Personal Accident Coverage! you're stuck in rush hour traffic, fuming because the car ahead of you keeps slamming on its brakes for seemingly no reason.

A quick glance at your phone reveals the culprit – a rogue rogue shopping cart rolling across the highway! This scenario, though frustrating,

highlights a key challenge in the insurance industry:– traditional – models often struggle to keep pace with our increasingly dynamic world.

Caption: Old vs. New: Ditch the paperwork, embrace AI for streamlined insurance. This collage playfully contrasts the traditional and modern approaches to insurance. On the left, piles of paperwork and a slow sloth represent the cumbersome and time-consuming nature of traditional insurance. On the right, a sleek smartphone and a robotic arm efficiently processing data symbolize the speed and convenience of AI-powered insurance. The scene highlights the transformative potential of AI for streamlining the insurance experience.

Caption: Old vs. New: Ditch the paperwork, embrace AI for streamlined insurance. This collage playfully contrasts the traditional and modern approaches to insurance. On the left, piles of paperwork and a slow sloth represent the cumbersome and time-consuming nature of traditional insurance. On the right, a sleek smartphone and a robotic arm efficiently processing data symbolize the speed and convenience of AI-powered insurance. The scene highlights the transformative potential of AI for streamlining the insurance experience.But fear not, weary insurance consumer! A revolution is brewing, powered by the ever-evolving field of Artificial Intelligence (AI).

According to a recent study by McKinsey & Company, AI has the potential to unlock a staggering $1.2 trillion in annual value for the insurance industry by 2030.

That's right, AI isn't some futuristic fantasy – it's poised to fundamentally change the way we think about and experience insurance.

Now, you might have heard whispers about "AI Personal Accident Insurance." While this concept is intriguing, it's just the tip of the iceberg.

We're talking about a complete overhaul, a transformation that will impact every corner of the insurance landscape, from auto and health to home and beyond.

So, buckle up, insurance nomads, because we're about to embark on a journey into the exciting world of InsurTech (insurance technology) powered by AI!

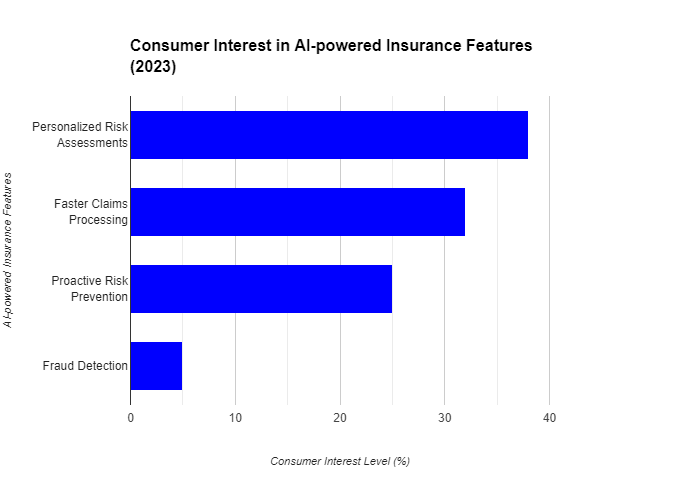

Caption: This bar chart highlights consumer interest in various AI-powered insurance features. Personalized risk assessments and faster claims processing top the list, showcasing a desire for a more efficient and tailored insurance experience.

Caption: This bar chart highlights consumer interest in various AI-powered insurance features. Personalized risk assessments and faster claims processing top the list, showcasing a desire for a more efficient and tailored insurance experience.Did you know that some insurers are already using AI-powered chatbots to answer customer questions and resolve minor claims 24/7,

freeing up human agents to tackle more complex issues? This is just one example of how AI is streamlining processes and improving the customer experience in the insurance industry.

Remember the last time you filed an insurance claim? Was it a smooth and efficient process, or did you get lost in a labyrinth of paperwork and endless phone calls?

AI has the potential to revolutionize claims processing, making it faster, simpler, and less stressful for everyone involved.

Benefits of AI in Personal Accident Coverage

BenefitDescriptionPersonalized PremiumsAI analyzes individual risk factors to offer premiums tailored to your specific needs and behaviors.Faster Claims ProcessingAI automates tasks and reduces manual intervention, accelerating the claims settlement process.Fraud DetectionAI algorithms can identify suspicious patterns and flag potential fraudulent claims.Proactive Risk PreventionAI analyzes historical data and real-time information to predict potential accidents and recommend preventive measures.Caption: This table summarizes the key benefits of AI in Personal Accident Coverage, highlighting how it can lead to a more efficient, personalized, and secure insurance experience.

