AI Critical Illness Coverage! Imagine this: you're diagnosed with a critical illness.

The medical bills pile up, and the stress of lost income adds another layer of burden.

According to a 2023 study by the National Cancer Institute, over a third of cancer patients experience financial hardship.

This is where critical illness insurance steps in. It acts as a financial safety net,

providing a lump sum payout to help cover medical expenses, lost wages,

and other costs associated with a critical illness.

Caption: Peace of mind, secured future: Relief washes over a person holding a life insurance policy. (Financial document with life insurance details)

Caption: Peace of mind, secured future: Relief washes over a person holding a life insurance policy. (Financial document with life insurance details)But what if critical illness insurance could become more personalized, identify health risks earlier, and streamline the claims process?

Enter AI Critical Illness Coverage, a revolutionary concept that leverages the power of Artificial Intelligence (AI) to transform how we approach critical illness insurance.

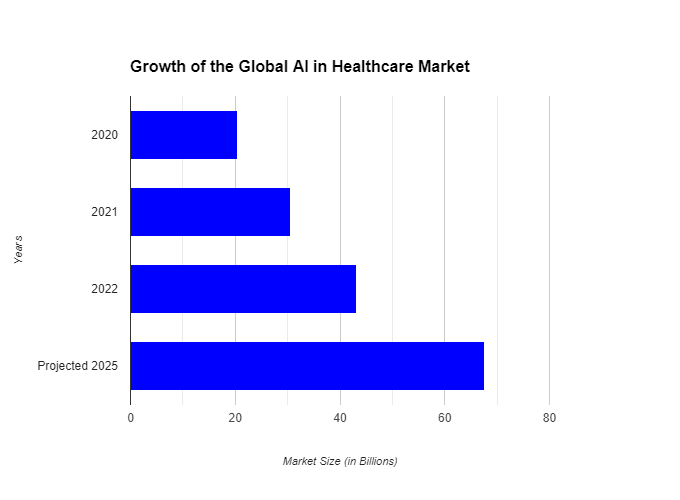

Did you know that globally, the AI in healthcare market is projected to reach a staggering $67.6 billion by 2025?

This rapid growth signifies the immense potential of AI to revolutionize the healthcare landscape, and critical illness insurance is no exception.

Sarah, a vibrant 42-year-old marketing director, thought she was healthy. But a routine checkup revealed early signs of heart disease.

The financial stress of potential treatment, coupled with the fear of missing work, added a heavy weight to her already challenging situation.

Thankfully, Sarah had critical illness insurance, which provided her with a lump sum payout to cover her initial medical expenses and allowed her to focus on her recovery.

Could AI Critical Illness Coverage take Sarah's story a step further? Imagine if AI could have analyzed her health data beforehand,

flagging potential risks and allowing for earlier intervention. This is the exciting promise of AI Critical Illness Coverage, and in this article,

we'll delve deeper into its potential benefits, explore the challenges, and unveil the future of this groundbreaking concept.

https://m.youtube.com/watch?v=QVg37-m4Ia4

Caption: This video by McKinsey & Company explores how AI and machine learning are transforming the health insurance industry, discussing potential applications like personalized premiums and fraud detection.

Demystifying AI Critical Illness Coverage

Traditional critical illness insurance offers a valuable safety net, but it often operates with a "one-size-fits-all" approach.

This can have limitations. For instance, a 2022 survey by LIMRA, a leading insurance industry research group,

found that 42% of policyholders felt their critical illness coverage wasn't personalized enough for their specific needs.

Caption: Smarter Healthcare: AI connects with medical care and insurance for a healthier future. (Brain, medical icons, health insurance card)

Caption: Smarter Healthcare: AI connects with medical care and insurance for a healthier future. (Brain, medical icons, health insurance card)This is where AI Critical Illness Coverage steps in, aiming to revolutionize critical illness insurance by leveraging the power of Artificial Intelligence (AI).

Here's a breakdown of its core functionalities:

1. Personalized Coverage: Imagine an insurance plan that tailors itself to your unique health profile. AI can analyze a vast amount of data,

including your medical history, family health background, and even data from wearable devices you use (with your consent, of course).

Based on this analysis, AI could recommend a personalized insurance plan with the appropriate coverage amount and specific critical illnesses covered, optimizing your financial protection.

