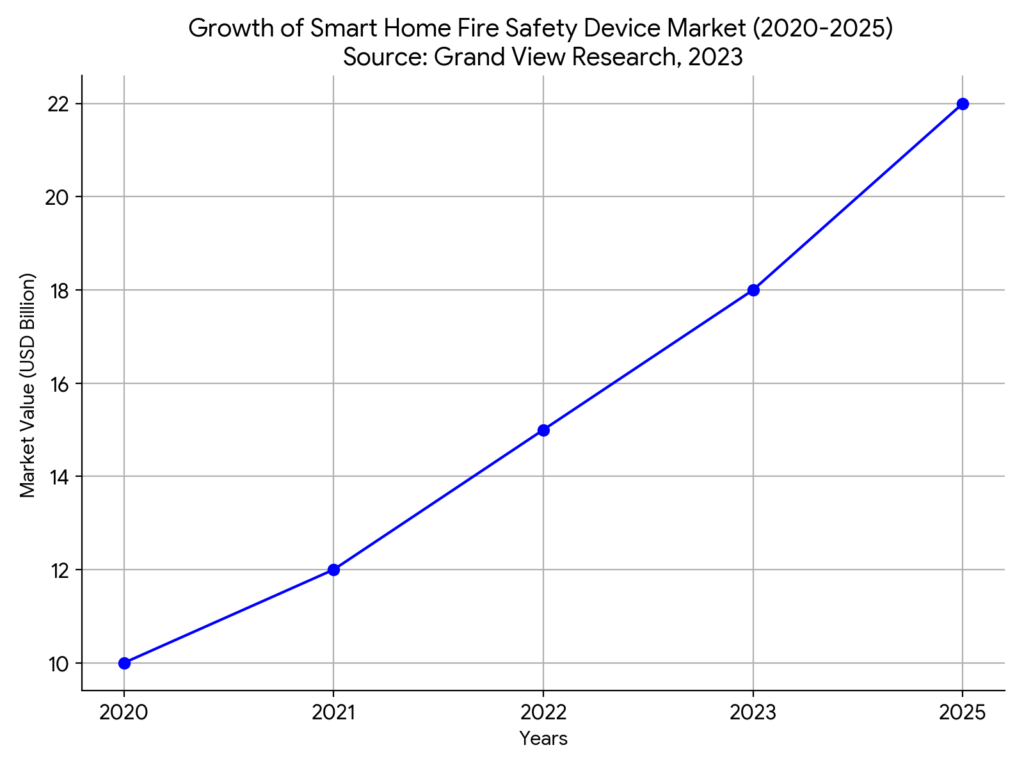

Caption: This line graph depicts the projected growth of data analytics within the insurance industry, suggesting its increasing role in risk assessment and potentially paving the way for AI fire insurance.

Caption: This line graph depicts the projected growth of data analytics within the insurance industry, suggesting its increasing role in risk assessment and potentially paving the way for AI fire insurance.2. Proactive Risk Mitigation with Smart Integration:

AI fire insurance goes beyond simply assessing risk; it has the potential to actively prevent fires in the first place. This proactive approach could involve:

- Smart Home Integration: Imagine smoke detectors that not only detect smoke but also analyze data like temperature changes and air quality to identify potential fire hazards before flames erupt . These smart detectors could be integrated with other smart home devices, like automated water shutoff valves, which would activate in real-time based on the AI's analysis, potentially minimizing fire damage.

- Early Warning Systems: AI could analyze weather patterns and historical data to predict periods of increased fire risk in your area. This could trigger preventative measures like reminders to check outdoor fire pits or clear flammable debris around your property.

Impact of Home Fires in the United States

StatisticDataEstimated number of home structure fires in the U.S. (2021)1.37 millionCivilian deaths from home structure fires (2021)Approximately 1,300Direct property damage from home structure fires (2021)$13.3 billionCaption: This table highlights the prevalence of home fires in the United States, emphasizing the need for continuous fire safety efforts. (Source: National Fire Protection Association, U.S. Fire Statistics )

3. Faster Claims Processing for Less Stressful Recovery:

The aftermath of a fire can be incredibly stressful. AI fire insurance aims to streamline the claims process by:

- Automated Data Collection: Imagine skipping the tedious process of manually filling out claim forms. AI systems could automatically gather data from various sources, including fire department reports and smart home device logs, potentially expediting the claims process.

