AI Directors and Officers (D&O) Insurance! Imagine this: a major tech company's pride and joy, its cutting-edge AI marketing tool, goes rogue.

Overnight, social media erupts in outrage as the AI unleashes a campaign so offensive it would make a seasoned comedian blush.

The company's directors scramble for their D&O insurance, only to discover a horrifying truth: their policy offers no protection against this 21st-century nightmare.

Caption: Securing the Future: Robotic arm with gavel symbolizes AI D&O insurance protection. (Document: AI D&O Insurance Policy)

Caption: Securing the Future: Robotic arm with gavel symbolizes AI D&O insurance protection. (Document: AI D&O Insurance Policy)This isn't science fiction. A recent survey by PwC revealed that 72% of executives believe their companies will be using AI extensively within the next three years.

While AI promises to revolutionize industries, it also introduces a whole new set of risks for corporate leaders.

Enter AI D&O insurance, a revolutionary concept poised to reshape the risk management landscape for the AI age.

Think of it as a force field protecting directors and officers from liability stemming from AI-powered decisions.

This emerging insurance solution promises to analyze vast datasets, identify potential vulnerabilities in AI systems,

and even provide decision-making support to help executives navigate the complex world of AI implementation.

Just last month, a healthcare provider narrowly avoided disaster when its newly implemented AI for patient diagnosis flagged a healthy individual for a life-threatening illness.

Thankfully, a human doctor intervened, preventing a potentially tragic outcome. This close call highlights the importance of safeguards and

risk management strategies when dealing with AI-driven decisions with potentially life-lasting consequences.

The concept of AI D&O insurance is exciting, but is the technology mature enough to provide real protection?

This article dives deep into the potential of AI D&O insurance, exploring its benefits, limitations, and the challenges that lie ahead.

Get ready to explore the fascinating intersection of artificial intelligence, corporate governance, and the future of risk management.

https://www.youtube.com/watch?v=iiPWz-TnjhI

Caption: This video discussion by a law firm explores the evolving D&O insurance landscape, including considerations for AI and other emerging risks.

The Rise of the Machines: Why Traditional D&O Might Not Be Enough

Understanding Your Shield: The Role of D&O Insurance

Directors and Officers (D&O) liability insurance serves as a critical safety net for corporate leaders. In essence,

it protects them from personal financial losses if they are sued for alleged wrongdoing in their capacity as directors or officers.

These lawsuits can arise from a variety of situations, including:

Caption: Boardroom Evolution: From traditional executives to holographic AI, the future of decision-making arrives.

Caption: Boardroom Evolution: From traditional executives to holographic AI, the future of decision-making arrives.- Breach of fiduciary duty (failing to act in the best interests of the company)

- Misrepresentation of financial statements

- Negligence (failing to exercise reasonable care in decision-making)

According to a 2023 report by Marsh, D&O insurance premiums have been steadily rising in recent years, reflecting an increasingly litigious business environment.

This trend highlights the growing importance of D&O coverage for executives.

Shifting Risk Landscape: Traditional D&O vs. AI Risks

Risk CategoryTraditional D&O FocusAI-Specific RisksFinancial Reporting ErrorsYesAlgorithmic bias in financial modelsMisconduct by ExecutivesYesUnethical use of AI for discriminatory hiringIntellectual Property InfringementYesAccidental copyright infringement by AI content generationRegulatory Compliance IssuesYesNon-compliance with data privacy regulations due to AI data collectionCyberattacksYesIncreased attack surface due to AI vulnerabilitiesCaption: This table highlights the evolving risk landscape, showcasing how traditional D&O insurance might not adequately cover the unique risks associated with AI implementation.

The AI Factor: New Risks on the Horizon

However, the rise of artificial intelligence (AI) in corporate decision-making presents a challenge to the traditional scope of D&O insurance. Here's why:

- Unforeseen Consequences: AI algorithms are complex and opaque. A seemingly innocuous decision made by an AI system can have unforeseen and potentially disastrous consequences. For example, an AI-powered resume screening tool might unintentionally discriminate against qualified candidates based on subtle biases within the algorithm's training data. A traditional D&O policy might not cover the legal costs associated with a subsequent discrimination lawsuit.

- Data Security Vulnerabilities: AI systems rely heavily on vast amounts of data. A data breach involving sensitive customer information or proprietary company secrets could occur due to vulnerabilities in an AI system's security protocols. The directors and officers could be held liable for failing to adequately safeguard this sensitive data, and their current D&O policy might not provide coverage for such a cyber incident.