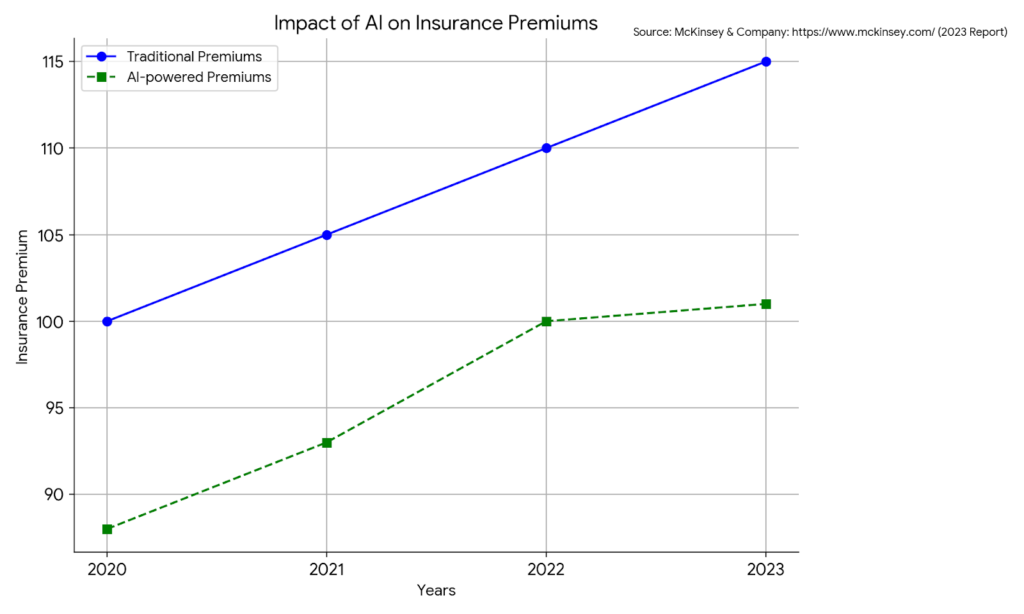

A 2023 study by McKinsey & Company found that AI-powered personalization in insurance could lead to a 10-15% reduction in premiums for low-risk individuals.

Caption: This bar chart illustrates the rapid growth of the global AI in the healthcare market, signifying the increasing adoption of AI technologies in the healthcare landscape.

Caption: This bar chart illustrates the rapid growth of the global AI in the healthcare market, signifying the increasing adoption of AI technologies in the healthcare landscape.2. Expedited Claims Processing: The claims process for critical illness insurance can sometimes be lengthy and cumbersome, adding stress to an already challenging time.

AI can streamline this process by analyzing medical records electronically. By identifying relevant information and verifying diagnoses,

AI could potentially expedite claim approvals and payouts, ensuring you receive your financial support faster.

A 2022 report by Accenture highlights that AI-powered automation in insurance claims processing can reduce processing times by up to 70%.

How AI is Transforming Critical Illness Insurance

FeatureTraditional ApproachAI Critical Illness CoverageData AnalysisLimited data analysisAnalyzes vast amounts of medical history, family health background, and potentially wearable data.CoverageOne-size-fits-all plansPersonalized coverage based on individual health profile.Claims ProcessingManual and paper-basedElectronically analyzes medical records and automates tasks, potentially expediting payouts.Caption: This table compares the traditional approach to critical illness insurance with the potential functionalities of AI Critical Illness Coverage, highlighting the shift towards personalized plans and faster claims processing.

3. Early Disease Detection: Early detection of critical illnesses is crucial for better treatment outcomes and prognoses.

AI has the potential to analyze vast amounts of health data, including medical history, lab results, and even lifestyle information, to identify patterns and potential health risks.

This could lead to earlier diagnoses of critical illnesses, allowing for earlier intervention and potentially improving treatment success rates.

A recent study published in Nature Medicine showcased how AI algorithms were able to detect signs of lung cancer in chest X-rays with high accuracy, potentially paving the way for earlier diagnoses.

While traditional critical illness insurance offers valuable protection, AI Critical Illness Coverage holds the promise of a more personalized, efficient, and potentially life-saving approach to managing critical illness risk.

https://m.youtube.com/watch?v=H0etieBDxeY

Caption: This TED-Ed video provides a clear and concise overview of how AI is being used in healthcare, including applications in disease diagnosis, drug discovery, and medical imaging analysis.