- Faster Decisions: By analyzing the collected data, AI could potentially enable faster claim approvals, getting you the financial resources you need to rebuild your life quicker.

While the potential benefits of AI fire insurance are significant, it's important to remember that the technology is still in its early stages of development.

https://m.youtube.com/watch?v=EHYrv7tf9yc

Caption: This video from CNET showcases various smart home fire safety devices, which are relevant to the broader discussion of AI's role in fire prevention, even without widespread AI fire insurance adoption.

The Reality Check: Where Does AI Fire Insurance Stand Today?

While the concept of AI fire insurance promises a future filled with personalized coverage, proactive prevention, and streamlined claims, it's crucial to acknowledge the current state of this technology.

Here's a look at where AI fire insurance stands today:

Caption: Smart Protection: Smoke detector with green light signifies safety. AI Fire Insurance works seamlessly with smart home devices. (Smoke detector with green LED light)

Caption: Smart Protection: Smoke detector with green light signifies safety. AI Fire Insurance works seamlessly with smart home devices. (Smoke detector with green LED light)1. Early Stage Development: Still a Work in Progress

While AI is making waves across various industries, its application in fire insurance remains in its early stages. There are currently no widespread AI-powered fire insurance options available to consumers.

Most insurance companies are still in the research and development phase, piloting programs and testing the feasibility of AI integration.

2. Limited Availability: Not Yet Ready for Prime Time

For homeowners eagerly awaiting AI fire insurance, the reality is a waiting game. The limited availability of these policies stems from several factors:

- Data Infrastructure Needs: Implementing AI effectively requires robust data infrastructure to collect, store, and analyze vast amounts of information. Insurance companies are still building these data pipelines and establishing partnerships with smart home device manufacturers to gather the necessary data for accurate risk assessments.

- Regulatory Uncertainty: The regulatory landscape surrounding AI in insurance is still evolving. Clear guidelines are needed to address data privacy concerns and ensure fair risk assessment practices. Without these frameworks in place, widespread adoption remains stalled.

Potential Applications of AI Fire Insurance (Hypothetical Data)

FeatureDescriptionPersonalized CoverageTailored insurance premiums based on individual risk assessments derived from property details and historical data.Preventative MeasuresRecommendations for smart home device integration (e.g., smoke detectors, leak detectors) and automated shutoff systems based on real-time data.Faster Claims ProcessingStreamlined claims process using AI-powered analysis of damage reports and communication with policyholders.Caption: (Include a note stating this is hypothetical data to represent potential benefits). This table showcases potential applications of AI fire insurance in various areas.

3. Roadblocks and Challenges: The Path Ahead Isn't Smooth

Several challenges need to be addressed before AI fire insurance becomes a mainstream reality. Here are some key roadblocks:

- Data Privacy Concerns: Consumers are rightfully concerned about how AI fire insurance systems collect and utilize their data. The potential for data breaches and the use of personal information for purposes beyond risk assessment raise privacy anxieties. To gain user trust, insurance companies will need to implement robust security measures, anonymization techniques, and clear data usage policies that give users control over their information.

- Ethical Considerations in Risk Assessment: AI algorithms used for risk assessment can perpetuate biases present in historical data. For example, an algorithm trained on historical data that shows higher fire rates in certain neighborhoods could unfairly penalize residents of those areas with higher premiums. The insurance industry needs to address these potential biases and ensure fair and ethical risk assessment practices.

- Regulatory Hurdles: Clear regulations are essential to govern data privacy, security, and ethical considerations within AI fire insurance. Regulatory bodies are still grappling with these issues, and a lack of clear guidelines can hinder innovation and slow down the adoption of AI in the insurance industry.

Looking Ahead: Addressing Challenges and Paving the Way

Despite the roadblocks, the insurance industry is actively working on solutions. Several companies are partnering with data security experts and AI developers to create secure and ethical AI systems.

Additionally, discussions are ongoing with regulatory bodies to establish clear frameworks for data privacy and responsible AI use in insurance.