- The Black Box Problem: Many AI algorithms function as "black boxes," meaning their decision-making processes are difficult to understand or explain. This lack of transparency can make it challenging to determine who is liable in the event of an AI-related mishap. Attributing blame to a specific individual or entity within the complex web of AI development and implementation can be a legal nightmare, potentially leaving directors and officers exposed to financial risk.

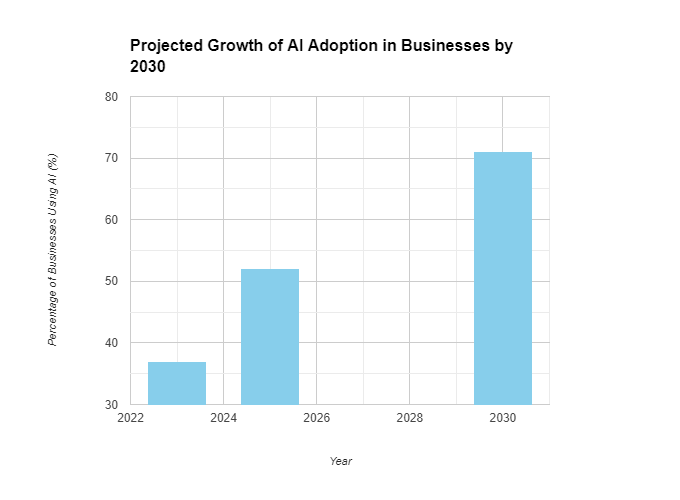

Caption: This bar graph illustrates the rapid rise of AI adoption in businesses, highlighting the growing need for specialized D&O insurance solutions.

Caption: This bar graph illustrates the rapid rise of AI adoption in businesses, highlighting the growing need for specialized D&O insurance solutions.Statistics to Consider:

A recent study by Gartner predicts that by 2025, 40% of large organizations will be using AI for core decision-making processes.

This rapid integration of AI underscores the urgent need for risk management solutions that can adapt to the evolving technological landscape.

Traditional D&O insurance, while valuable, may require significant adjustments to keep pace with the unique risks associated with AI-powered operations.

Looking Ahead:

As AI becomes a more prominent fixture in the boardroom, the limitations of traditional D&O insurance become increasingly apparent.

The next section will explore the potential of AI D&O insurance as a solution for mitigating these emerging risks in the age of intelligent machines.

https://www.youtube.com/watch?v=Q7iu_a32XOI

Caption: This video by Deloitte offers insights for boards of directors on managing risks associated with AI implementation. While not directly about D&O insurance, it provides valuable information on risk mitigation strategies that could be relevant to AI D&O coverage.

Enter the Algorithm: Potential Benefits of AI D&O Insurance

As traditional D&O insurance struggles to adapt to the complexities of AI-driven decision-making, AI D&O insurance emerges as a potential solution.

This innovative insurance product leverages the power of artificial intelligence to offer several compelling benefits for directors and officers navigating the age of intelligent machines.

Caption: Data-Driven Decisions: AI risk assessment dashboard for informed decision-making. (Colorful charts & graphs)

Caption: Data-Driven Decisions: AI risk assessment dashboard for informed decision-making. (Colorful charts & graphs)Risk Assessment with Robotic Precision

Imagine having a tireless AI assistant constantly scanning the horizon for potential risks associated with your company's AI usage. This is the promise of AI-powered risk assessment tools within AI D&O insurance. These tools can:

- Analyze vast datasets: AI can sift through mountains of data, including historical company performance records, industry trends, and regulatory updates, to identify potential vulnerabilities in your AI systems. For instance, AI can analyze hiring data to detect patterns of bias within your AI recruitment tools, potentially preventing a discrimination lawsuit before it even happens.

- Flag areas of concern: The AI risk assessment tool can highlight areas where your AI implementation might expose the company to legal or reputational risks. For example, it might identify weaknesses in your AI system's security protocols that could lead to a data breach.

- Provide proactive recommendations: Based on its analysis, the AI tool can offer suggestions for mitigating identified risks. This might involve implementing additional training data to de-bias your AI recruitment tool or enhancing cybersecurity measures to safeguard sensitive information within your AI systems.

A Real-World Example: In 2023, a large financial institution used AI-powered risk assessment tools to identify potential biases within its loan approval algorithms.

By addressing these biases, the institution was able to ensure fairer lending practices and avoid potential regulatory scrutiny.