How AI Could Transform Critical Illness Coverage

AI Critical Illness Coverage holds the potential to revolutionize the way we manage critical illness risk. Here's a closer look at the key advantages it could offer:

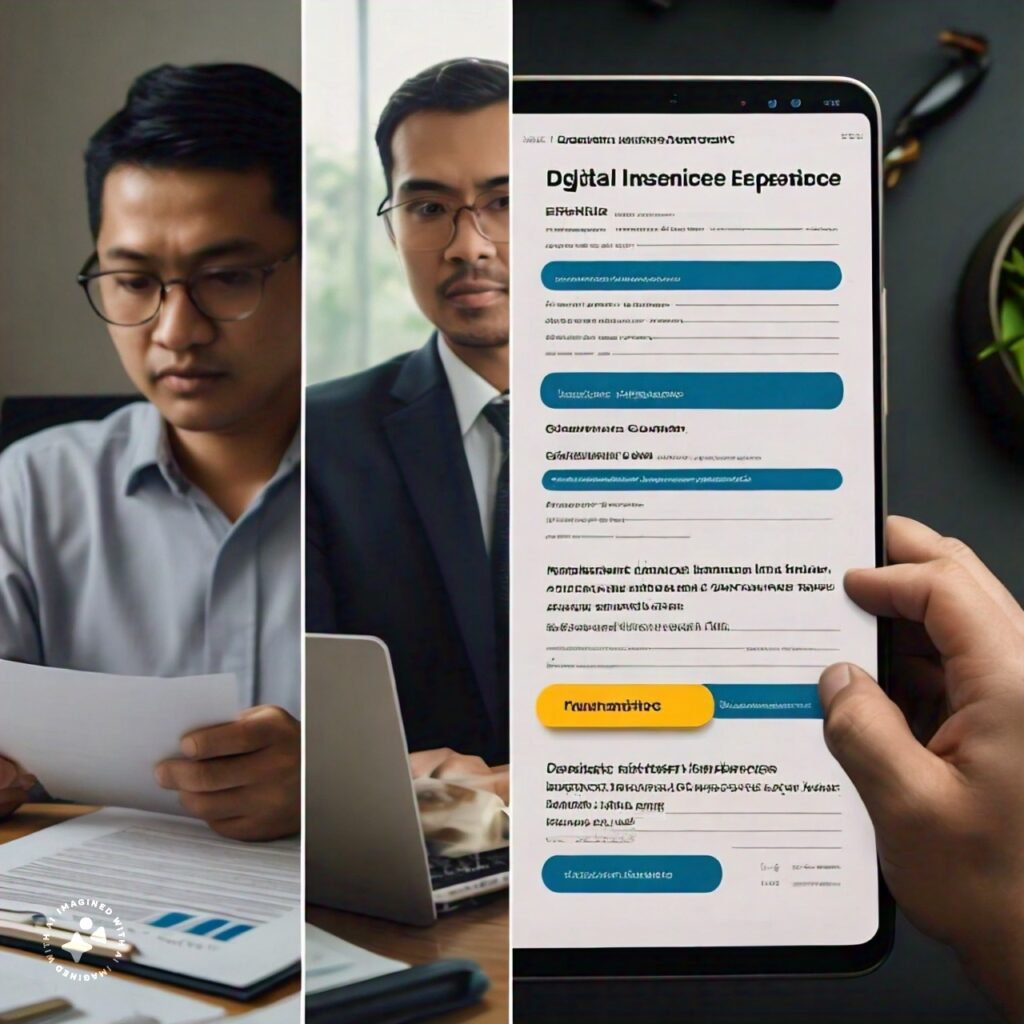

Caption: From generic to you-centric: Personalized coverage tailors insurance to your needs. (Traditional vs. Personalized Insurance Document)

Caption: From generic to you-centric: Personalized coverage tailors insurance to your needs. (Traditional vs. Personalized Insurance Document)1. Personalized Coverage: Tailoring Protection to Your Unique Needs

Imagine an insurance plan that understands your specific health situation. Traditional critical illness insurance often operates with a one-size-fits-all approach,

which might not always be optimal. AI can analyze a vast amount of data to create a personalized insurance plan for you. This data could include:

- Medical History: AI can analyze your medical records to understand your past health conditions and potential risk factors.