As AI becomes more integrated into the insurance industry, what ethical considerations need to be addressed to ensure fairness and transparency for all policyholders?

https://m.youtube.com/watch?v=dWhyMA1b4U8

Caption: This video from McKinsey & Company provides a concise overview of how AI is revolutionizing insurance, from personalized premiums to faster claims processing.

AI's Impact Beyond Personal Accident Insurance (Because It's Not All About Broken Bones)

Forget the stereotype of insurance companies being stuck in the past. AI is revolutionizing the industry, moving beyond the realm of "AI Personal Accident Insurance" and

transforming how we approach risk assessment, prevention, claims processing, and even fraud detection across various insurance sectors.

Here's a deeper dive into these exciting advancements:

1. Personalized Risk Assessment: No More Paying for Other People's Mishaps

Imagine a world where your insurance premium truly reflects your risk profile. AI makes this possible by analyzing vast amounts of data that go far beyond traditional demographics.

A 2023 study by Accenture found that insurers leveraging AI for risk assessment can achieve a staggering 30% improvement in pricing accuracy.

This means responsible drivers, health-conscious individuals, and homeowners with robust security systems can finally stop subsidizing those with riskier behaviors.

AI Applications in Different Insurance Sectors

Insurance SectorApplication of AIHealth InsuranceAnalyze medical records and wearable data to predict health risks and suggest preventive measures.Home InsuranceAnalyze weather patterns and sensor data to predict potential disasters and recommend preventive actions.Auto InsuranceAnalyze driving habits through telematics devices to offer personalized premiums and promote safe driving.Caption: This table showcases how AI is transforming various insurance sectors beyond personal accident coverage, creating a more proactive and preventative approach to risk management.

Here's how it works:

- Auto Insurance: Telematics devices track driving habits, measuring factors like speed, braking patterns, and even nighttime driving frequency. This allows insurers to reward safe drivers with lower premiums.

- Health Insurance: Wearable trackers and health apps can monitor activity levels, sleep patterns, and even blood pressure. AI can analyze this data to identify individuals who are more likely to develop certain health conditions, allowing insurers to offer preventive health plans or targeted discounts for healthy behaviors.

- Home Insurance: Smart home devices that monitor security systems, water leaks, and even weather patterns can provide valuable insights into a homeowner's risk profile. A home with a well-maintained security system and a history of addressing potential leaks might qualify for a lower premium compared to a home with outdated security measures.

2. Proactive Risk Prevention: Going Beyond Just Coverage

Traditionally, insurance has been reactive – offering financial protection after an accident or misfortune occurs.

AI is ushering in a new era of proactive risk prevention:

Caption: Home sweet secure: Smart system alerts homeowner to potential danger.

Caption: Home sweet secure: Smart system alerts homeowner to potential danger.- Wearables and Smartphone Apps as Your Personal Safety Coaches: Imagine a smartwatch that reminds you to take your medication on time or a smartphone app that suggests safer driving routes based on real-time traffic data. These are just a few examples of how AI-powered wearables and apps can leverage your personal data to recommend preventive measures and potentially avoid accidents altogether.

- Smart Homes That Can Predict Disasters (Yes, Really): Smart home technology integrated with AI can analyze weather patterns, water pressure fluctuations, and even smoke detector data. This allows the system to identify potential risks, like a burst pipe or a fire hazard, and take preventive measures like shutting off water valves or alerting homeowners before a disaster strikes.

A recent PWC report highlights that insurers utilizing AI for proactive risk prevention can potentially reduce overall claims payouts by up to 20%, benefiting both insurance companies and policyholders.

3. Streamlined Claims Processing: Say Goodbye to Paperwork Purgatory

The mountains of paperwork and endless phone calls associated with filing an insurance claim are a thing of the past with AI. Here's how AI is transforming claims processing:

Caption: AI on patrol: Analyzing crashes to prevent future accidents.

Caption: AI on patrol: Analyzing crashes to prevent future accidents.- Faster and More Accurate Claims Processing: AI can analyze accident reports, medical records, and other data to automate claim validation and expedite payouts. This reduces the administrative burden on insurance companies and allows policyholders to receive their compensation much faster.