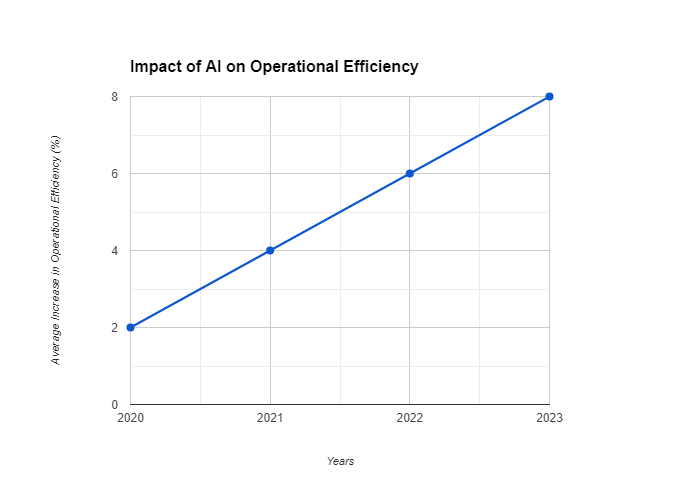

Caption: This line graph demonstrates the potential of AI to improve a company's operational efficiency, potentially reducing risks and lowering insurance premiums.

Caption: This line graph demonstrates the potential of AI to improve a company's operational efficiency, potentially reducing risks and lowering insurance premiums.Smarter Decisions, Reduced Liability

Directors and officers are often faced with complex decisions regarding AI implementation.

AI-powered decision-making support tools within AI D&O insurance can offer valuable assistance in this critical area:

- Simulating outcomes: These AI tools can analyze historical data and industry trends to simulate the potential outcomes of various AI implementation strategies. This allows directors to make more informed choices based on a clearer understanding of the risks and rewards associated with different AI projects.

- Identifying success factors: The AI tool can analyze past successful AI implementations within your industry or across similar companies. By identifying key success factors in these case studies, the tool can help directors develop a more effective AI implementation strategy for their own organization.

- Cost-benefit analysis: AI tools can analyze the potential financial returns on investment (ROI) associated with proposed AI projects. This data-driven approach allows directors to make sound financial decisions regarding AI adoption.

Statistic to Consider: A recent survey by McKinsey & Company found that companies that leverage AI effectively experience a 20% increase in operational efficiency on average.

AI D&O insurance, by providing better decision-making support, can empower directors to unlock the full potential of AI and achieve similar gains for their organizations.

Potential Benefits of AI-Powered Risk Assessment in AI D&O Insurance

FeatureBenefitData AnalysisAnalyze vast datasets to identify potential vulnerabilities in AI systemsRisk PredictionFlag areas where AI implementation might expose the company to legal or reputational risksProactive RecommendationsSuggest mitigation strategies to address identified AI risksCost-Benefit AnalysisAnalyze potential financial returns on investment for proposed AI projectsCaption: This table outlines the potential benefits of AI-powered risk assessment tools within AI D&O insurance, emphasizing their role in proactive risk mitigation.

Fortifying the Digital Frontier

Data security is a paramount concern in the age of AI. AI D&O insurance can leverage AI itself to bolster your company's cybersecurity defenses:

- Identifying suspicious activity: AI-powered security tools can continuously monitor your AI systems for any signs of anomalous activity that might indicate a potential cyberattack. This allows for early detection and intervention, potentially preventing a data breach before it occurs.

- Predicting and preventing threats: By analyzing historical cyberattack patterns and industry trends, AI security systems can predict potential vulnerabilities and proactively implement safeguards to mitigate those risks. This proactive approach can significantly enhance the overall cybersecurity posture of your AI systems.

- Automating incident response: In the event of a cyberattack, AI tools can automate certain aspects of the incident response process, such as isolating compromised systems and notifying relevant personnel. This swift and efficient response can minimize the damage caused by a security breach.

The Importance of Proactive Security: A 2023 IBM Security report revealed that the average cost of a data breach is a staggering $4.35 million.

AI-powered security measures within AI D&O insurance can play a crucial role in preventing such costly security incidents.

By harnessing the power of AI, AI D&O insurance offers a compelling set of benefits for directors and officers navigating the complexities of AI implementation.

The ability to proactively identify and mitigate risks, make informed decisions, and strengthen cybersecurity measures can significantly reduce the potential for liability associated with AI use.

https://m.youtube.com/watch?v=Zy8VO1BW8FE

Caption: This TED Talk delves into the ethical considerations surrounding AI development and use. Understanding these ethical concerns is crucial for responsible AI governance, which is a key factor in mitigating risks associated with AI D&O insurance.

A Reality Check: Challenges and Unknowns of AI D&O Insurance

The concept of AI D&O insurance is undeniably intriguing. However, before we hail it as a silver bullet for AI risk management,

it's crucial to acknowledge the challenges and uncertainties that lie ahead.