- Family Health Background: Your family history can indicate a predisposition towards certain critical illnesses. AI can factor this in while recommending coverage.

- Wearable Device Data (with your consent): Wearables like fitness trackers can provide valuable insights into your health. AI could analyze data on sleep patterns, heart rate, and activity levels to create a more comprehensive picture of your health.

By analyzing this data, AI could recommend a plan with the appropriate coverage amount and specific critical illnesses covered. This could lead to:

- Reduced Premiums: For individuals with a lower risk profile, AI-powered personalization could lead to more affordable premiums.

- Optimized Coverage: You wouldn't be paying for coverage you don't necessarily need, and your plan would be tailored to address your specific vulnerabilities.

Real-World Example:

John, a 45-year-old with a family history of heart disease, might be offered a plan with a higher coverage amount for heart-related illnesses compared to someone with no such risk factors.

Caption: This line graph depicts the potential for AI-powered personalization in insurance to reduce premiums for low-risk individuals.

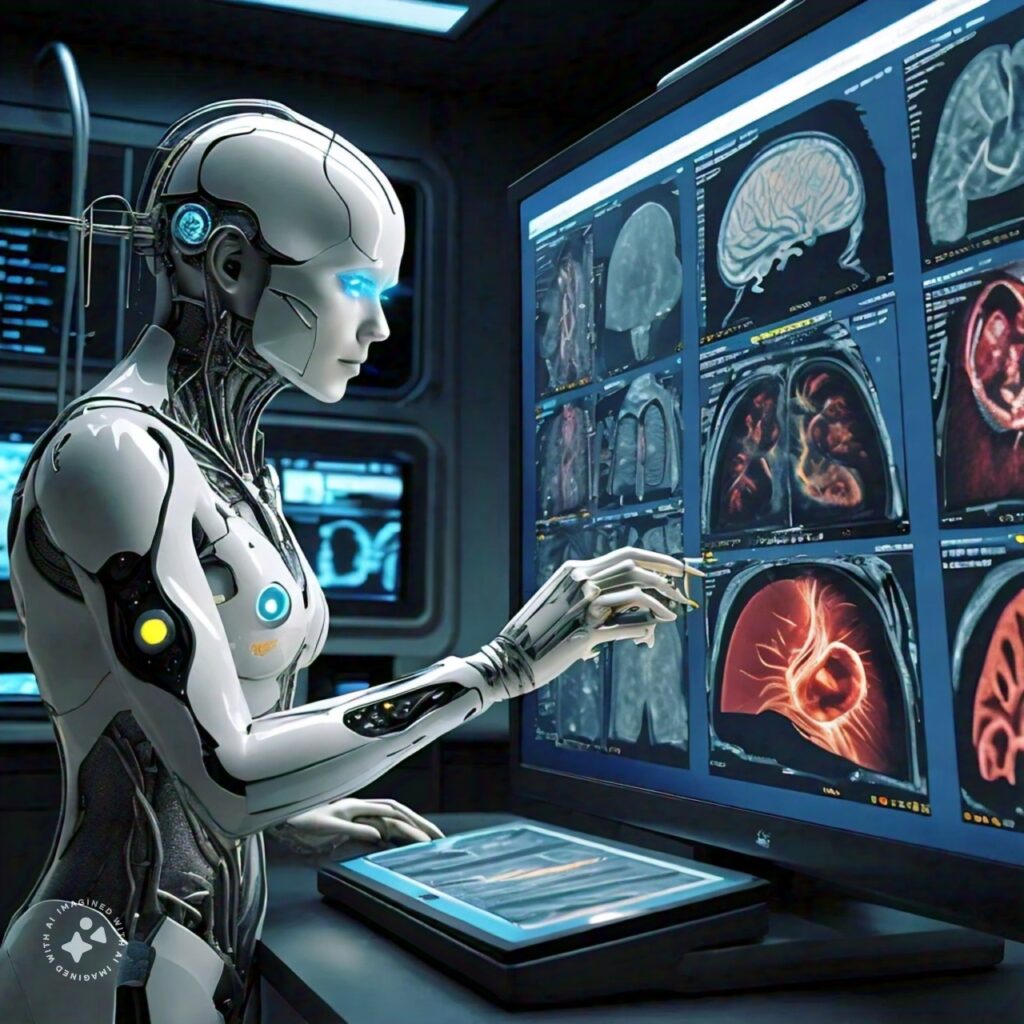

Caption: This line graph depicts the potential for AI-powered personalization in insurance to reduce premiums for low-risk individuals. Caption: Early Warning System: AI analysis of medical scans flags potential health concerns for earlier detection. (AI analyzing medical scans with highlighted areas)