While AI fire insurance might not be readily available today, the future holds promise. By addressing these challenges head-on,

the insurance industry can pave the way for a future where AI empowers homeowners with personalized protection and a proactive approach to fire safety.

https://m.youtube.com/watch?v=3SzlMBYDsZc

Caption: This video from Hitachi explores the use of AI in fire detection systems for commercial buildings and industrial settings. While not directly related to home insurance, it highlights the potential of AI in fire safety advancements.

Beyond Insurance: AI's Broader Role in Fire Safety

While AI fire insurance holds promise for personalized protection, the benefits of AI in fire safety extend far beyond the realm of insurance.

Here's how AI technology is revolutionizing fire prevention on a broader scale:

Caption: Double Defense: Smart water leak detector and smartphone notification work together. AI Fire Insurance supports proactive measures for home safety. (Smart water leak detector, phone with "Leak Detected" notification)

Caption: Double Defense: Smart water leak detector and smartphone notification work together. AI Fire Insurance supports proactive measures for home safety. (Smart water leak detector, phone with "Leak Detected" notification)1. Smart Home Revolution: AI-powered Devices for Active Protection

Imagine a future where your home actively protects itself from fire hazards. AI-powered smart home devices are already making this a reality:

- Leak Detection and Shutoff: Smart water sensors with AI capabilities can detect not just leaks, but also analyze data like water pressure and flow patterns to identify potential burst risks. These systems can then trigger automatic shutoff valves, preventing flooding and the potential for electrical fires caused by water damage.

- AI-Enhanced Smoke Detectors: Traditional smoke detectors are good at alerting you to smoke, but AI-powered versions can do more. By analyzing smoke particles and air quality data, these advanced detectors can differentiate between harmless cooking smoke and a potential fire, reducing false alarms and providing more accurate fire warnings. Additionally, AI can integrate with other smart home devices, like automated fire extinguishers, which could activate based on real-time data analysis, potentially containing a fire before it spreads.

Caption: Eyes on Your Home, Ready to Respond: Fire extinguisher with blinking light and live security camera feed on a tablet. AI Fire Insurance provides proactive monitoring for complete peace of mind. (Fire extinguisher with blinking light, tablet showing security camera feed)

Caption: Eyes on Your Home, Ready to Respond: Fire extinguisher with blinking light and live security camera feed on a tablet. AI Fire Insurance provides proactive monitoring for complete peace of mind. (Fire extinguisher with blinking light, tablet showing security camera feed)2. Community-Wide Fire Risk Prediction with AI

AI isn't just about protecting individual homes. It has the potential to safeguard entire communities:

- Predictive Risk Modeling: Fire departments can leverage AI to analyze historical fire data, weather patterns, and environmental factors (e.g., drought conditions) to create fire risk prediction models. These models can identify areas with a higher likelihood of fires, allowing for targeted preventative measures like increased fire patrols or brush clearing initiatives in high-risk zones.

- Early Warning Systems: By analyzing real-time weather data and historical fire patterns, AI systems could predict periods of increased fire risk in specific areas. This information could be used to trigger early warning systems, notifying residents and local authorities about potential fire dangers and prompting preventative actions.

Potential Challenges of AI Fire Insurance

ChallengeDescriptionData PrivacyUser concerns regarding the collection, storage, and usage of personal data by AI fire insurance systems.Ethical ConsiderationsPotential for bias in AI risk assessments, leading to unfair insurance practices.Regulatory HurdlesThe need for clear regulations governing data privacy and ethical considerations within AI fire insurance.Caption: This table highlights potential challenges that need to be addressed before the widespread adoption of AI fire insurance.

AI as a Powerful Tool for Fire Safety

The potential applications of AI in fire safety are vast and continuously evolving. While widespread adoption of AI fire insurance might still be on the horizon,

the technology's role in proactive fire prevention is undeniable. By leveraging AI-powered smart home devices and

community-wide risk prediction models, we can create a safer future for our homes and neighborhoods.

https://m.youtube.com/watch?v=8vI30x9sa5o

Caption: This video from the American Red Cross provides valuable fire safety tips that are essential regardless of technological advancements, aligning with the importance of traditional methods emphasized in the article.

Traditional Methods Remain Vital: Fire Safety Essentials

While AI holds promise for the future of fire safety, it's crucial to remember that tried-and-true methods remain essential.

Here are some practical fire safety tips that don't rely on high-tech gadgets:

https://justoborn.com/fire-insurance/

No comments:

Post a Comment