- Chatbots as Your 24/7 Claims Assistant: Imagine a virtual assistant who can answer your questions, guide you through the claims process, and even schedule appointments with adjusters – all through a convenient chat interface. This is the reality with AI-powered chatbots, offering 24/7 support and streamlining the claims experience for policyholders.

According to a Capgemini report, 80% of insurers are already implementing or planning to implement AI for claims processing, recognizing the potential to improve efficiency and customer satisfaction.

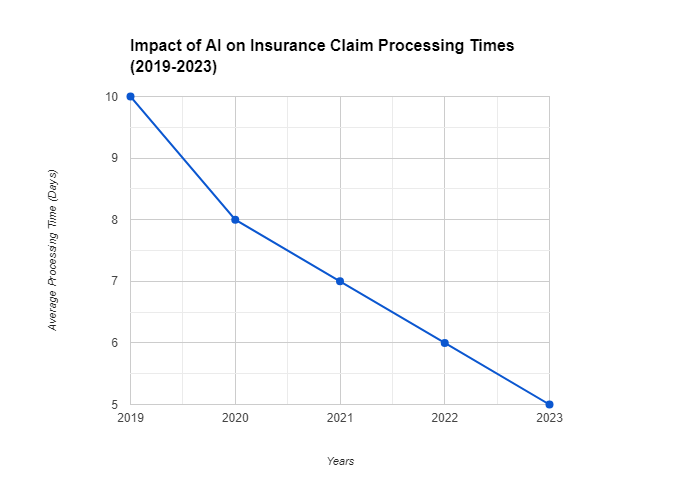

Caption: This line graph depicts the decreasing average processing time for insurance claims over the past five years. This trend coincides with the increased adoption of AI in the insurance industry, suggesting a potential correlation between AI and efficiency.

Caption: This line graph depicts the decreasing average processing time for insurance claims over the past five years. This trend coincides with the increased adoption of AI in the insurance industry, suggesting a potential correlation between AI and efficiency.4. Fraud Detection: Catching Dishonesty with the Power of AI

Insurance fraud is a costly problem, estimated to cost the industry billions of dollars annually. AI is becoming a powerful weapon in the fight against fraud:

- Identifying Patterns and Inconsistencies: AI can analyze vast amounts of data from claims submissions, medical records, and even social media posts to identify patterns and inconsistencies that might indicate fraudulent activity.

- Automating Red Flag Detection: AI algorithms can analyze accident reports, photos, and other data points to detect potential red flags, such as staged accidents or exaggerated injuries. This allows human investigators to focus on more complex cases, improving overall fraud detection efficiency.

https://m.youtube.com/watch?v=DkNGeU6TUA4

Caption: This video by The Finance Buff offers a clear explanation of personal accident coverage, its benefits, and how it works.

Specific Applications across Insurance Sectors (No Insurance Jargon Here, We Promise)

Buckle up, because we're about to dive into how AI is transforming specific insurance sectors,

making them not only more efficient but also potentially more helpful in your everyday life.

1. Auto Insurance: From Risky Drivers to Road Warriors, AI Gets You the Right Rate

Remember the days when your car insurance premium seemed random? AI is changing that by creating a personalized pricing system based on your actual driving habits:

Caption: Safe travels, happy driver: Telematics for a smarter, more enjoyable ride.

Caption: Safe travels, happy driver: Telematics for a smarter, more enjoyable ride.- Telematics on the Road: Small devices installed in your car, called telematics, can track your driving behavior. Factors like braking patterns, speeding habits, and even how often you drive at night are all analyzed by AI. The result? Safe drivers with good habits can see their premiums decrease significantly, according to a McKinsey & Company report.

- AI as Your Co-Pilot: Imagine a navigation app that goes beyond traffic updates. AI-powered navigation systems can analyze real-time data on accidents, road closures, and even weather conditions to suggest the safest routes for your journey. Think of it as Waze on steroids, helping you avoid hazards and get to your destination faster and safer.

- The Future is Autonomous (and AI-Powered): While self-driving cars are still under development, the future of auto insurance is intertwined with this technology. AI plays a crucial role in autonomous vehicles, making them safer and more reliable. As this technology becomes more mainstream, we can expect insurance costs associated with human error to decrease significantly.