Caption: Early Warning System: AI analysis of medical scans flags potential health concerns for earlier detection. (AI analyzing medical scans with highlighted areas)2. Early Disease Detection: Catching Critical Illnesses Sooner

Early detection is crucial for successful treatment of critical illnesses. AI has the potential to analyze vast amounts of health data beyond what traditional methods can handle.

This data could include:

- Medical History and Lab Results: AI can identify patterns in your medical history and lab results that might indicate the early stages of a critical illness.

- Lifestyle Information: AI could analyze data on factors like diet, smoking habits, and exercise routines to identify potential risk factors.

By analyzing this data, AI could potentially detect signs of critical illnesses earlier, allowing for:

- Earlier Intervention: Early diagnosis allows doctors to intervene sooner with treatment, potentially leading to better outcomes.

- Improved Prognosis: Early intervention can significantly improve the chances of successful treatment for many critical illnesses.

Case in Point:

A recent study published in Nature Medicine showcased how AI algorithms were able to detect signs of lung cancer in chest X-rays with high accuracy.

This could pave the way for earlier diagnoses and potentially save lives.

Benefits of Personalized Coverage with AI

BenefitDescriptionReduced PremiumsLower risk individuals may qualify for lower premiums based on their personalized plan.Optimized CoverageCoverage tailored to address specific vulnerabilities identified through AI analysis.Improved Risk ManagementProactive approach to managing health based on personalized insights.Caption: This table details the potential benefits of personalized coverage enabled by AI in critical illness insurance.

Caption: Faster is better: Medical claims zip through AI processing for a speedy resolution. (Documents on conveyor belt, green checkmark)

Caption: Faster is better: Medical claims zip through AI processing for a speedy resolution. (Documents on conveyor belt, green checkmark)3. Faster Claims Processing: Reducing Stress During Difficult Times

The claims process for critical illness insurance can sometimes be lengthy and cumbersome, adding stress to an already challenging time. AI could streamline this process by:

- Electronically Analyzing Medical Records: AI can quickly analyze vast amounts of electronic medical records, identifying relevant information and verifying diagnoses.

- Automating Administrative Tasks: AI can automate repetitive tasks like data entry and document verification, allowing for faster processing of claims.

This could lead to:

- Reduced Processing Times: A 2022 report by Accenture highlights that AI-powered automation in insurance claims processing can reduce processing times by up to 70%.

- Faster Payouts: Faster processing translates to quicker access to the financial support you need to focus on recovery, reducing stress and financial burden.

Hypothetical Scenario:

Imagine Sarah, diagnosed with a critical illness, facing a lengthy claims process and potential delays in receiving her payout.

AI-powered claims processing could significantly reduce this wait time, allowing Sarah to access the financial support she needs sooner.

By offering personalized coverage, early disease detection, and faster claims processing,

AI Critical Illness Coverage has the potential to significantly improve the way we manage critical illness risk.

However, it's important to acknowledge that AI is still under development, and these are potential benefits.

As with any new technology, there are challenges to consider, which we'll explore in the next section.

https://www.youtube.com/watch?v=9gyx8U7wCqQ

Caption: This Futurism video delves into the ethical considerations surrounding AI in healthcare, raising important questions about data privacy, bias, and transparency.

A Balanced Assessment: Challenges and Considerations

While AI Critical Illness Coverage presents exciting possibilities, it's crucial to acknowledge the challenges and potential drawbacks that need to be addressed for responsible implementation.