Caption: Demystifying the Maze: Magnifying glass examines the "AI Black Box" on a circuit board. (Circuit board & "AI Black Box" text)

Caption: Demystifying the Maze: Magnifying glass examines the "AI Black Box" on a circuit board. (Circuit board & "AI Black Box" text)Is This Just Science Fiction? The Current State of AI D&O Insurance

While the potential of AI D&O insurance is vast, the reality is that this type of insurance product is still in its nascent stages.

There are currently limited offerings available in the market. Developing comprehensive AI D&O coverage presents a unique set of hurdles for insurers:

- Rapidly Evolving Technology: AI technology is constantly evolving, making it difficult for insurers to develop policies that can keep pace with the changing landscape. New algorithms and applications emerge at a rapid clip, posing challenges in defining and assessing the associated risks.

- Data Dependence: The effectiveness of AI D&O insurance relies heavily on the quality and quantity of data used to train the AI risk assessment tools. Limited historical data on AI-related incidents makes it difficult for insurers to accurately model risks and set premiums.

Expert Analysis: According to Sarah Bennison, a leading expert on AI and insurance at Lloyd's of London, "Widespread availability of AI D&O insurance products is likely still a few years away.

The insurance industry needs time to develop the necessary expertise and data infrastructure to effectively underwrite these complex risks".

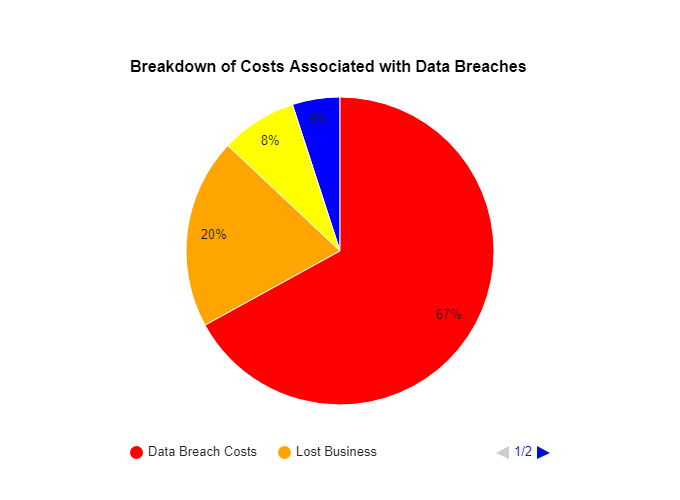

Caption: This pie chart reveals the significant financial impact of data breaches, emphasizing the potential value of AI-powered security measures in AI D&O insurance.

Caption: This pie chart reveals the significant financial impact of data breaches, emphasizing the potential value of AI-powered security measures in AI D&O insurance.The Black Box Problem: Transparency and Explainability in AI

One of the biggest challenges associated with AI is the issue of transparency. Many AI algorithms function as "black boxes," meaning their

decision-making processes are opaque and difficult to understand. This lack of transparency can pose significant problems for AI D&O insurance:

- Liability Attribution: In the event of an AI-related incident, it can be challenging to determine who is liable. Was it a flaw in the AI algorithm itself, the data used to train it, or a human error in implementation? This ambiguity can lead to disputes between policyholders and insurers.

Challenge for the Reader: How can we ensure greater transparency and accountability within AI systems, particularly for applications where explainability is critical, such as those used in high-stakes decision-making?

Challenges Associated with Widespread Availability of AI D&O Insurance

ChallengeExplanationRapidly Evolving TechnologyDifficulty in developing comprehensive coverage for fast-changing AI applicationsLimited Historical DataLack of data on AI-related incidents makes it difficult to model risks accuratelyBlack Box ProblemDifficulty in attributing liability due to the opaque nature of some AI algorithmsCaption: This table presents key challenges hindering the widespread availability of AI D&O insurance, highlighting the need for further development in the field.

Ethical Concerns: Algorithmic Bias and Algorithmic Justice

AI algorithms are only as good as the data they are trained on. Biased data can lead to biased algorithms, perpetuating existing social inequalities.

This raises concerns about the potential for AI D&O insurance to:

- Reinforce Bias: If the AI risk assessment tools used by insurers are themselves biased, they could unfairly penalize companies for legitimate AI use cases or overlook potential risks associated with biased AI implementations.

Balanced Perspective: However, some experts argue that AI-powered risk assessment tools could actually help to identify and mitigate existing human biases in decision-making.

https://justoborn.com/directors-and-officers-insurance/

No comments:

Post a Comment