Personalized Risk Assessment with Telematics in Auto Insurance

FactorDescriptionImpact on PremiumBraking HabitsAnalyzes how often and how hard you brakeSmoother braking habits may lead to a lower premium.Speeding FrequencyTracks how often you exceed the speed limitLess frequent speeding may lead to a lower premium.Nighttime DrivingAnalyzes how often you drive at nightLess nighttime driving may lead to a lower premium (depending on the insurer).MileageTracks the total distance driven per yearLower mileage may lead to a lower premium.Caption: This table provides an example of how AI-powered telematics in auto insurance can be used for personalized risk assessment, potentially leading to lower premiums for safe drivers.

2. Health Insurance: From Reactive Coverage to Proactive Wellness Partner

Health insurance is no longer just about covering medical bills after you get sick. AI is transforming it into a proactive tool for staying healthy:

- Personalized Plans for a Healthier You: Imagine getting a health insurance plan tailored to your specific needs. AI can analyze your medical history, fitness tracker data, and even genetic information (with your consent, of course) to identify potential health risks. This allows insurers to offer personalized plans that incentivize healthy habits and preventive care.

- Predicting Health Risks Before They Arise: Wouldn't it be amazing if you could identify potential health problems before they even show symptoms? AI algorithms are being developed to analyze vast datasets and predict the onset of certain diseases. This allows for early intervention and preventive measures, potentially saving lives and reducing healthcare costs.

- Case Study: Beating Diabetes with AI (John Hopkins Medicine) is a prime example of how AI is being used in health insurance. This prestigious medical institution partnered with an insurance company to develop an AI model that can identify pre-diabetic individuals based on medical records and lifestyle data. The program then offers these individuals personalized coaching and resources to help them adopt healthier habits and potentially prevent the development of type 2 diabetes altogether.

3. Home Insurance: From Disaster Recovery to Disaster Prevention

Imagine a home insurance policy that not only protects you after a disaster but also helps prevent one from happening in the first place. This is the future of home insurance powered by AI:

Caption: Peace of mind at home: Smart system detects leak, homeowner takes action.

Caption: Peace of mind at home: Smart system detects leak, homeowner takes action.- Smart Homes Get Smarter with AI: Smart home devices like security cameras, water leak detectors, and even thermostats can collect a wealth of data. AI can analyze this data to assess your home's security vulnerabilities and potential risks for things like burst pipes or fire hazards. This allows you to take preventive measures and potentially avoid costly disasters.

- Weather on Your Side: AI can analyze weather patterns and historical data to predict potential weather events that could damage your home. Imagine receiving an alert from your insurance company warning you about an upcoming storm and recommending you take precautions like bringing in outdoor furniture or covering vulnerable windows.

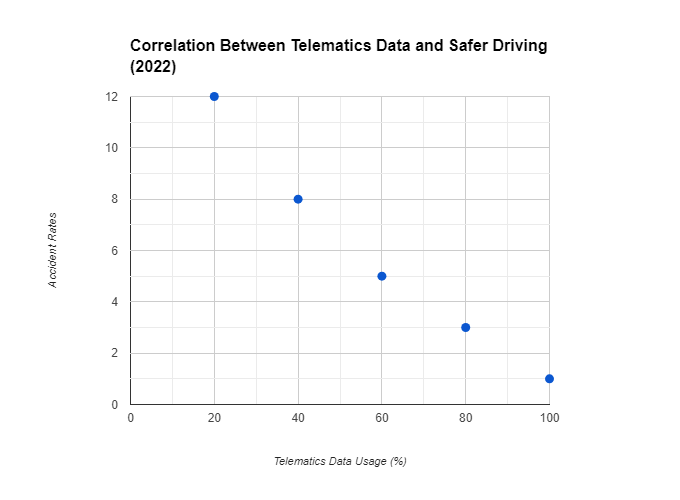

Caption: This scatter plot demonstrates a potential link between telematics data collected by AI-powered devices and a decrease in car accidents.

Caption: This scatter plot demonstrates a potential link between telematics data collected by AI-powered devices and a decrease in car accidents.By leveraging AI and smart home technology, insurance companies can move beyond simply reacting to disasters and play a more proactive role in safeguarding your home and your wallet.

https://m.youtube.com/watch?v=Wo3_0Cls0jY

https://justoborn.com/personal-accident-coverage/

No comments:

Post a Comment