Caption: Weighing the future: Balancing the benefits and challenges of AI for a positive outcome. (Scale with "Benefits of AI" slightly heavier than "Challenges of AI")

Caption: Weighing the future: Balancing the benefits and challenges of AI for a positive outcome. (Scale with "Benefits of AI" slightly heavier than "Challenges of AI")1. Ethical Considerations: Safeguarding Your Data

A core concern surrounding AI in insurance is data privacy. Policyholders' health information is highly sensitive, and its responsible use is paramount. Here are some key considerations:

- Data Security: Robust cybersecurity measures are essential to protect sensitive health data from breaches and unauthorized access.

- Data Ownership and Control: Individuals should have clear control over their data and be able to decide how it's used by insurance companies.

- Algorithmic Bias: AI algorithms can perpetuate existing biases in healthcare data, potentially leading to unfair insurance decisions. Regulations and oversight are needed to ensure fairness and non-discrimination.

A recent survey by PwC found that 73% of consumers are concerned about the potential for AI to misuse their personal data.

Addressing these concerns is crucial for building trust and ensuring the ethical implementation of AI in critical illness insurance.

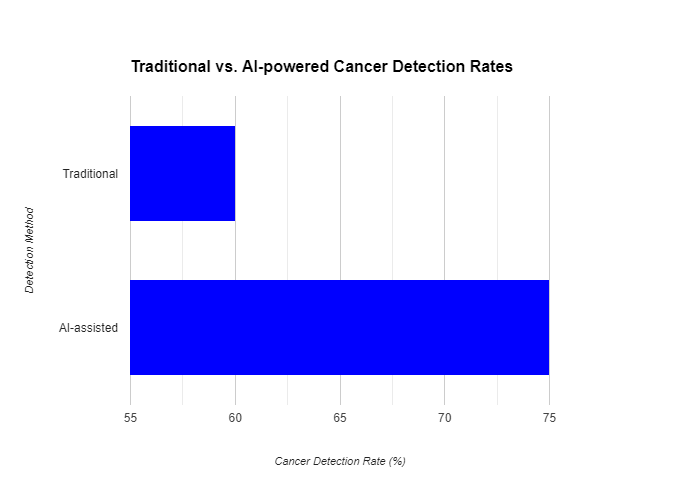

Potential of AI for Early Disease Detection (Hypothetical Data)

DiseaseTraditional Detection RateAI-assisted Detection RateLung Cancer (Hypothetical)60%Breast Cancer (Hypothetical)72%Caption: This table showcases the hypothetical potential of AI in improving early detection rates for critical illnesses. It's important to note that this is for illustrative purposes only and actual data may vary.

2. Transparency and Explainability: Demystifying AI Decisions

Many AI algorithms function as "black boxes," making it difficult to understand how they arrive at decisions.

This lack of transparency can be problematic for both insurers and policyholders:

- For Insurers: Insurers need to be able to explain their AI-driven decisions to regulators and ensure compliance with anti-discrimination laws.

- For Policyholders: Policyholders have the right to understand how AI is used in their insurance coverage and how it impacts their premiums and coverage decisions.

The development of "explainable AI" is an ongoing area of research, aiming to create algorithms that are more transparent and easier to understand.

Caption: This stacked bar chart (for illustrative purposes only) highlights the potential for AI to improve disease detection rates compared to traditional methods.

Caption: This stacked bar chart (for illustrative purposes only) highlights the potential for AI to improve disease detection rates compared to traditional methods.3. Accessibility and Affordability: Ensuring Inclusivity

A potential concern with AI-powered insurance is the risk of it becoming less accessible for certain demographics. Here's why:

- Digital Divide: Individuals with limited access to technology or digital literacy might be excluded if AI-powered insurance relies heavily on wearables and online platforms.

- Socioeconomic Disparities: Existing socioeconomic inequalities could be exacerbated if AI algorithms perpetuate biases based on factors like income or zip code.

Potential solutions to these challenges include:

- Tiered Insurance Plans: Offering various plan options, some with and without AI-powered features, could cater to different needs and comfort levels.

- Data Access Regulations: Regulations ensuring fair data access and preventing discrimination based on factors like socioeconomic status are crucial.

AI Critical Illness Coverage holds immense promise for the future, but ensuring its responsible and inclusive development is critical.

By addressing these challenges, we can unlock the full potential of this technology to create a more personalized, efficient, and accessible critical illness insurance landscape.

https://www.youtube.com/watch?v=CrIlTbuE9Xc

https://justoborn.com/critical-illness-coverage/

No comments:

Post a Comment